Notification of Trading Adjustment – Nov 5, 2024

Dear Client,

Starting from November 3, 2024, the trading hours of some MT4/MT5 products will change due to the upcoming Daylight Saving Time change in the US.

Please refer to the table below outlining the affected instruments:

The above information is provided for reference only; please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].

This Billionaire Investor Sees the US Election Risks, Braces for Even More Inflation Trades

Betting markets have shown rising odds for a Trump victory in the upcoming US election. Traders are considering the potential inflationary effects of policies like tariffs under a possible second term.

Market participants are closely assessing what his potential win could mean for the upcoming U.S. presidential election. At the heart of this analysis is the so-called “Trump Trade.”

What is a Trump Trade?

The “Trump Trade” describes how markets and investors react to the economic policies and political moves tied to a Donald Trump presidency. This concept became prominent after his 2016 election, as markets responded to his agenda of deregulation, tax cuts, and expanded infrastructure spending. It mainly captures the expectation of a pro-business environment and economic stimulus that could bolster U.S. growth.

How the “Trump Trade” Affected Monetary Policy

To understand what the markets expect, it’s helpful to look back at market reactions during Trump’s previous term.

With expectations of stronger economic growth, the Federal Reserve adjusted its policies:

- Interest Rate Increases: As the economy gained momentum and inflation pressures rose, the Fed raised interest rates to keep growth steady. This was a change from the low-interest rates seen after the 2008 financial crisis.

- Balance Sheet Reduction: The Fed also began looking at reducing its large balance sheet, which had grown due to years of economic support. This shift signaled a move toward tighter monetary policies.

US Election 2024: Will All Roads Lead to Inflation?

Regardless of who wins the upcoming election, two billionaire investing legends remain focused on the US bond market due to the unsustainable trajectory of large US deficits.

“I have moved in that direction for sure,” Jones told CNBC when asked if he was adjusting his strategy for a possible Trump win over Vice President Kamala Harris.

“It just means more in inflation trades,” Jones added, joining other top investors in voicing concerns about the U.S. government’s fiscal outlook, regardless of the election outcome, given both candidates’ commitments to tax cuts and spending.

The Growing U.S. Debt Crisis

On the alarming US deficit and debt path: Jones didn’t hold back here—it’s worth watching as he breaks down the US debt problem in simple terms. He compares it to someone earning $100,000 a year but borrowing $700,000 and planning to add $40,000 more in debt annually. So, why would anyone still lend to the US government?

U.S. debt situation has spiraled out of control. Just 25 years ago, the national debt was a little under 60% of GDP. Today, that rate has doubled to 120%.

Source: OMB; St. Louis Fed; US Global Investors

Paul Tudor Jones warns the U.S. faces a fast-approaching debt crisis unless it tackles government spending. He notes that political promises of increased spending or tax cuts only deepen the issue, saying the U.S. will be “broke really quick” without serious fiscal action.

Stanley Druckenmiller, billionaire investor and former chairman of Duquesne Capital and former chief portfolio manager for George Soros’ Quantum fund, shared his views on the Fed, criticising its overly easy policies during the pandemic, when he believed rate hikes should have started sooner.

He also expressed concern that the Fed may be making a new mistake by cutting rates too aggressively, which could trigger another inflation spike if the economy stays strong and potentially compromise the Fed’s independence.

In case you missed, read our article on the 2024 September Fed cut here.

What can you do to protect your portfolio from election uncertainty

It’s worth noting that Druckenmiller is less interested in discussing the equity markets and is more focused on the risks to the bond market, which could impact stocks negatively. He specifically indicates that he is taking a strong position against US long-term treasury bonds, hoping to profit from a sharp further rise in US yields.

With Jones taking a similar stance, he said, “I’m long gold, I’m long bitcoin…Commodities are ridiculously underowned.”

Important: The interaction between bond yields and stock markets is crucial for understanding currency movements. If bond yields rise, it may lead to a stronger U.S. dollar (creating challenges for equities) as investors seek higher returns, thereby increasing demand for dollars to purchase U.S. bond.

3 strategies to navigate these market shifts

The “Trump Trade” meant reevaluating and adjusting their portfolios to adapt to the changing economic environment:

Fixed Income Strategy

Investors needed to be careful with long-term bonds because rising yields could decrease their value. Instead, they shifted their focus to shorter-duration bonds, which are less affected by interest rate changes. This approach helps reduce the risk of losing money if interest rates rise further.

Currency Considerations

For portfolios that include foreign investments, implementing hedging strategies has become increasingly important. This is to protect against potential losses due to a strong U.S. dollar, which can make foreign assets less valuable when converted back to dollars.

Geopolitical Hedging

It became wise to diversify investments into assets that are not heavily influenced by U.S. political events. Including safe-haven assets, such as gold or Swiss Franc, provides a buffer against market volatility caused by political uncertainty. These assets tend to hold their value better in turbulent times.

You might be interested: How to Manage Market Volatility in the US Elections

Why trade CFDs with VT Markets?

When considering wise words of these investing legends, one key observation is that they are extremely quick to change their mind if something dramatically new happens.

In fast-moving markets where prices can shift direction rapidly, you can trade CFDs across a wide range of assets, from forex to precious metals, capitalising on breaking news and political changes.

It takes less than 5 minutes to open your CFD trading account here.

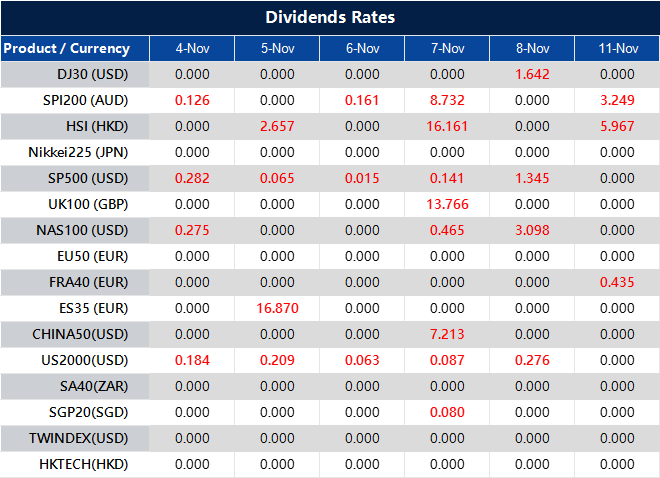

Dividend Adjustment Notice – Nov 04,2024

Dear Client,

Please note that the dividends of the following products will be adjusted accordingly. Index dividends will be executed separately through a balance statement directly to your trading account, and the comment will be in the following format “Div & Product Name & Net Volume ”.

Please refer to the table below for more details:

The above data is for reference only, please refer to the MT4/MT5 software for specific data.

If you’d like more information, please don’t hesitate to contact [email protected].

A Complete Guide to VT Markets Trading Platforms in Hong Kong

Understanding VT Markets Trading Platforms in Hong Kong

For traders in Hong Kong, VT Markets offers a suite of cutting-edge trading platforms, from advanced desktop software to flexible mobile applications, catering to both novice and professional traders. This comprehensive guide will cover the features and benefits of each VT Markets platform available, offering insights into which may be best suited to your trading style and goals.

Why Choose VT Markets for Trading in Hong Kong?

VT Markets has built a reputation for providing user-friendly platforms with powerful tools, low spreads, and access to a range of global markets. Their platforms allow traders to access a variety of assets, including forex, commodities, indices, shares, and more. Here’s a detailed look at each platform available:

1. VT Markets App: Trade Anywhere, Anytime

The VT Markets mobile app brings trading flexibility to the palm of your hand. Tailored for traders who want to manage positions on the go, the app is intuitive and designed with both new and experienced traders in mind.

Key Features:

- User-Friendly Interface: The app’s layout is simple, allowing easy access to real-time market prices, account balances, and trading history.

- Advanced Charting Tools: The app provides in-depth charting tools that allow traders to perform technical analysis, set indicators, and customize chart views.

- Risk Management Tools: With the app, you can place stop-loss and take-profit orders, and receive instant notifications for price alerts and order confirmations.

- Secure Transactions: VT Markets app prioritizes user security with high-level encryption, ensuring that all transactions are safe.

Whether you’re on a morning commute or relaxing at home, the VT Markets app lets you stay connected to the market, providing a seamless experience across iOS and Android devices.

2. MetaTrader 4 (MT4): The Industry Standard

MetaTrader 4 (MT4) is a staple among trading platforms and remains popular for its reliability and advanced tools. VT Markets offers MT4 for those who prefer a more traditional approach to forex and CFD trading.

Key Features:

- Customizable Interface: Traders can easily customize the MT4 interface, adding indicators, chart tools, and trading options to fit their strategies.

- Automated Trading with Expert Advisors (EAs): MT4 supports EAs, allowing traders to automate their strategies based on pre-set parameters.

- Comprehensive Analysis Tools: MT4 offers over 30 built-in technical indicators, multiple chart setups, and timeframes for detailed analysis.

- Real-Time Quotes: With MT4, traders can access real-time quotes and pricing for all assets, giving a clear view of the market.

MT4 is available for download on both Windows and MacOS, making it a versatile choice for desktop traders. Its longevity and robust tools make it ideal for those looking to perform detailed analysis and execute complex trades.

3. MetaTrader 5 (MT5): Enhanced Flexibility and Asset Access

MetaTrader 5 (MT5) is the upgraded version of MT4 and is geared towards traders seeking multi-asset trading capabilities with more advanced features. MT5 builds upon MT4’s foundation, adding more trading options and analytical tools.

Key Features:

- Extended Order Types: MT5 offers six order types, including stop limit orders, allowing traders greater flexibility in executing trades.

- In-Depth Market Depth Analysis: The platform provides access to market depth data, showing real-time bid and ask prices to aid in decision-making.

- Integrated Economic Calendar: MT5 includes an economic calendar with real-time updates, allowing traders to track significant global events and plan trades accordingly.

- Hedging and Netting Options: MT5 supports both hedging and netting trading systems, giving traders more control over their positions.

MT5 is accessible on Windows, MacOS, and mobile devices, making it suitable for traders in Hong Kong who need the flexibility to monitor and trade on multiple asset classes, including forex, commodities, indices, and stocks.

4. VT Markets WebTrader Plus: Trading Directly on Your Browser

For those who prefer to trade directly from a web browser without installing software, VT Markets WebTrader Plus offers a seamless and fully functional trading experience.

Key Features:

- No Download Required: WebTrader Plus is accessible from any browser, eliminating the need for downloads or installations. Just log in, and you’re ready to trade.

- Full Compatibility with MT4: WebTrader Plus is integrated with MT4, allowing traders to enjoy the same indicators, tools, and trading capabilities.

- Real-Time Data and Analysis: With WebTrader Plus, traders get real-time pricing, one-click trading, and access to charting tools and indicators.

- Cross-Device Syncing: Trades, settings, and indicators sync across WebTrader Plus and MT4, so you can seamlessly transition between your desktop and mobile device.

WebTrader Plus is ideal for traders who require a flexible solution and prefer trading from multiple devices without any software restrictions. It’s accessible and equipped for serious trading, making it perfect for both short-term and long-term trades.

Choosing the Right VT Markets Platform for Your Needs

Each VT Markets platform offers distinct advantages depending on your trading approach:

- Mobile Traders: The VT Markets App is perfect for those who want to trade on the go with full access to their account.

- Detailed Analysis and Automation: MT4 is the go-to choice for traders who rely on EAs and technical indicators for strategy execution.

- Multi-Asset and Advanced Trading: MT5’s extensive features make it suitable for traders who want to access a broader range of assets and advanced tools.

- Browser-Based Trading: WebTrader Plus allows for trading flexibility without software installations, ideal for quick and easy access across devices.

How VT Markets Trading Platform Can Help You With Your Trading Strategies

VT Markets offers a versatile trading platform designed to support traders in developing and executing their strategies effectively. With access to MetaTrader 4 (MT4), MetaTrader 5 (MT5), and VT Markets’ mobile app, traders can leverage advanced tools such as real-time data, technical indicators, and charting capabilities. For those using automated strategies, MT4 and MT5 support Expert Advisors (EAs) to implement automated trading, making it easier to execute complex strategies around the clock.

Additionally, with features like risk management tools, one-click trading, and custom alerts, VT Markets empowers traders to adapt and respond to market shifts in real-time, enhancing precision in both short-term and long-term strategies.

Platform-Specific Strategy Applications

Each VT Markets platform brings unique features that can complement different trading strategies. For instance, MT4 is ideal for traders looking to automate their strategies with Expert Advisors (EAs), which allow you to execute trades automatically based on pre-set criteria—especially useful for high-frequency trading or scalping strategies. MT5, on the other hand, offers additional order types and access to multi-asset trading, making it suitable for those looking to diversify into various asset classes, such as commodities and indices.

Using the right platform for your strategy can maximize efficiency and help you respond more swiftly to market movements.

Emphasis on Risk Management Across Platforms

Trading requires more than just executing orders; effective risk management is critical for long-term success. VT Markets provides essential risk management tools across all platforms, such as stop-loss orders, take-profit levels, and alerts, enabling you to define your risk parameters before entering trades.

Starting with a demo account is highly recommended, as it allows you to practice without risking real funds. Additionally, position sizing and setting leverage limits can help both novice and seasoned traders protect their capital, especially in volatile markets like forex and commodities.

FAQ: VT Markets Trading Platforms in Hong Kong

1. Which platform is best for beginner traders?

For beginners, the VT Markets App provides an intuitive, easy-to-use interface with essential risk management features and technical analysis tools.

2. Can I use both MT4 and MT5 with the same VT Markets account?

Yes, VT Markets allows you to access both MT4 and MT5, but you’ll need separate accounts for each platform due to their distinct features and trading capabilities.

3. Does VT Markets WebTrader Plus have the same features as the desktop versions of MT4 or MT5?

WebTrader Plus offers many core features of MT4, including indicators and one-click trading, but it’s designed for convenient browser access rather than desktop-based automation.

4. What devices support VT Markets App?

The VT Markets App is compatible with iOS and Android, allowing you to trade from your smartphone or tablet.

5. Is MT5 better than MT4 for forex trading?

While MT5 offers enhanced features like additional order types and an integrated economic calendar, MT4 remains popular for its simplicity and established tools. It depends on your trading needs and preferences.

Conclusion: Finding Your Ideal Trading Platform with VT Markets

Selecting the right trading platform is key to executing trades effectively and managing your strategies. VT Markets offers a range of platforms tailored to diverse trading preferences, from the powerful MT4 and MT5 for detailed analysis to the accessible VT Markets App and WebTrader Plus for flexibility. By choosing a platform that aligns with your trading style, you can maximize your trading potential in the dynamic Hong Kong market.

Ready to start? Open an account with VT Markets and explore these advanced platforms to discover which one fits your trading approach best!

How to Navigate the US Election’s Market Impact

The Trump-Harris showdown begins: Voters in the US will go to the polls on 5 November to elect their next president. Will America get its first ever woman president or a second Donald Trump term? The election volatility brings a wave of both opportunities and challenges. Market participants are closely monitoring how it might impact both short-term and long-term trends.

Key Points to Consider in the US Election Impact

The 2024 US election is a tightly contested one, with two candidates, Kamala Harris and Donald Trump, each having unique approaches to economic policy.

Source: NY Times (As of 3 November 2024)

The result of this election will undoubtedly have implications for traders. Here, we explore how both the short-term volatility and the longer-term policies may affect market dynamics.

Short-Term Uncertainty and Market Volatility

Leading up to the election, market volatility is likely to spike due to the uncertainty surrounding the outcome. A tightly contested election can cause hesitation in the markets, particularly if the results are delayed or there are recounts in swing states. This uncertainty tends to lead to heightened short-term volatility, which is both an opportunity and a risk for different types of traders.

For day traders, this environment of short-term swings could be beneficial for seizing quick opportunities. On the other hand, longer-term traders may find themselves in a riskier position, with markets reacting suddenly to polling news or to disputes over election outcomes. The extended uncertainty could weigh on financial sentiment until January 2025, when the new president officially assumes office.

Continuity vs. Change: How Policy Affects Stability

If Kamala Harris were to win the election, market participants may anticipate a sense of stability as her administration would be viewed as a continuation of the Biden presidency. Historically, incumbent administrations have provided a more predictable environment, leading to smoother market transitions. Traders might expect less turmoil in reaction to the election results due to the familiarity with ongoing policies and existing economic plans.

On the contrary, a return of Donald Trump to the presidency could foster an environment of uncertainty. A new administration typically takes time to get up to speed, and traders may need to wait for new policies to be communicated and implemented before gauging their full impact. This scenario is more likely to trigger short-term volatility as the markets react to unknowns.

Longer-Term Implications Based on Policies

Looking beyond immediate market reactions, the long-term effects of the US election are tied closely to each candidate’s economic policies.

Kamala Harris: Harris’s potential continuation of Biden’s administration is likely to bring regulatory policies that affect financial markets. Her focus on social spending may increase national debt, putting downward pressure on the dollar, while potentially triggering inflation. Rising inflation could prompt the Federal Reserve to raise interest rates, which could then strengthen the dollar in the medium term.

Donald Trump: The 2016 Trump administration had a strong pro-business stance, focusing on deregulation and tax cuts, which initially strengthened the dollar. However, his position on fiscal stimulus could increase national debt, thereby weighing on the currency. Additionally, Trump’s unpredictable approach to foreign policy could lead to geopolitical instability, with potential consequences for the US dollar.

Source: Reuters

Both candidates have policies that could have a contrasting effect on the dollar. Fiscal stimulus and regulatory measures could simultaneously impact the value of the dollar, pushing it either higher or lower depending on how effectively policies are implemented and received by the market.

The Importance of Adaptability for Traders

Given the current environment, traders need to stay adaptable. Monitoring polling data, understanding the incoming administration’s economic plans, and watching the market’s response to breaking news are essential strategies. The Federal Reserve’s response to inflation—influenced by policies on spending, regulation, and commodity prices like oil—will be an important focus for traders, especially those with positions in US dollar pairs.

Short-term opportunities might emerge as market volatility spikes in response to evolving headlines, but understanding the long-term direction will require a careful assessment of policy impacts, especially around fiscal discipline and regulatory actions. We recommend paying attention to any shifts in the dollar’s trajectory due to changes in fiscal and monetary policy, as these will be key indicators in the months following the election.

For more insights, read this article on how you can manage market volatility in the US elections.