We get it. The presidential elections are always the talk of the town when they roll in. The stakes are always high, and markets are already toeing the line with stirring volatility.

But what is it about a presidential election that gets the world in a tizzy? The United States has had a long history of influence on the global economy, from policies passed to shifting sectors.

It’s all old hat to the wolves of Wall Street by now, but it’s always good practice to look back at the past to make better decisions for the future.

Election Volatility and the Market

The months leading up to U.S. elections have been prime time for market swings.

The influence of the presidential election is very clearly seen on the VIX (Chicago Board Options Exchange Volatility Index). Colloquially known as the “fear gauge”, the VIX often displays a spike before election season, signalling a surge in hedging and the anticipation of rapid market moves.

For now, the VIX remains fairly stable ahead of the presidential race, but a contested election or results uncertainties could turn it on its head in a blink.

Picture: The daily VIX chart, as seen on the VT Markets app

Let’s take a look at some major volatility highlights from past elections:

2000 Bush-Gore Election

The 2000 election between George W. Bush and Al Gore was like a political roller coaster that Americans couldn’t get off of—especially once the results in Florida started swinging back and forth.

While Gore won the popular vote by a hair’s breadth, the fate of the election came down to Florida’s 25 electoral votes. “Hanging chads” and “butterfly ballots” became household terms as everyone struggled to understand what had gone wrong with the vote-counting process.

As tensions rose, the S&P 500 slid nearly 5%, and the VIX jumped over 40%.

After a dramatic 5-4 decision by the Supreme Court in Bush v. Gore, the recount was stopped, essentially handing the presidency to Bush.

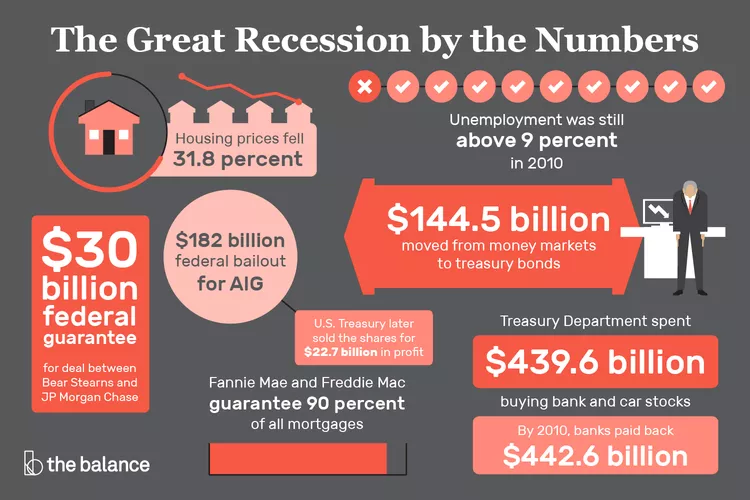

2008 Financial Crisis and Obama-McCain

When the financial crisis hit in 2008, it was like watching dominoes fall, each one representing jobs, homes, and financial security for millions of Americans. The economy felt like it was teetering on the edge, and people were desperate for a leader who could step up with a vision of stability.

Image source: The Balance

The VIX hit 89.53—an all-time high—as markets were gripped by uncertainty over which candidate’s policies would steer the recovery.

2016 Trump-Clinton Election

The 2016 election brought America into a whole new kind of campaign, one that was messy, loud, and deeply divided.

Clinton won the popular vote by nearly 3 million, but Trump clinched the Electoral College in key states like Pennsylvania and Michigan, which were seen as Democrats’ strongholds.

Trump’s win came out of left field for many, including the markets.

Dow futures dropping more than 800 points overnight. However, the whiplash rebound saw the S&P 500 ending the year up 9.5%.

2020 Trump-Biden Election

The 2020 election was like no other in recent memory, taking place against the backdrop of a global pandemic, economic uncertainty, and heightened racial tensions. Joe Biden, with his “Build Back Better” message, positioned himself as a calm, empathetic counter to President Trump, who was criticised for his handling of COVID-19 and his combative approach to social issues.

Biden ultimately won both the popular vote by over 7 million and the Electoral College, but the transition was anything but smooth. The VIX surged to 40 as concerns over potential delays or contested results kept traders on edge.

Picture: The CBOE VIX movement in 2020 as seen on the VT Markets app.

Why Does the Market Get So Jumpy?

Like the rest of the world, markets do not like uncertainty. The U.S. Elections deliver it in spades, especially in such closely fought elections as we are seeing at the moment, where the winning candidate is still very much in balance. Predicting which candidate’s policies will come into play, and what they’ll mean for trade, taxes, and industry regulation, makes markets skittish.

Add in media speculation and poll shifts, and it’s no wonder we see such volatility.

Policies of each candidate can shake specific sectors differently, like green energy or healthcare, leading traders to hedge their bets or rotate sectors to manage the risk.

How Traders Hedge Against Election Volatility

With elections ramping up volatility, traders employ various strategies to protect their portfolios or benefit from market moves:

Options

Options are a great tool to let traders hedge against downside risks, with many buying put options on indices like the S&P 500. They can also provide

The VIX

The VIX itself is a popular hedge, as it rises during periods of uncertainty.

Currency Hedges

U.S. Elections can send shockwaves through global currencies, affecting pairs like USD/JPY or EUR/USD. Traders might shift into other currencies if the dollar weakens, capitalising on global market reactions.

Sector Rotations

During election cycles, traders rotate between sectors that may fare better under each candidate. For example, green energy stocks surged in 2020, while healthcare stocks saw volatility due to opposing reform views.

Safe-Haven Assets

Gold, U.S. Treasuries, and the Swiss franc (USD/CHF) are classic go-tos when things get rocky, offering a sense of security when markets turn turbulent. This can be seen particularly with the surge in the price of Gold in recent months due to an increase in geopolitical tension and the uncertainty of the US Presidential elections

Picture: Daily gold chart, as seen on the VT Markets app.

Turning Volatility into Opportunity

While some traders play defence, others see volatility as an opportunity for profit. Election-driven price swings can be ideal, especially for short-term trading.

Swing Trading

Elections offer ripe conditions for swing traders, who can capitalise on short-term moves driven by breaking news, polls, and debates.

Key technical indicators such support and resistance levels help traders navigate volatility. Following such technical cues allows traders to adapt to sudden price swings as the market reacts and digests news driven events

Futures contracts, especially on indices, commodities, and currencies, are heavily traded during elections. Contracts on crude oil, gold, and the S&P 500 see considerable action as traders leverage rapid market shifts.

Post-Election Adjustments

After the election, markets may reassess the implications of the results, leading to further price swings, creating additional opportunities.

We know that the markets will tend to perform better in years where the incumbent president is re-elected, as it provides more consistency.

Likewise, a change in the administration can lead to short term turbulence as the new policies take their time to be adopted and the impacts assessed.

Navigating the Election Volatility Storm

With each U.S. election comes a wave of volatility, but traders can navigate it with smart hedging or by riding the price swings.

Options, safe-haven assets, and sector shifts can provide protection for portfolios, while swing and futures trading can turn uncertainty into opportunity.

Election-driven volatility brings risk, but for the prepared trader, it also brings potential rewards.