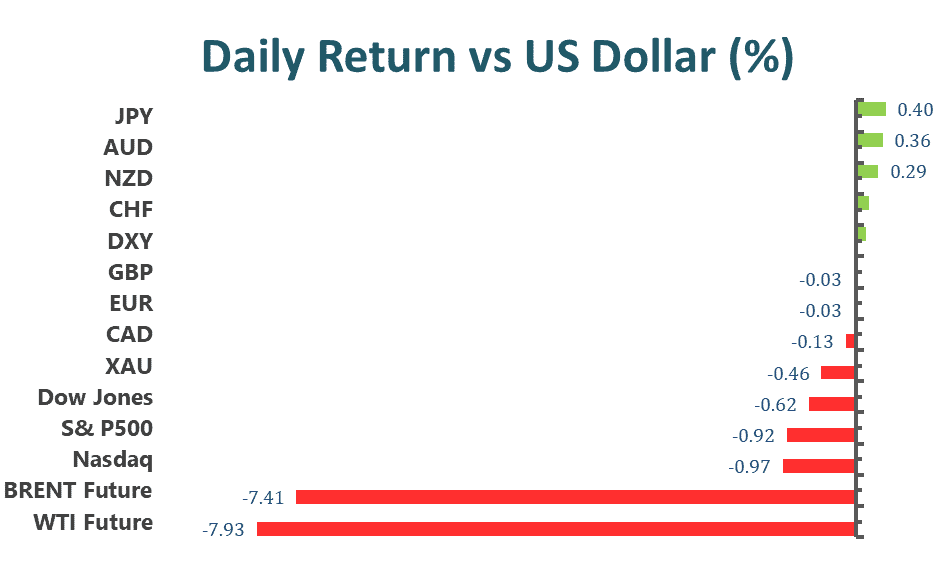

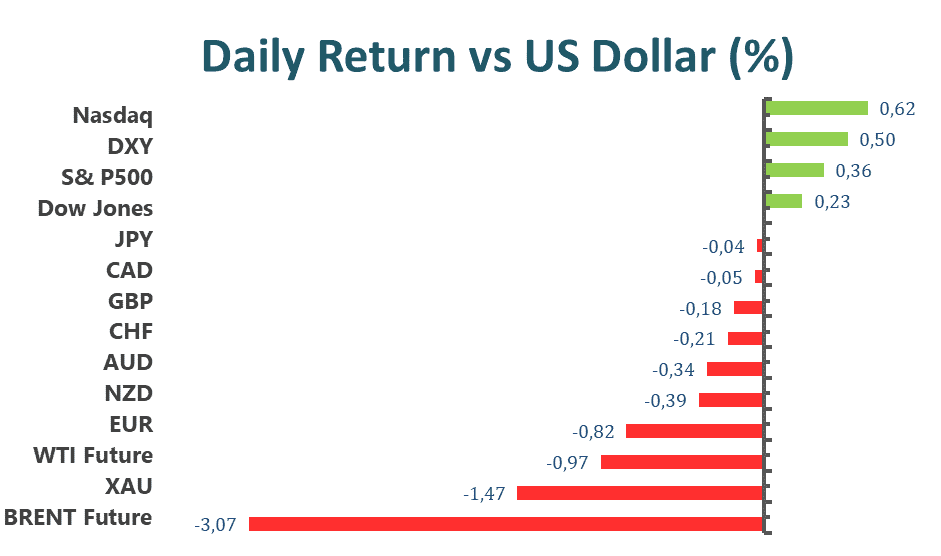

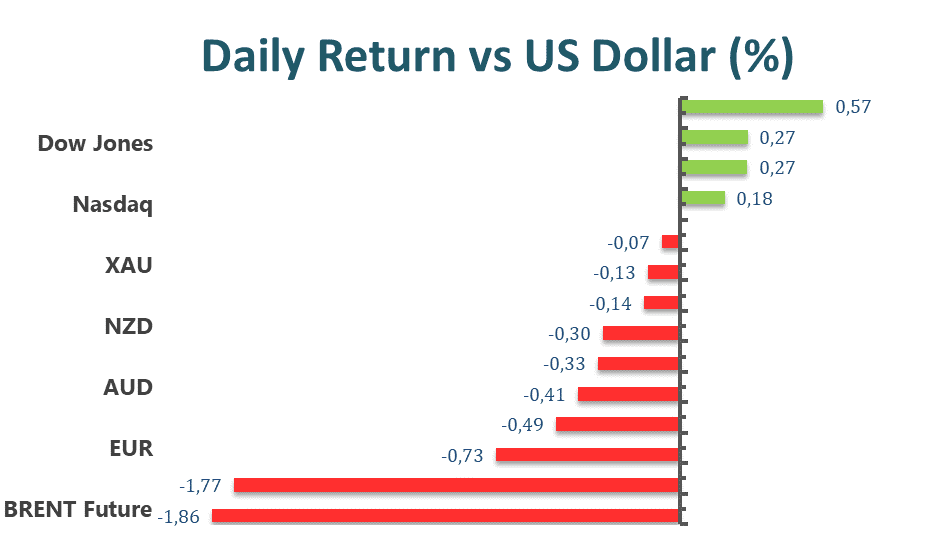

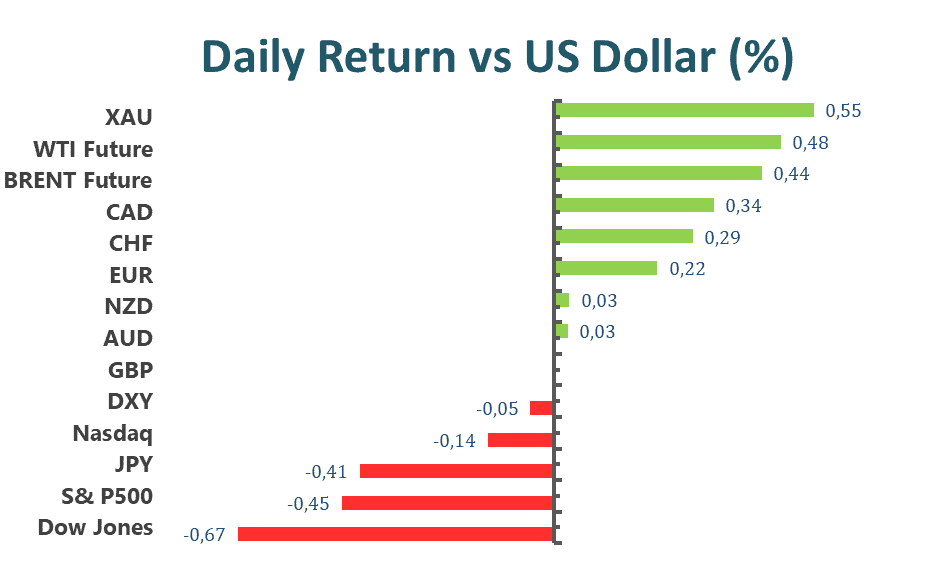

US stock continued its slide on Wednesday amid the hot US inflation report, which weighed on financial markets and boosted speculation that the US Federal Reserve will tighten its monetary policy more aggressively. The US Consumer Price Index soared by 9.1% YoY in June, which was much worse than the 8.8% expected and also much higher than May’s 8.6% print. The biggest surge in US consumer prices since 1981 indicated escalating inflation pressures and the Fed will keep raising rates rapidly soon. On top of that, Atlanta Fed President Raphael Bostic said that everything is in play to combat price pressures, which also acted as a headwind for market sentiment. In the Eurozone, the European Central Bank will start with its modest tightening in July by hiking 25 bps. Investors might keep their eyes on the interest rate differentials between the Fed and the ECB.

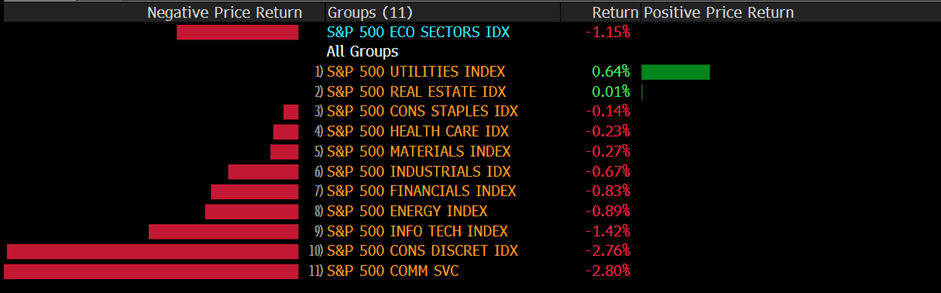

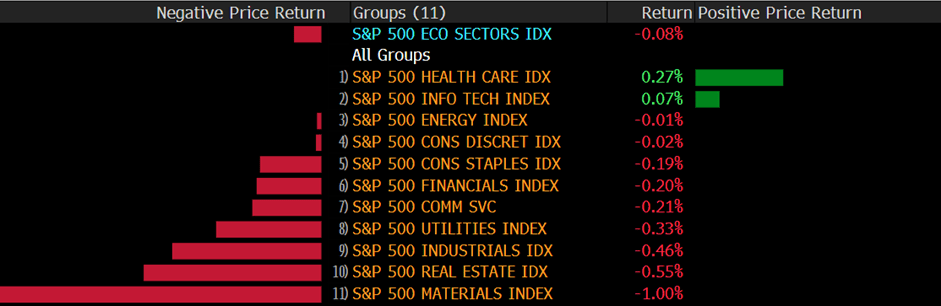

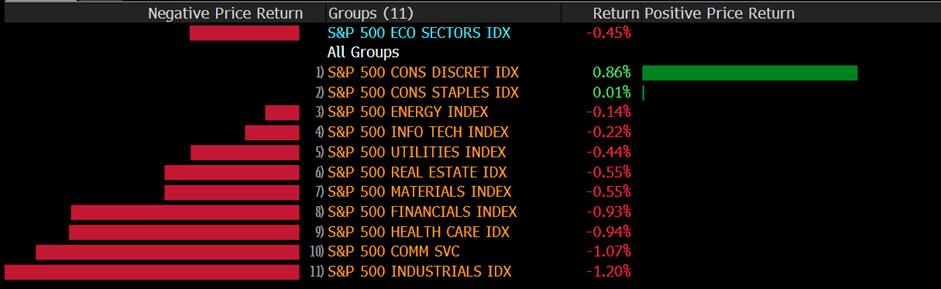

The benchmarks, S&P 500 and Nasdaq 100 both dropped on Wednesday as the market expects the US Federal Reserve will likely add another 75 bps this month after the central bank has hiked rates multiple times. The S&P 500 was down 0.5% daily and the Nasdaq 100 declined with a 0.1% loss for the day. Nine out of eleven sectors stayed in negative territory as the industrials and the communication services sectors are the worst performings among all groups, losing 1.20% and 1.07%, respectively. The Dow Jones Industrial Average meanwhile declined the most with a 0.7% loss on Wednesday and the MSCI World index fell 0.4%.

Main Pairs Movement

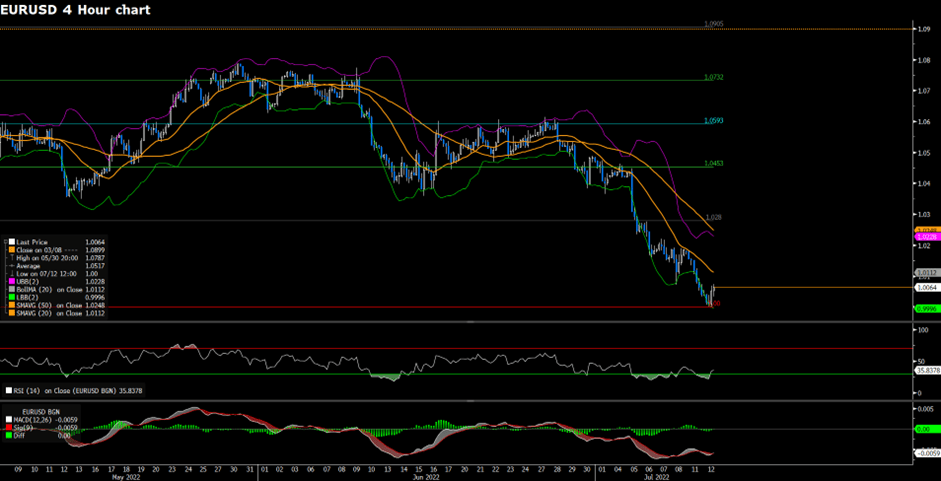

The US dollar edged lower on Wednesday, ending its previous rally to a 20-year high and settled marginally lower after the release of the US Consumer Price Index. The DXY index witnessed fresh buying at the initial release of CPI data but then lost its upside traction, dropping to a daily low below 107.5 level to erase most of its daily gains. The higher-than-expected CPI prints continue to reinforce the case for a more aggressive tightening path from the Federal Reserve in the next months, meanwhile, equities declined and government bond yields soared amid risk aversion.

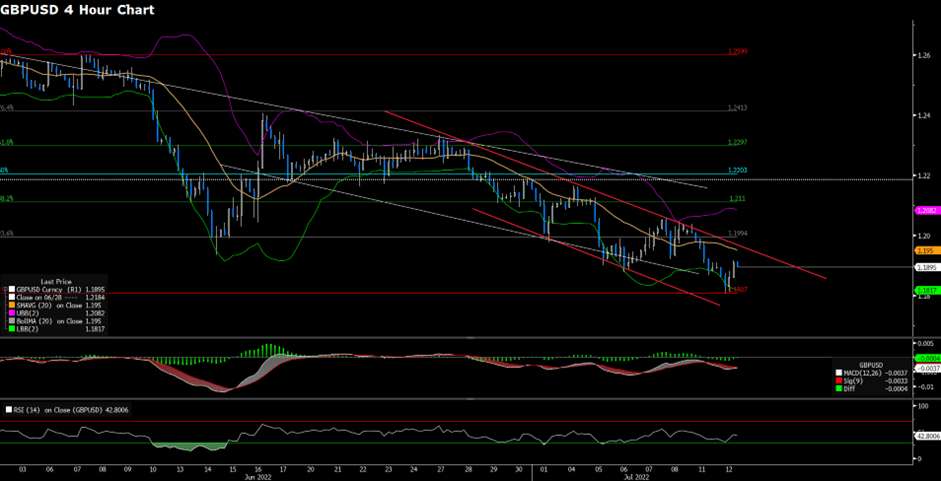

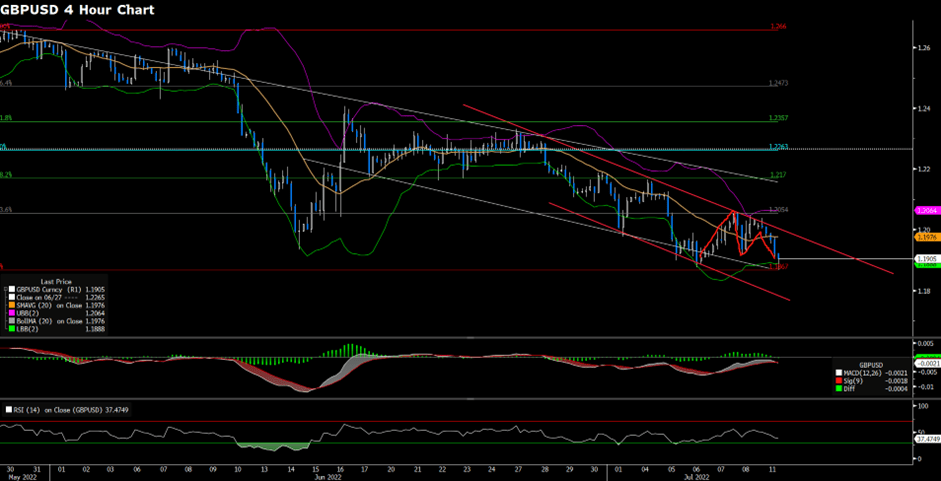

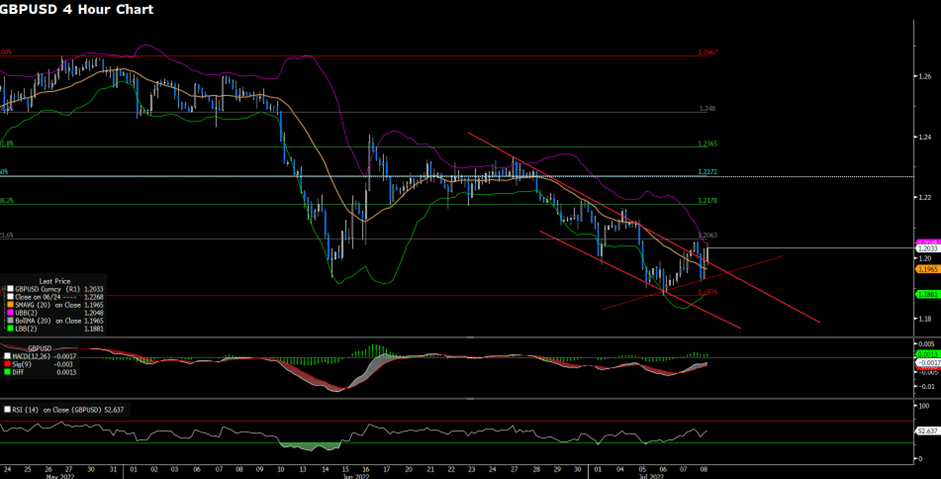

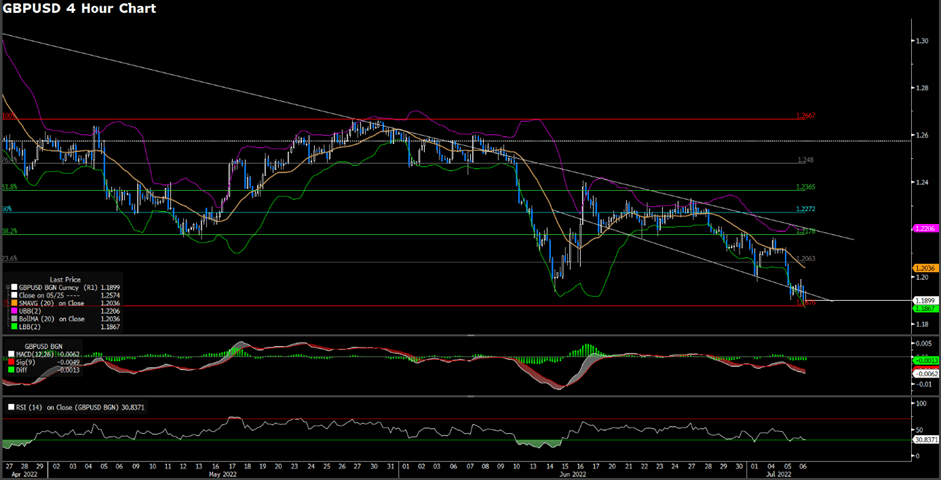

GBP/USD advanced a little with a 0.05% gain on Wednesday despite the risk-off market mood across the board. UK Gross Domestic Product (GDP) was climbing 0.5% in May and Industrial Production in June climbed 1.4%, but the hawkish data failed to provide support to the cable. The GBP/USD pair regained upside momentum and touched a daily high in the early US session, but then retreated to surrender its daily gains. Meanwhile, EUR/USD extended its 20-year slump to the 0.9997 level but quickly bounced back to 1.0121 in the American session. The pair was up almost 0.20% for the day.

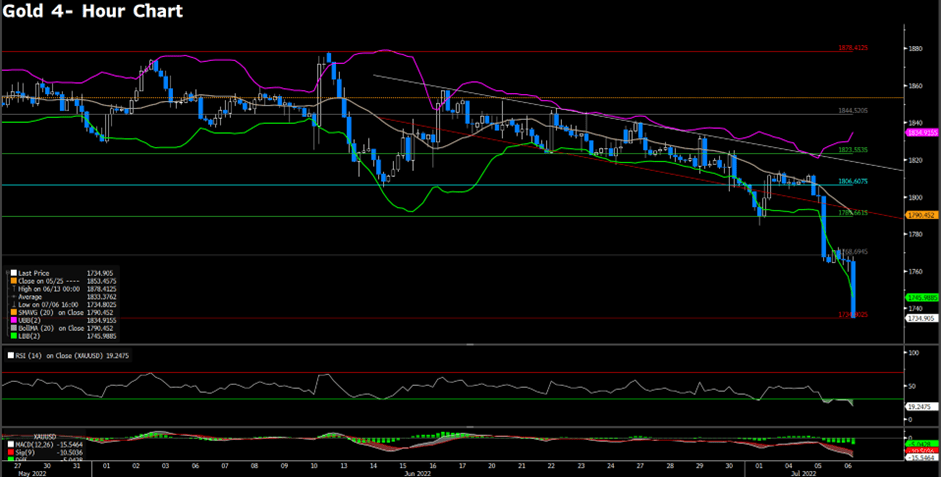

Gold advanced with a 0.55% gain for the day after touching a daily high above $1744 during the US trading session, as the surprise in US CPI data favoured the precious metal on a mixed day of sentiment in markets. Meanwhile, WTI oil rebounded from a three-month low to $96 area amid the weaker-than-expected oil demand growth in advanced economies.

Technical Analysis

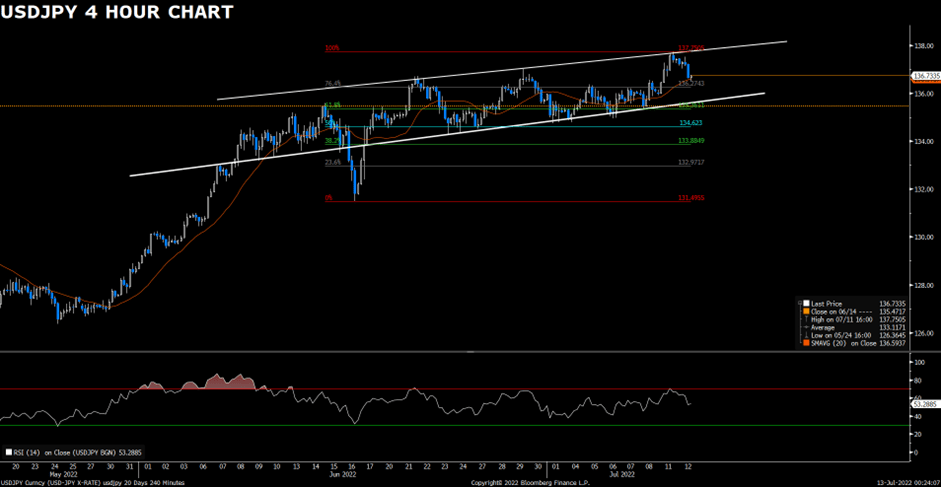

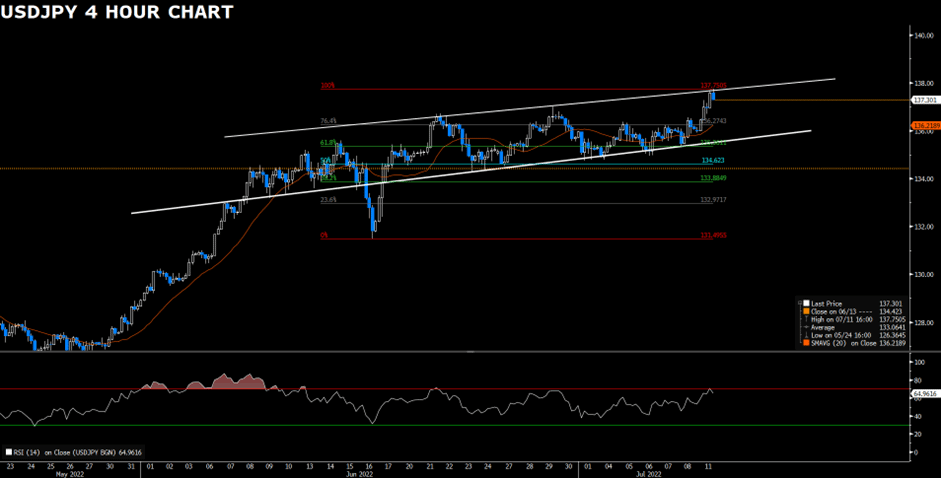

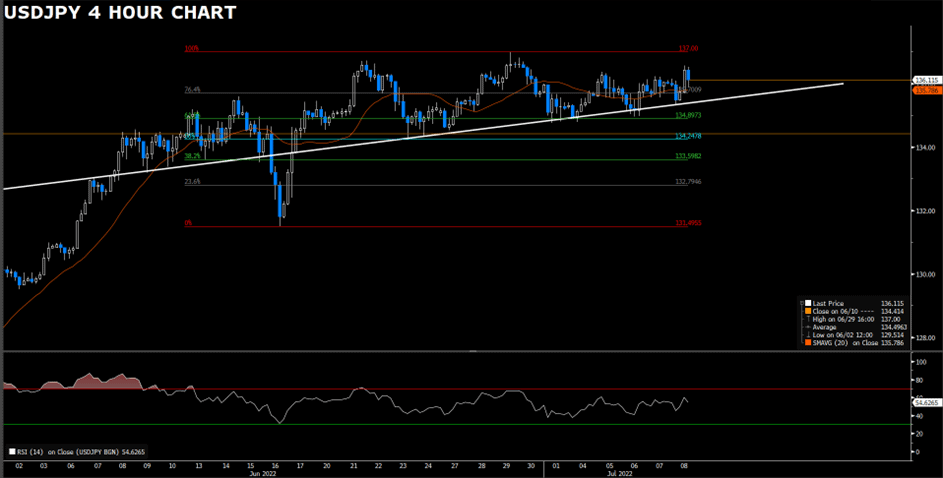

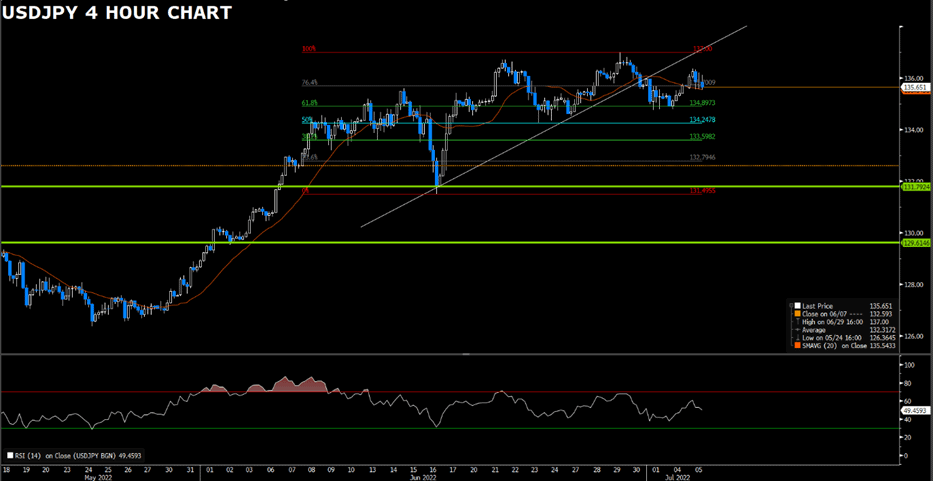

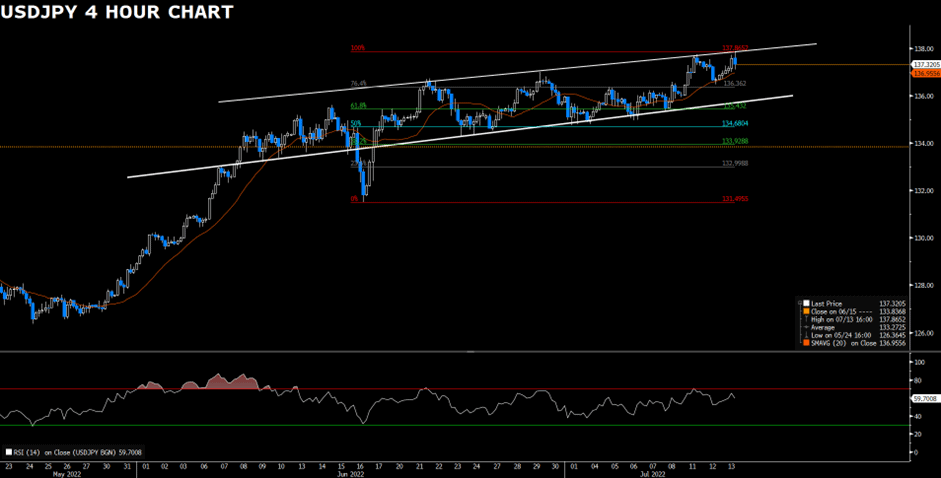

USDJPY (4-Hour Chart)

USDJPY edges higher toward its 24- year peak at the time of writing following the record-high US CPI report. In the meantime, the Bank of Japan hints at further stimulus, thus hurting the demand for the Japanese Yen.

Technical speaking, the intraday bias turns bullish after USDJPY hits the 20 Simple Moving Average; the 20 SMA becomes the first defending support for the bulls. The breakout of the resistance level of 137.86 would bring the currency further north. The current reading of the RSI indicator has not yet reached the overbought territory, suggesting that there are rooms for the pair to extend the rally. On the flip side, the support level of 135.43 would be the region that bearish momentum needs to break to bring USDJPY to the bearish projection.

Resistance: 137.86

Support: 136.36, 135.43, 134.68

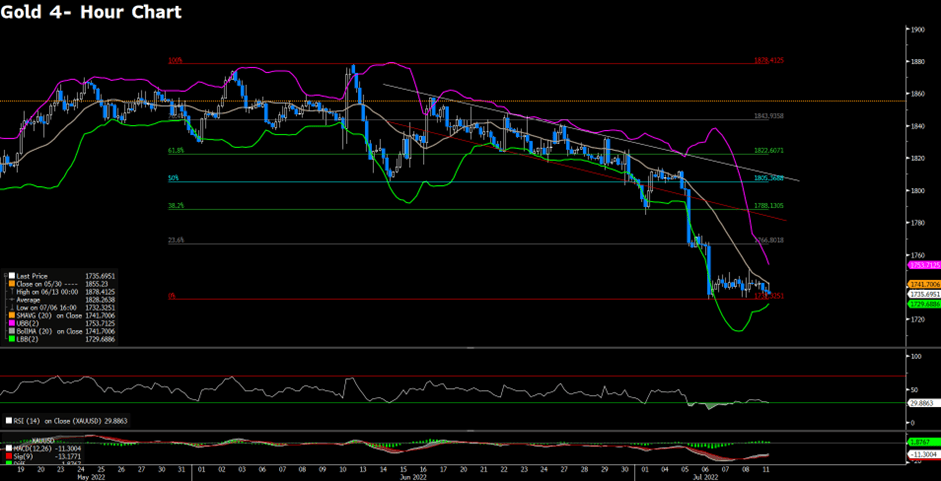

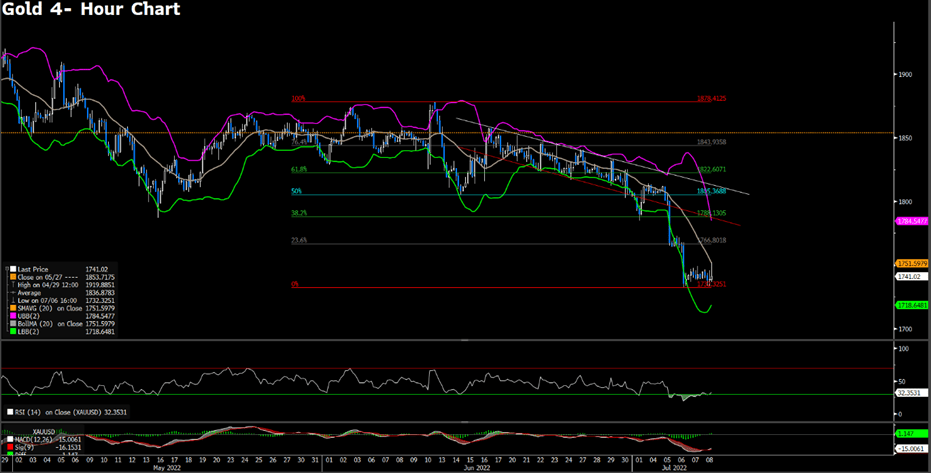

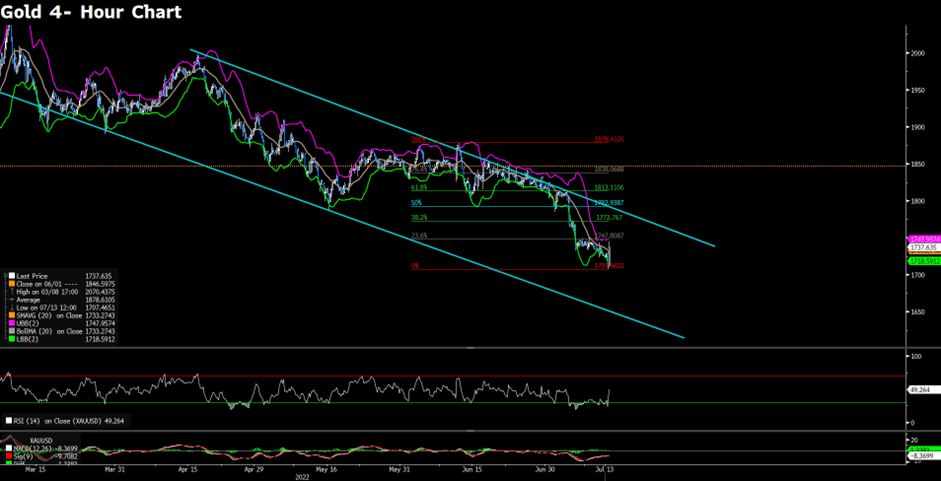

XAUUSD (4-Hour Chart)

Gold climbs near $1,740 after the release of the US CPI report, reaching 9.1% in June, its highest in nearly 40 years. An unprecedented inflation rate in June benefits the upside of gold.

From the technical perspective, the intraday rebound has pushed toward the immediate resistance of $1,747.80; with the RSI still far from being overbought, it might attract some follow-through buyers, boosting gold’s price further north. On the contrary, any up- surges would urge caution from the upcoming trading as the overall outlook of gold still looks bearish since gold still trades within the descending channel.

Resistance: 1747.80, 1772.76, 1792.93

Support: 1707.46

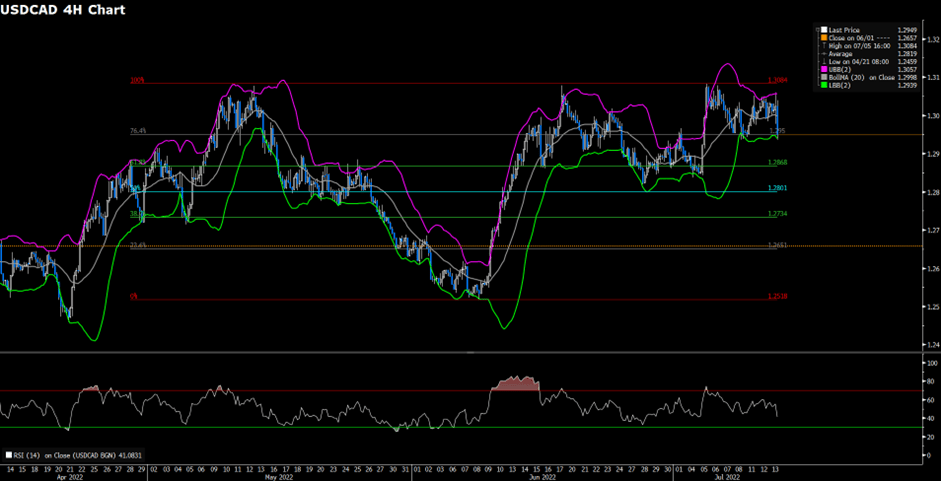

USDCAD (4-Hour Chart)

USDCAD fell sharply after the Bank of Canada decides to raise interest rates by 100 basis points to 2.5%.

From the technical aspect, the intraday bias turns bearish on the four-hour chart as the bearish double-top pattern has been form. And the downside is currently contesting the support level of 1.295; the breakout of 1.295 would bring a deeper fall back to the next support of 1.2868. To the upside, suitably holding above current support should favour the USD; climbing above the midline of Bollinger Band could lead the USD back in control and reclaim its upside momentum.

Resistance: 1.3084

Support: 1.295, 1.2868, 1.2801

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

| AUD | Employment Change (Jun) | 09:30 | 30K |

| USD | Initial Jobless Claims | 20:30 | 235K |

| USD | PPI (MoM) (Jun) | 20:30 | 0.8% |