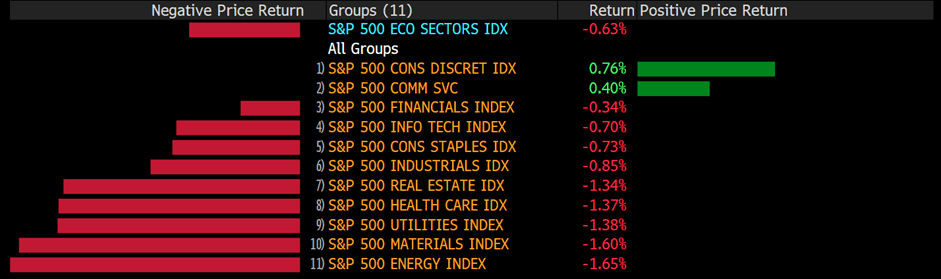

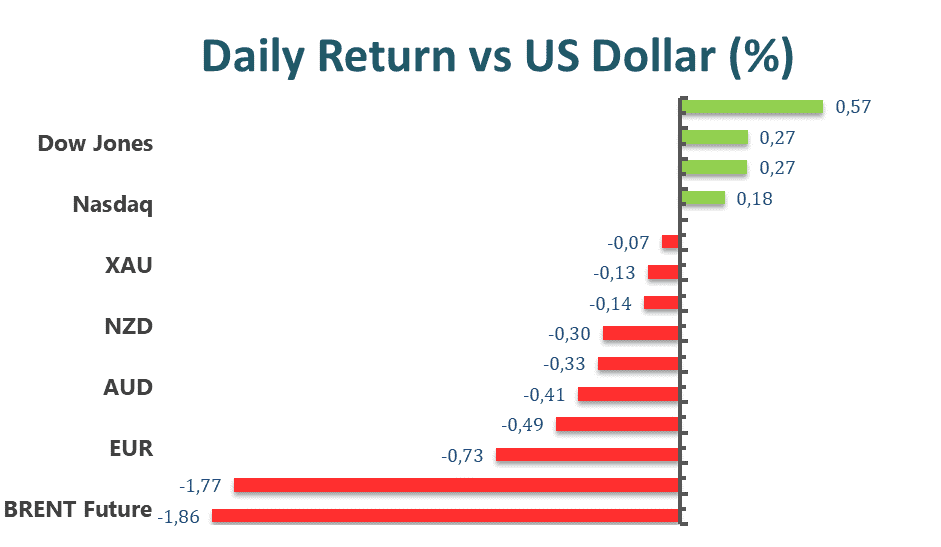

US equity market remained closed yesterday due to the US Independence Day holiday, but the cautious mood ahead of this week’s Monetary Policy Meeting Minutes from the Fed and the European Central Bank has exerted bearish pressure on investors’ sentiment. The futures for the US equity index and European bonds fell as investors worried that a faster pace of monetary tightening from global central banks will slow economic growth. Therefore, the economic fears kept the risk profile weak, which in turn helped the US dollar to remain upside momentum.

On the economic data side, the Producer Price Index from Eurozone rose 0.6% in May and came in weaker than the market’s expectations of 1%, which continues to warrant rate hikes from the European Central Bank. The dismal European data undermined demand for the Euros meanwhile the energy crisis also acted as a headwind for the shared currency amid the Russian invasion of Ukraine. The market focus now shifts to the FOMC minutes of its latest meeting on Wednesday and the Nonfarm Payrolls report on Friday, as market participants expect that the Fed elevated its interest rates by 75 basis points in its June monetary policy meeting.

Main Pairs Movement

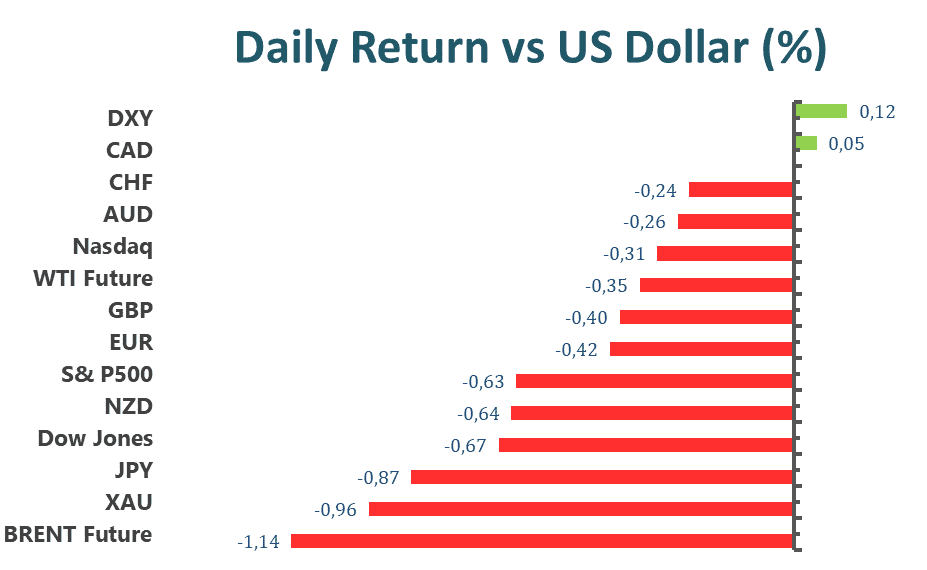

A slow beginning to the week, as US markets were closed due to the Fourth of July Holiday. The DXY index was also in the mood of holiday during the first half of Monday and stay steadily around 105.1, and then gained some strength by the end of the day, reaching 105.198, but the action was limited as some traders stayed away from their desks.

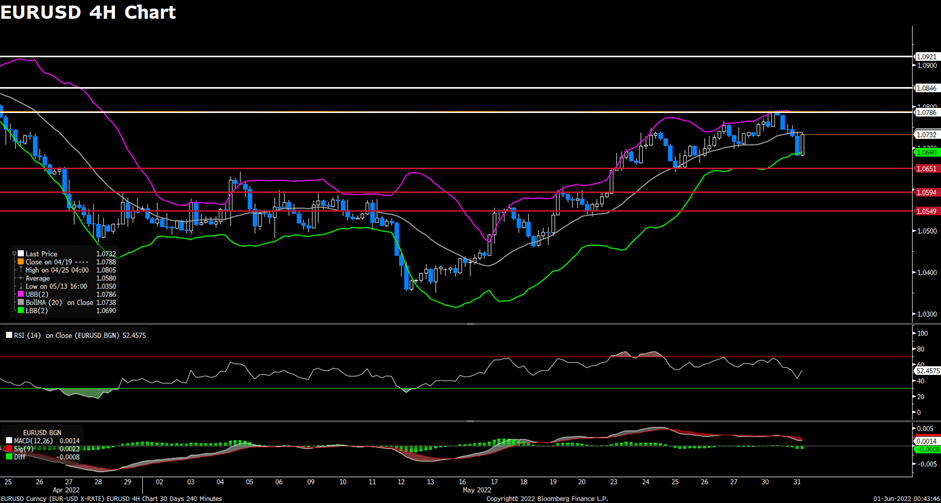

GBP/USD was surrounded by bullish momentum at the start of Monday, even reaching a daily high around 1.2154, but then lost its bullish traction and fell to around 1.2105, since Brexit woes undermined demand for the Pound. At the same time, EUR/USD got a rebound from last Friday’s low of around 1.039 to a daily high of around 1.045 at the middie on Monday, but then Dismal European Data undermined demand for shared currency, and EUR/USD closed by 1.0425.

Gold continued the rebound momentum gained from last Friday’s daily low below $1786 and managed to reach above $1812.5, but then fell below $1805 as the expectation of a hike in interest rates makes gold less attractive.

Technical Analysis

USDJPY (4-Hour Chart)

USDJPY advances toward near 135.70 at the time of writing. USDJPY turns upside after experiencing a correction. From current levels, weakness below the resistance level of 135.70 would continue to find robust support at 134.89. If the support level is broken, then it would trigger a fresh technical selling, making USDJPY slide further south. On the flip side, if the pair can break through the resistance at 135.70 and further above the ascending trend line, then USDJPY could potentially attract more buyers to lift the pair above the psychological level of 136.00 and 137.00.

Resistance: 1.35.70, 137.00

Support: 134.89, 134.24, 133.59

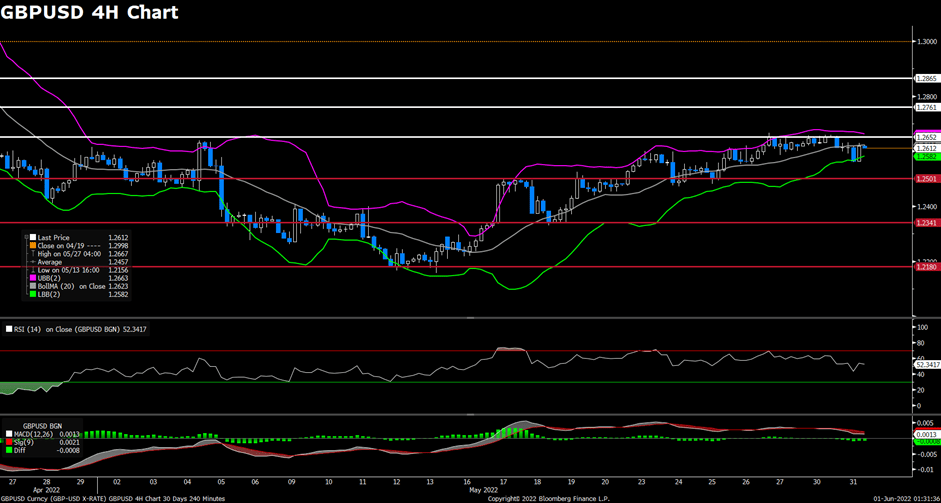

GBPUSD (4-Hour Chart)

GBPUSD clings around 1.2100 on Monday. The pair has reversed its direction after reaching near the support level around 1.1934 area. The British Pound looks to regain position as the RSI indicator stays below, suggesting that buyers remain on the sidelines for the time being; in the meantime, the MACD has turned positive, indicating the reversal trend from bearish to bullish. To the upside, GBPUSD is heading toward the next resistance at 1.2227; if the pair can successfully breach the level, then it would continue to head north. On the downside, if the support level of 1.1934 cannot eventually defend the line, then GBPUSD would slide further south.

Resistance: 1.2227, 1.2408, 1.2555

Support: 1.1934

Gold (4-Hour Chart)

Gold struggles to stage a recovery on Monday following last week’s drop. Despite gold attempts to climb above the $1,800 level, it stays under modest bearish pressure, remaining within the descending channel. At the moment, even though the RSI indicator stays below the midline, gold looks to be capped by the midline of the Bollinger Band, having a hard-to-move further north. Gold needs to climb above $1,835 to reclaim bulls in the near- term. On the flip side, if the current support level at $1,784 cannot hold, then gold would accelerate further south.

Resistance: 1835.026, 1866.243

Support: 1784.565

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

| GBP | Construction PMI (Jun) | 16:30 | 55 |

| USD | ISM Non-Manufacturing PMI (Jun) | 22:00 | 54.3- |

| USD | JOLTs Job Openings (May) | 22:00 | 11.000M |