Pictured: Your dream lambo

Can day trading make you rich? Are all the stories portrayed over social media true, that day traders would all be sipping pina coladas at the beach all day everyday, changing their Lamborghinis as they wish? With the right skills and experience, day trading can be lucrative and lead to significant financial gains even when you have capital as small as $100.

But here’s the catch – it is a skill to be acquired over years of experience.

So What is Day Trading?

Day trading is a strategy in financial markets where traders buy and sell a certain class of asset within the same trading day – occasionally just within a matter of a few minutes. The goal is to simply capitalise on short-term price movements in the market. Typically, day traders close out all positions before the market closes to avoid unmanageable risks and price gaps, just so that sleep is not lost by worrying about how the trade will go next.

Some key aspects of day trading include:

- Short-Term Nature: No holding positions for months or years, only holding positions for minutes to hours within the same day.

- High Frequency: Many day traders execute multiple trades per day, looking for small but consistent opportunities to profit from the market.

- Use of Leverage: Day traders often use leverage (borrowed money) to increase their buying power, which can amplify both gains and losses.

How Difficult or Risky is Day Trading?

As mentioned, the use of leverage magnifies the high returns. However at the same time it also creates significant risks. For a beginner in trading, it is common to go through a phase of financial losses, especially when risk management skills and psychological resilience is yet to be developed.

Is Day Trading a Scam?

It is, and it is not. Typically, day trading is perceived to have the image of a scam because new day traders failed to practice risk management leading to huge losses by over leveraging. Thereafter, such losses cannot be recovered except by sourcing new income from either becoming a better trader in the future or other channels of income, such as taking up a job, freelancing or working on a side hustle.

Another aspect of “scam” is when a day trader chooses to trade on a platform with little to none credentials. These are brokers that would entice traders to deposit money on a perpetual basis, and once a certain amount of deposit is hit, the broker would disappear into thin air, never to be found again. Therefore, it is important for a day trader to choose a trusted platform to start the journey.

OMG! So What is the Best Day Trading Platform?

Those who have been in the financial markets as long term investors may have heard about platforms such as Webull, Robinhood, Fidelity, eTrade and ThinkorSwim. These are platforms regulated by the United States, and there is this restrictive practice called the pattern day trading (PDT) rule.

A Quick Glance at Pattern Day Trading

The PDT rule is a regulatory guideline in the United States applicable to its stock market traders aiming to curb excessive risk-taking, protecting traders from the potential significant losses.

In general, traders who executed three day trades within five business days would be identified as a pattern day trader and would be required to maintain either $25,000 or they will not be allowed to day trade for a period of ninety days.

Sounds like a harsh requirement? That’s because it is.

How Much Money Do I Need to Start Day Trading? Must it be $25,000?

Not necessarily. With VTMarkets, it is much more flexible where you can start day trading with a minimum deposit of just $100. For a new trader, it is highly recommended that you test the platform out by trading on the demo account first.

Day Trading with a Variety of Asset Classes

Day trading is also not just limited to the stock market. VTMarkets give you a wide range of choices which include:

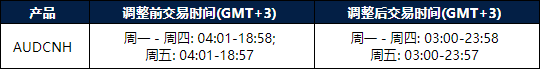

- Forex: Buying and selling currency pairs within the same trading day, aiming to profit from short-term fluctuations in exchange rates. The forex market operates 24 hours a day, five days a week, allowing traders to engage in trading activities during any session: Asia, Europe, or North America. Major currency pairs include EURUSD, USDJPY, GBPUSD, USDCHF, AUDUSD, USDCAD and NZDUSD.

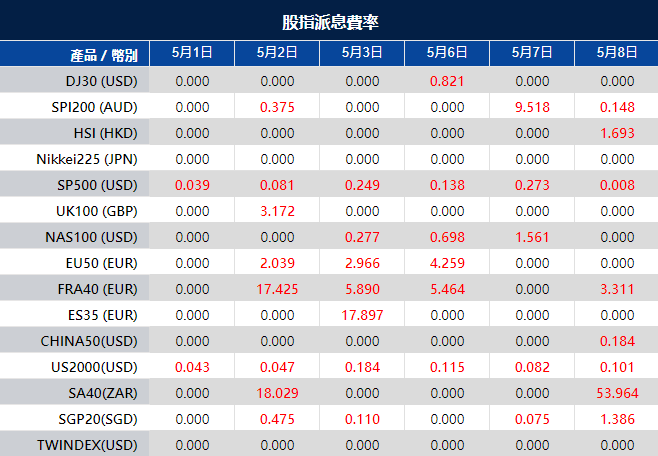

- Indices: Collections of stocks that represent a segment of the stock market, such as the S&P 500, Dow Jones Industrial Average, NASDAQ Composite, FTSE 100, DAX, or Nikkei 225. Day trading of indices simply capitalises the price movements within the same trading day.

- Energy: This sector includes commodities such as crude oil, natural gas, gasoline, and gas oil.

- Precious metals: Gold, silver, copper, platinum, and palladium are precious metals traded as commodities and are typically traded in the form of derivatives such as CFDs. In particular, gold is popular among day traders due to its liquidity.

Candlestick Chart Patterns are a Huge Part of Day Trading

Regardless of which asset class chosen, candlestick chart pattern is the bread and butter for a day trader. This is also known as technical analysis, whereby traders seek to understand price patterns and market dynamics, thereby executing trade strategies using such timely and actionable insights in the markets being traded. Candlestick chart patterns helps with risk management while maximizing opportunities for profit within the same trading day,

OK, I’m Convinced. How to Get Started in Day Trading Now?

As someone new to day trading, the first step is to start demo trading with VT Markets. Once you are familiar with the platform, and gain confidence in your trading knowledge, you can also start trading in a live market environment.

New to VT Markets? Open a demo account or start live trading!