Daily Market Analysis

Market Focus

Stocks climbed to a record after surprisingly weak jobs data eased fears about higher inflation and a cutback in stimulus. The dollar slumped, while Treasuries were little changed.

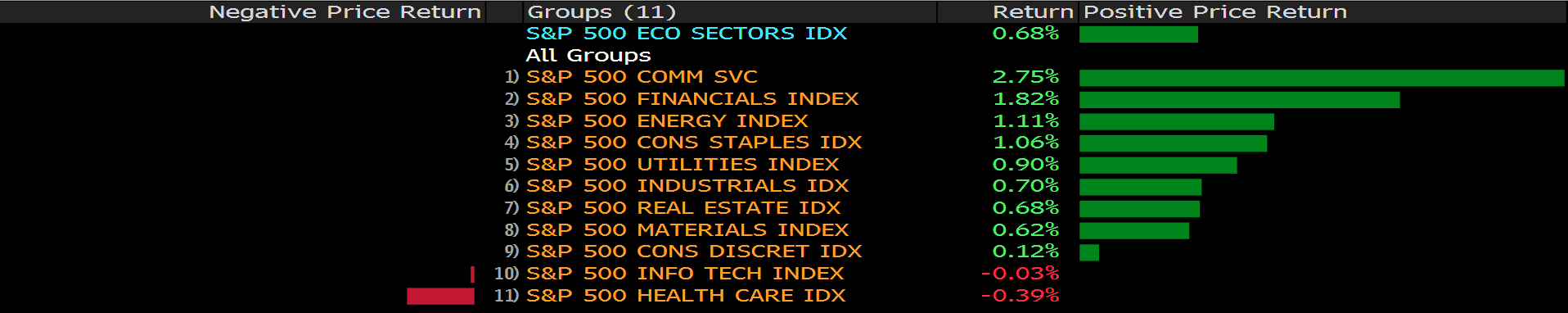

All major groups in the S&P 500 rose, with energy, real-estate and industrial shares leading the charge. Earlier in the day, technology led equity gains as softer economic data drove investors into the perceived safety of pandemic darlings – mega caps flush with cash and stay-at-home stocks. A gauge of giant growth companies such as Apple Inc. and Amazon.com Inc. pared most of its advance.

The long-awaited employment data rattled markets, with payrolls up only 266,000 in April, trailing the projected 1 million surges. For several analysts, the figures may give a boost to President Joe Biden’s $6 trillion economic agenda and another reason for the Federal Reserve to keep its accommodative stance. Treasury Secretary Janet Yellen said the report “underscores the long-haul climb back to recovery,” while retaining her expectation of a return to full employment next year.

Federal Reserve Bank of Minneapolis President Neel Kashkari told Bloomberg Television he has “zero sympathy” for critics on Wall Street, who slam the central bank’s aggressive support of the U.S. economy while millions of Americans remain out of work.

“We need to rebuild this labor market and put them back to work. Then there will be plenty of time to normalize monetary policy,” he said.

Main Pairs Movement:

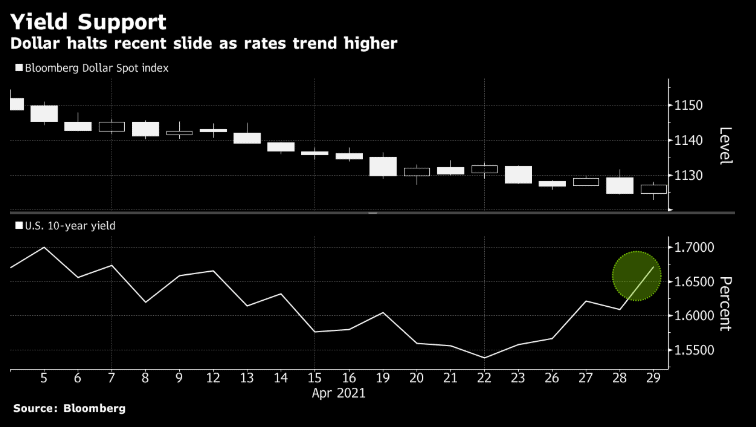

A gauge of the dollar slumped to a 10-week low after U.S. job growth missed all estimates and as stocks rose on easing inflation concerns. The euro advanced to the highest in more than two months amid short-covering.

Dollar Spot Index slid as much as 0.665%, the most since December, after data showed the U.S. unemployment rate edged up to 6.1% and payrolls increased by just 266,000 after a downwardly revised 770,000 March increase, well short of projections. The dollar also came under pressure as offshore yuan posts its biggest advance in four months.

The euro climbs as much as 0.8% to $1.2165 amid short-covering and after ECB governing council member Martins Kazaks said that a June decision to slow down bond-buying is possible if the economy doesn’t deteriorate. EUR/USD implieds are higher across the curve with 1-year climbing to as high as 6.4350, highest level since March 24.

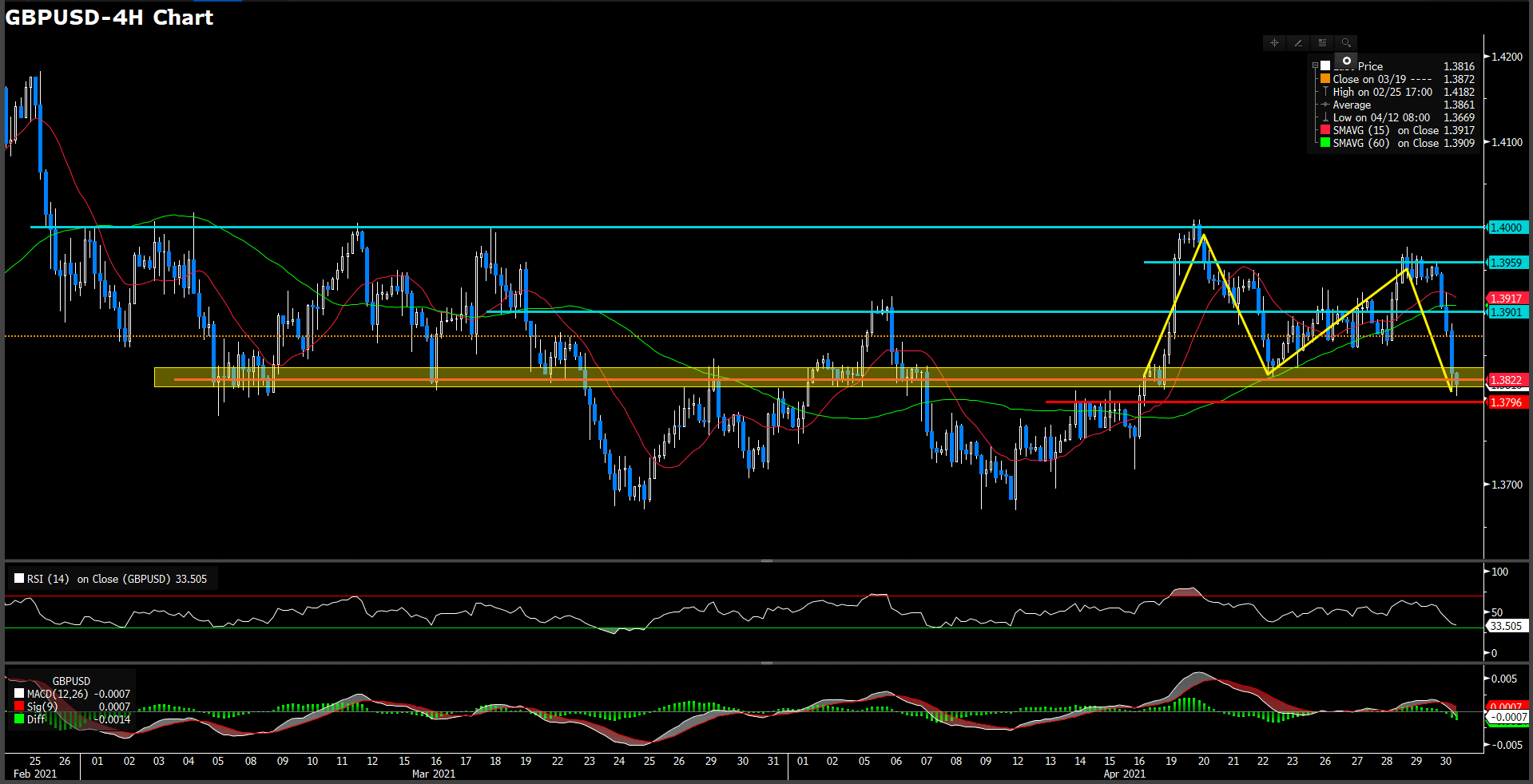

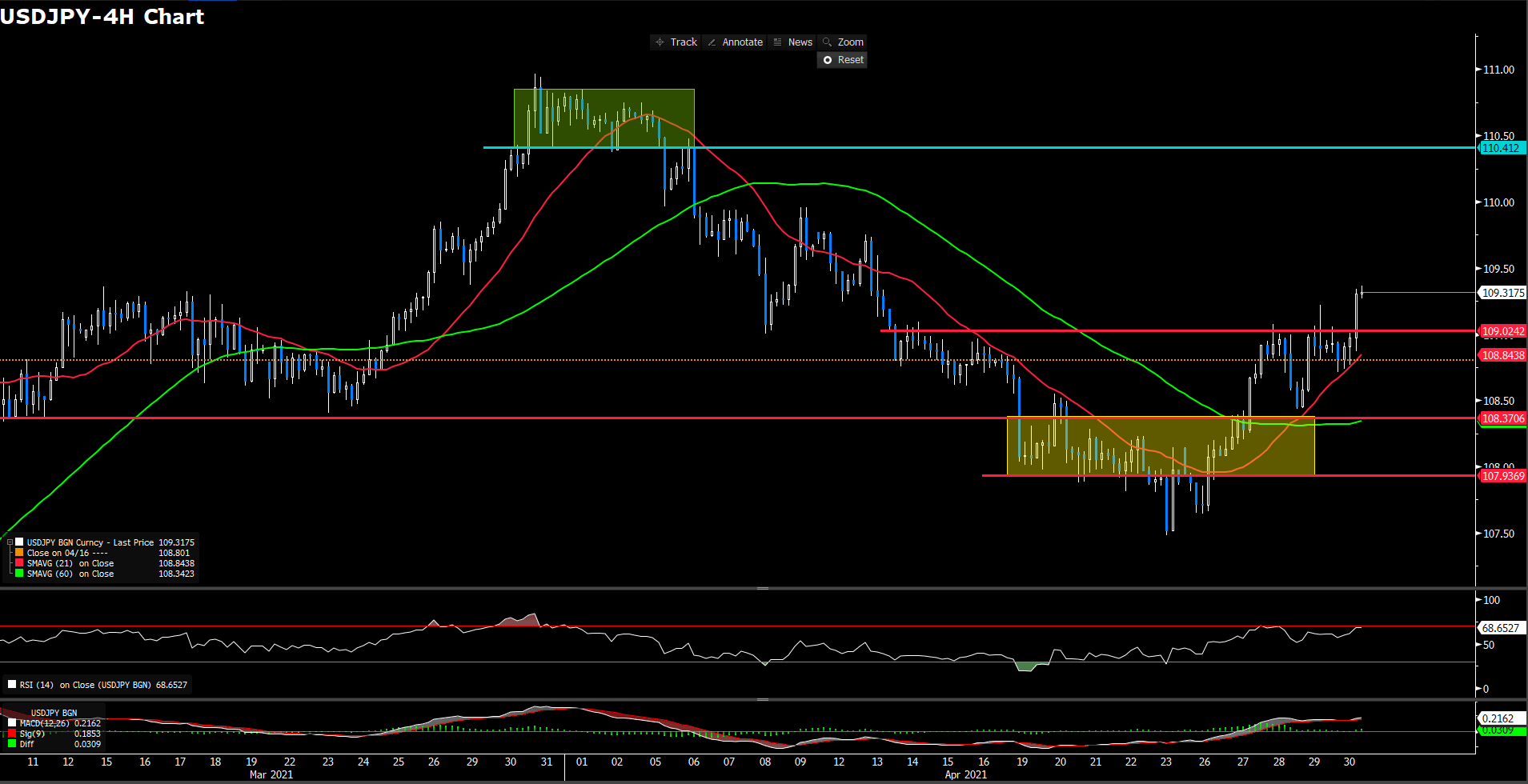

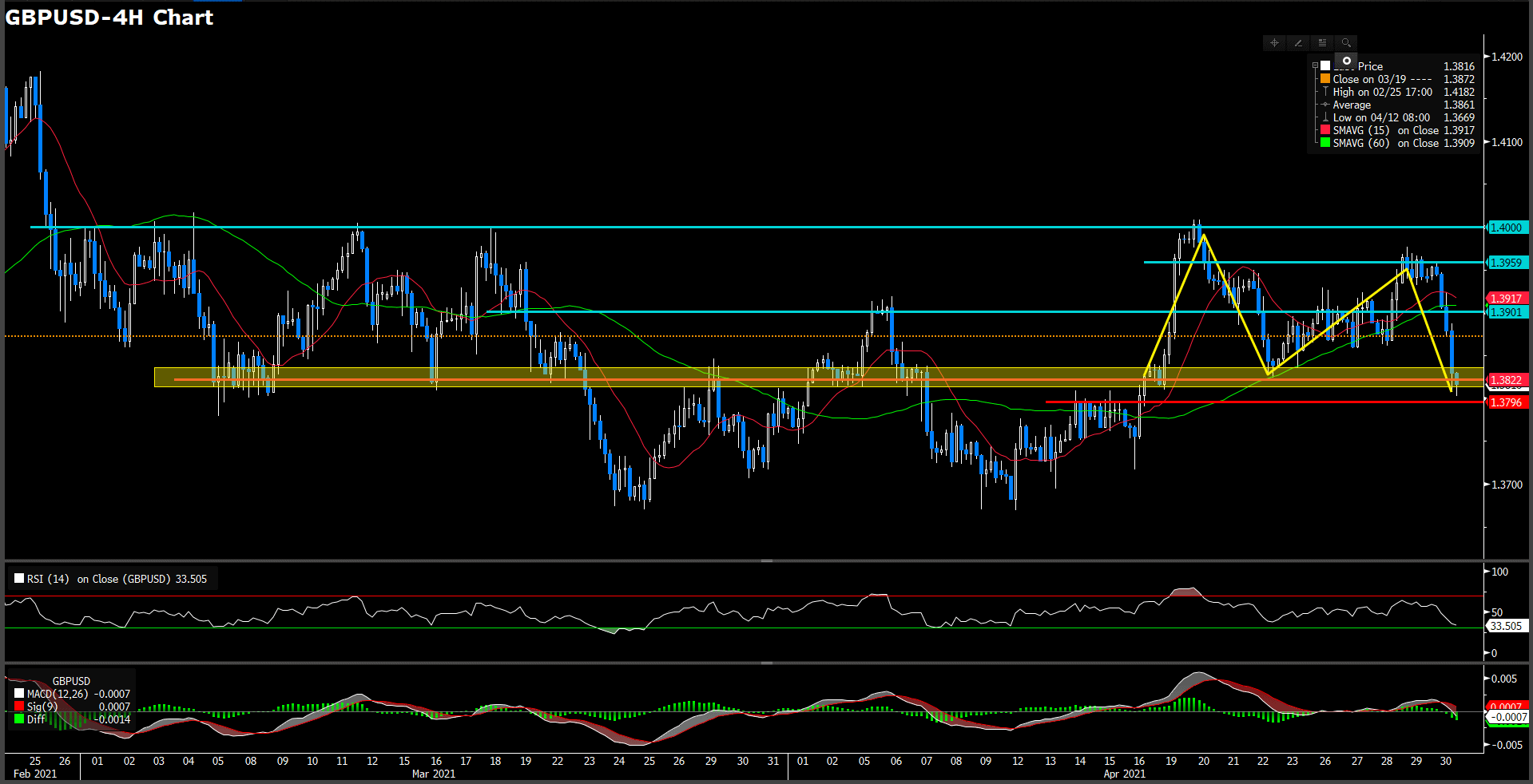

On the week, commodity currencies led gains against the dollar, as prices of raw materials continued to soar. GBP/USD gained as much as 0.8% to 1.4, falling just short of the 1.4009 level last seen on April 20. USD/JPY was down 0.4% to 108.71 after earlier sliding as much as 0.7% to 108.34, the lowest since April 27.

Technical Analysis:

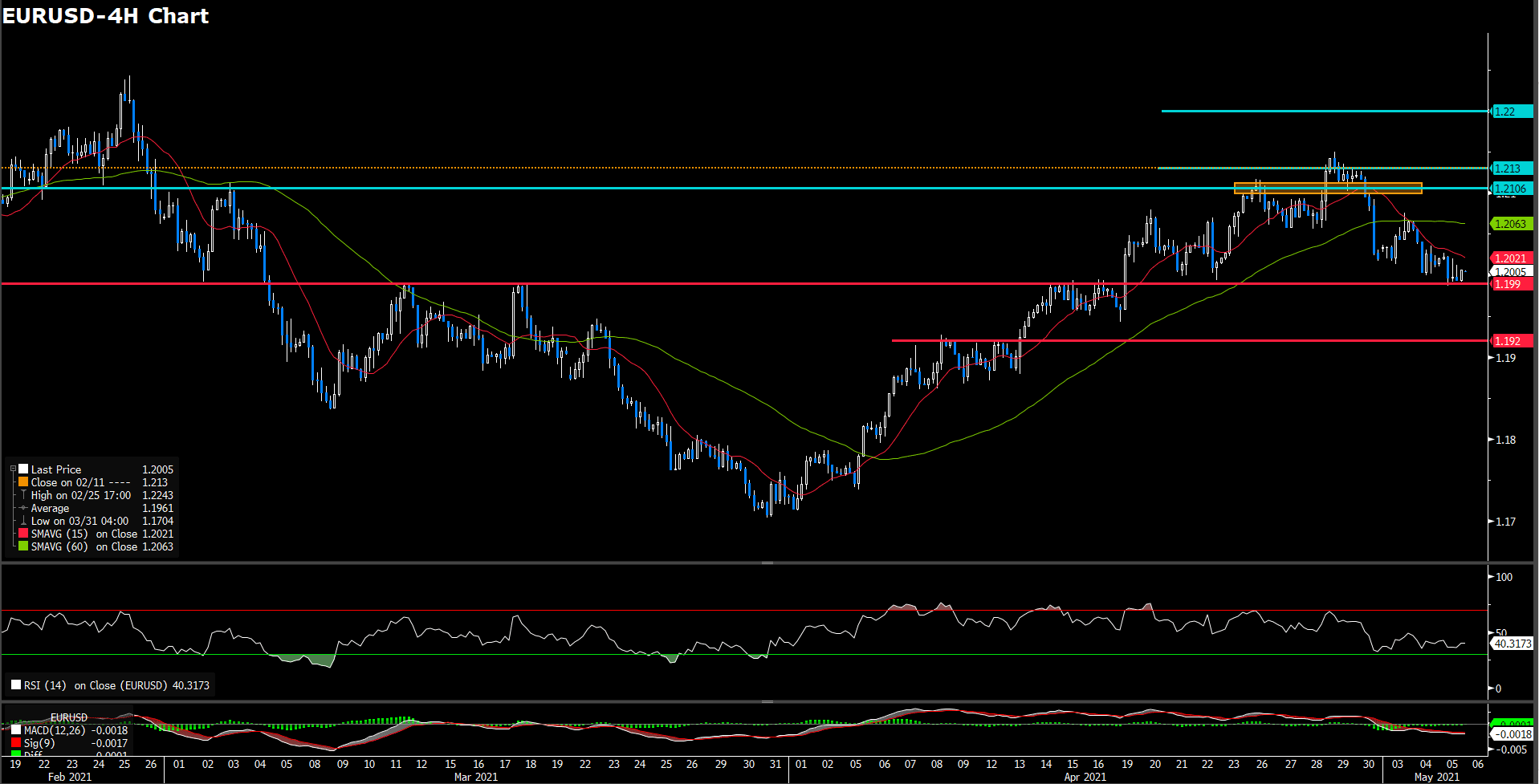

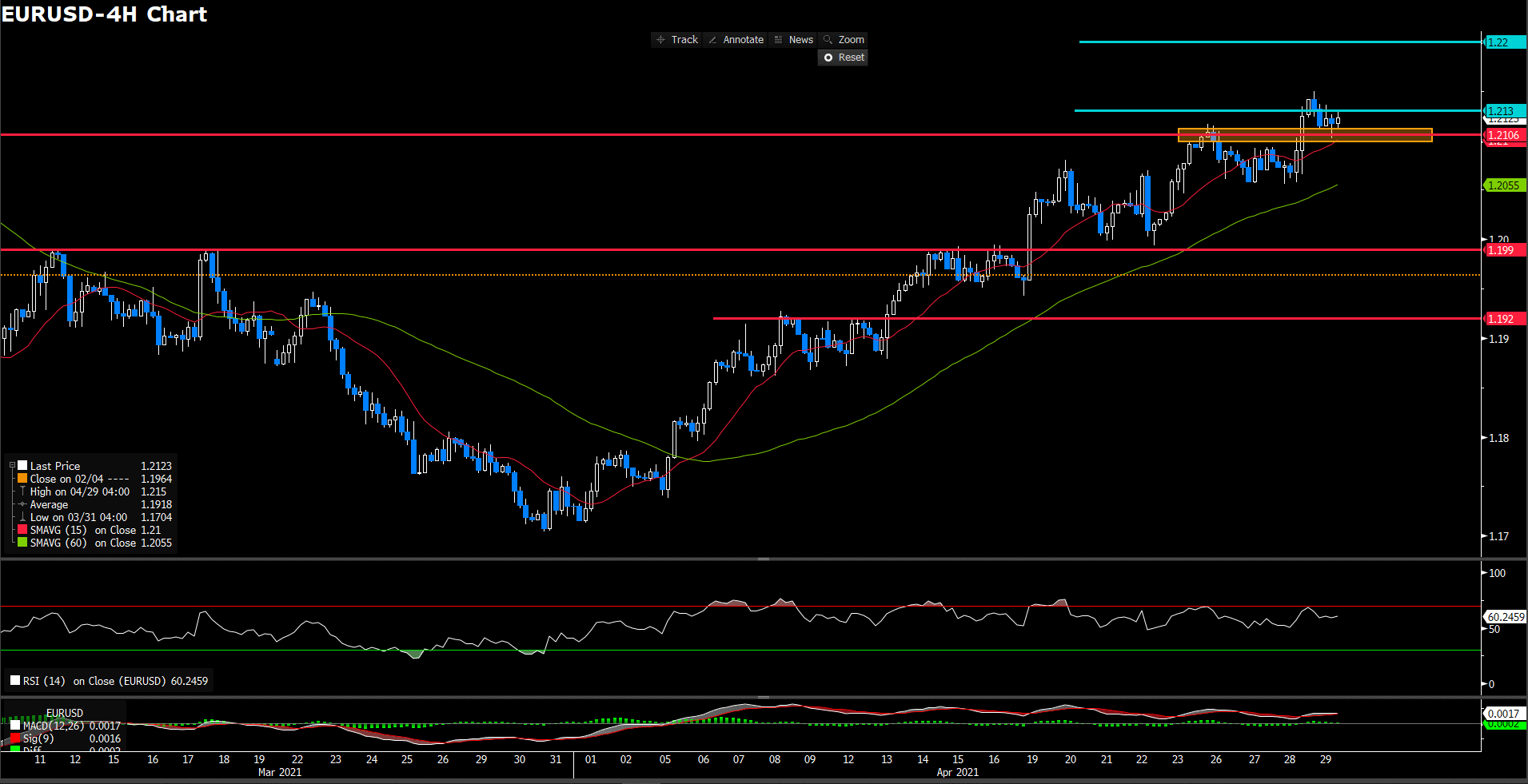

EURUSD (4 hour Chart)

Euro fiber extended it yesterday upward momentum to approached 2-month high on 1.216 level after U.S. unveiled an extremely disappointed NFP data that miss 1 million job gain versus 266 K actually, trading at 1.2164 as of writing. For technical aspect, RSI indicator shows 76 figures, suggesting a over bought sentiment at least for short term. On average price view, 15-long SMA accelerating it ascending slope and 60-long SMA turned it slope to teeny-tiny upside in day market.

We foresee market it pretty optimistic for gain traction as it edged higher than last peak. Meanwile, market seems try toward to next psychological level at 1.22. Therefore, we expect the first immediately downside support level will be the peak of last time at 1.2151 and 1.2106 following.

Resistance: 1.22

Support: 1.207, 1.2105, 1.215

XAUUSD (4 Hour Chart)

Gold consecutive it bull movement once breached to 3 months peak at 1843 and had a correction for it gain traction after market digest the poor US NFP data, trading at 1832. Meantime, U.S. 10 years Treasuries yield have fallen to 1.5% stage which is testing the neckline of 2-month-long double top pattern. For RSI side, indicator shows 73 figures which show market is experiencing a torrid sentiment. On the other hands, 15 and 60-long SMAs indicator are accelerating it upward slope.

At current stage, it seems market pricing for bullish trade while gold market without any cap pressure. However, we verdict that soared up rapidly in short term market could motivate take profit momentum. Therefore, for bull favour, first immediately downside support at 1812.8 and pyschological level at 1800 will be follow. On up way, we expect there has another take profit level on 1850.

Resistance: 1850

Support: 1812.8, 1800, 1760

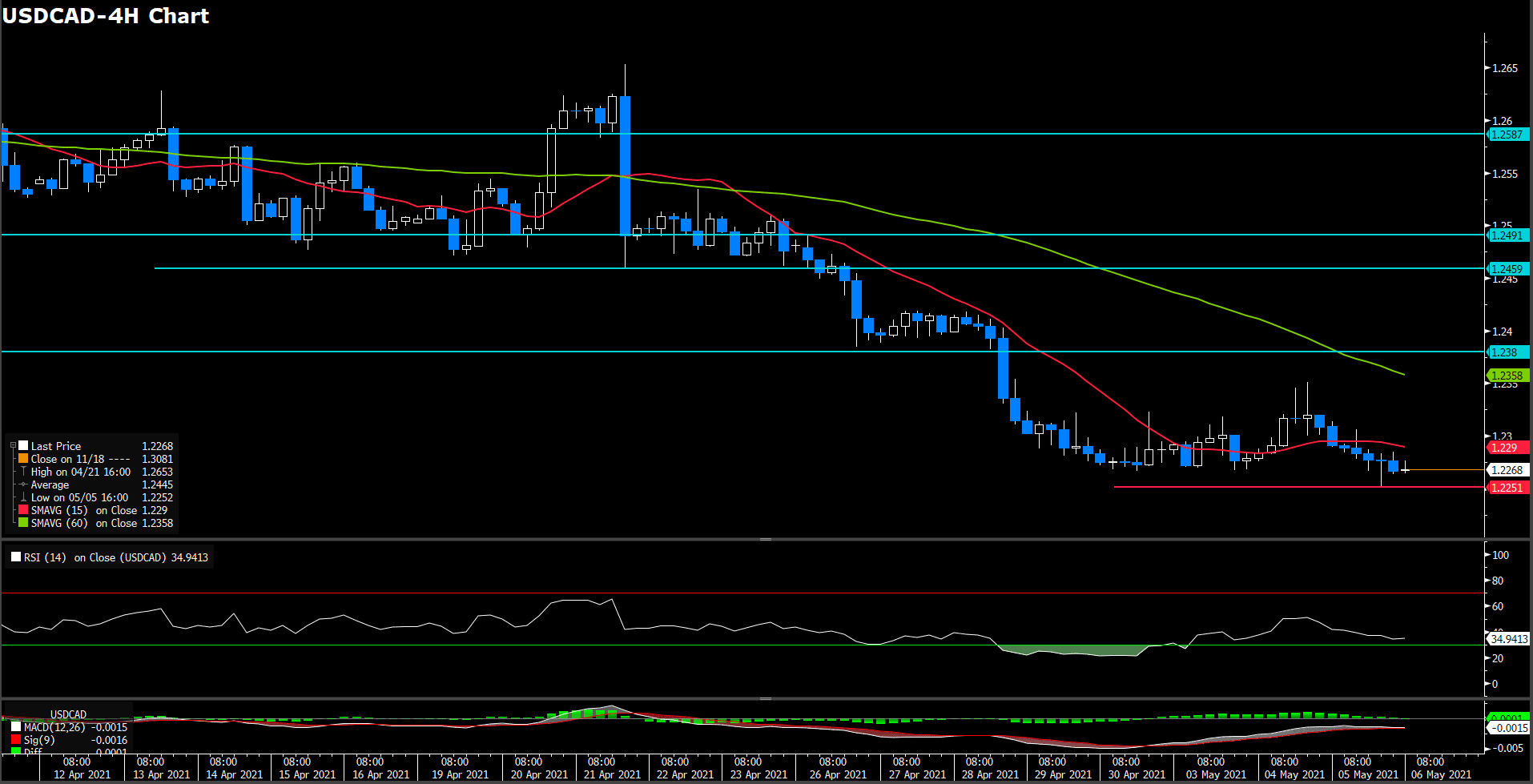

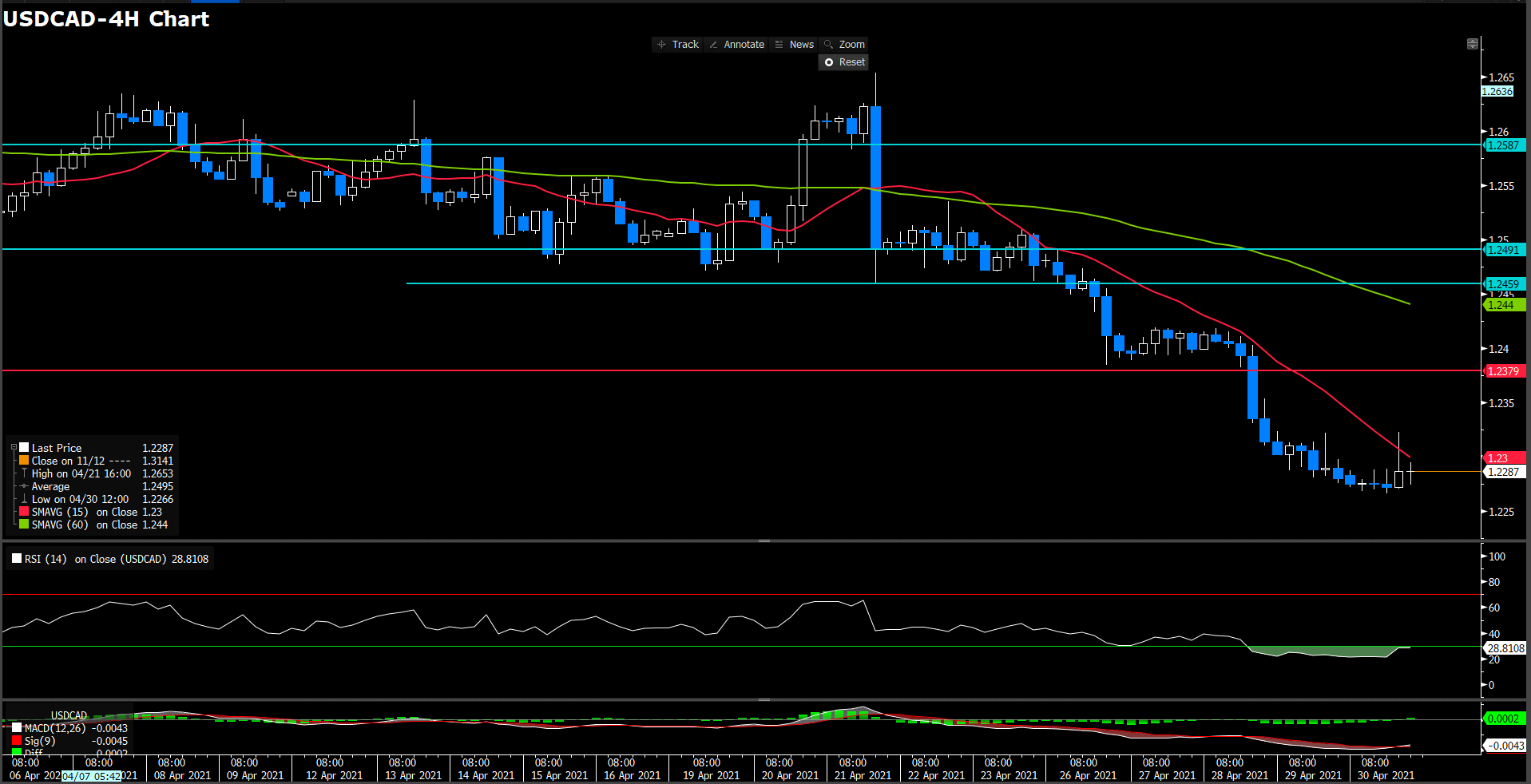

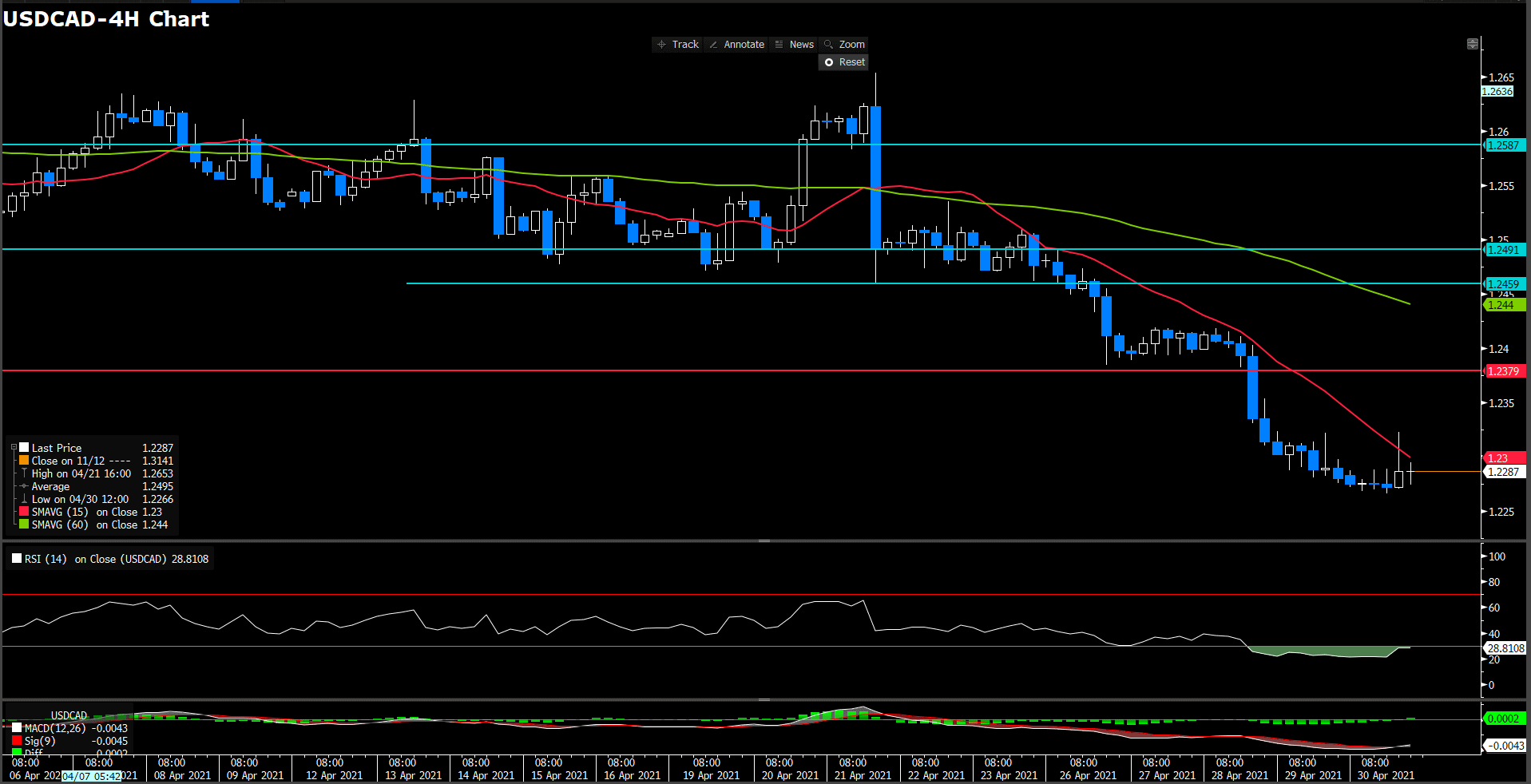

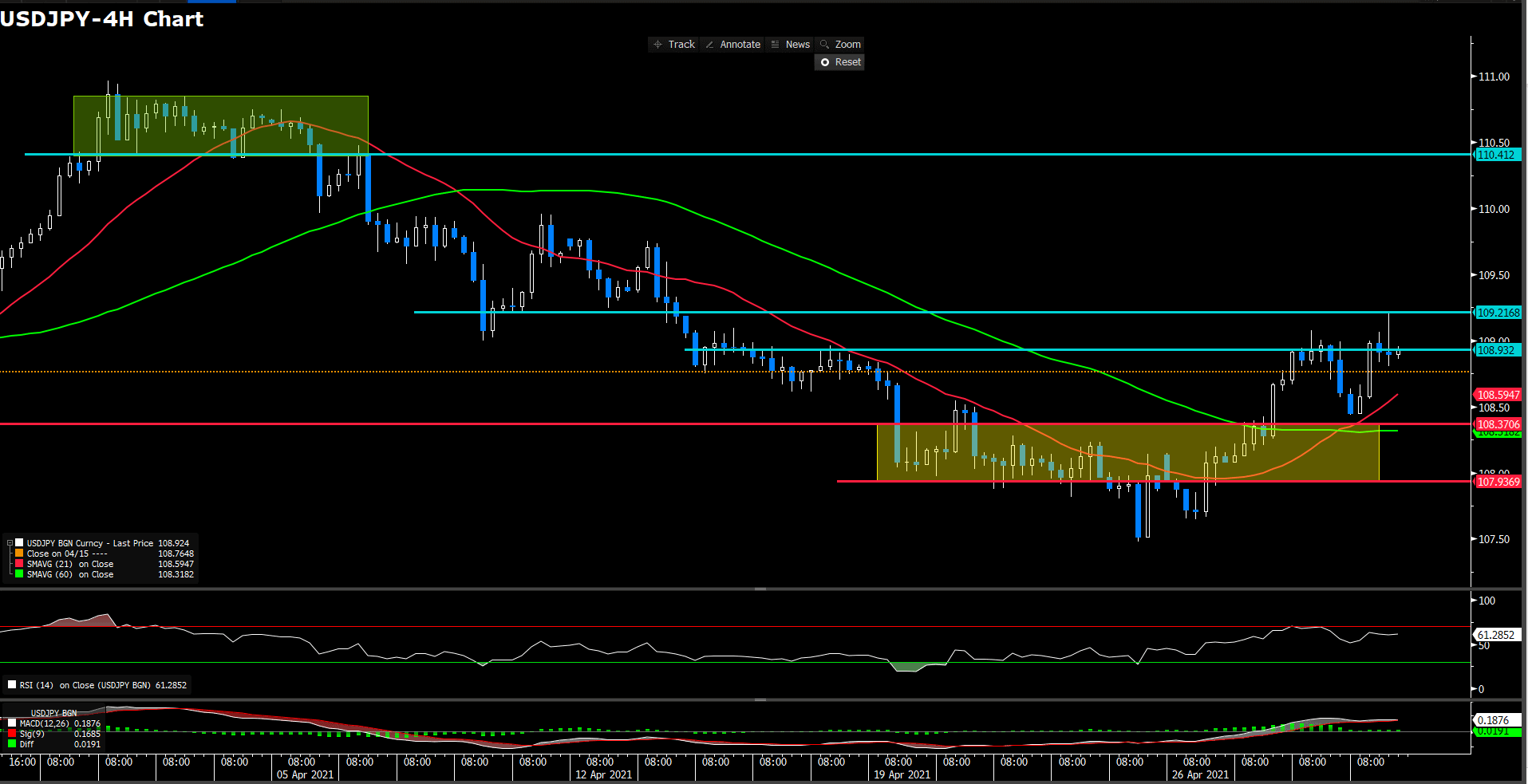

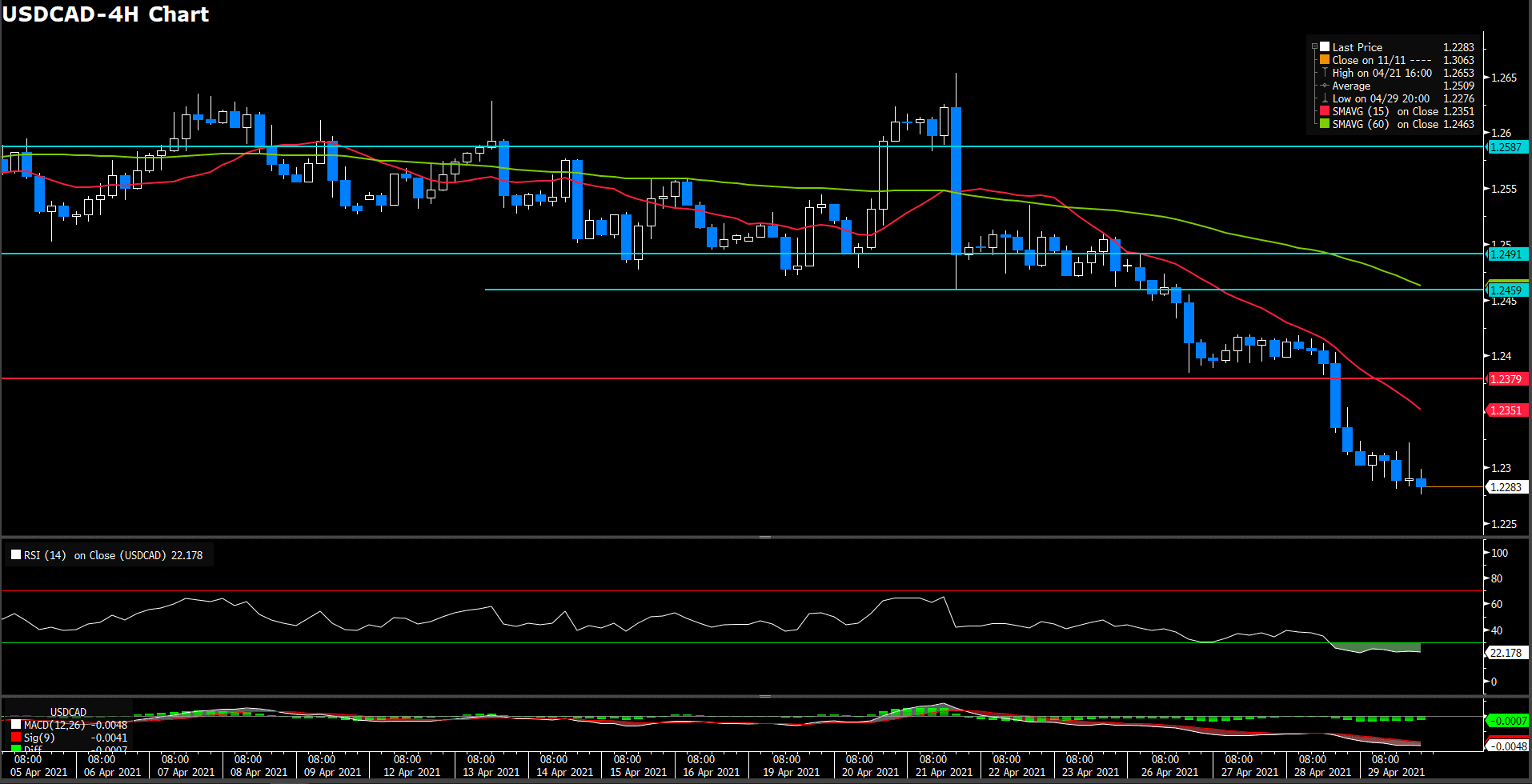

USDCAD (Daily Chart)

Loonie had a fluctuate movement in the day market and toward to another day to day low level, trading at 1.2137 as of writing, while market reacted mix for upsetting US job data and Canada’s unemployment rate also miss the 7.8% expecation that figure show 8.1% of actual. Meantime, WTI crude turn negative territory to positive area after U.S. session and copper was edging up to record-setting level. For RSI side, indicator shows 22 figures which shows market is on an over bought sentiment in recently. For moving average side, 15 and 60-long SMAs indicator are remaining it descending movement.

Overall, we foresee market will continue it downside movement as bearish momentum is still on favor traction. On slid way, we expect sell position will incent strong take profit on psychological level at 1.21.

Resistance: 1.2264, 1.238, 1.2491

Support: 1.21

Economic Data

|

Currency

|

Data

|

Time (GMT + 8)

|

Forecast

|

|

AUD

|

Retail Sales (MoM)(Mar)

|

09:30

|

1.4%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|