Dear our honorable clients:

VT markets provides major economies’s primary stock index from all over the world for contract transactions, including DAX30 index releases from Deutsche Börse Group.

In order to increase DAX30’s market competitive ability, since 2020 November Deutsche exchange continuing to impose more rigorous membership condition including profit eligibility criteria and financial report.

Recently, they announced a big revolution:

DAX30’s constituent stock will increase 10 more stocks which make blue chip DAX index from 30-40.

What is 【German DAX30 index】?

DAX30 index is combine with 30 biggest market value of international enterprise in German. In some circumstances, it represents Germany economy’s status.

These company are all required to listed in Frankfurt Stock Exchange (FWB), as result it also called (Frankfurt index)

Current constituent stocks of DAX30 are as follow:

German is the biggest economy in Europe, European Central Bank’s headquarters is also at German Frankfurt, DAX30 is as important as FTSE100 and Franch FRA-40 in Securities Index.

In this adjustment, added what kind of constituent stock?

In this adjustment to increase the visionary of Deutsche Börse Group, they add ten well-known companies as follow:

1. Airbus SE

2. Brenntag SE

3. HelloFresh SE

4. Porsche Automobil Holding

5. PUMA SE

6. Qiagen N.V.

7. Sartorius AG Vz

8. Siemens Healthineer AG

9. Symrise AG

10. Zalando SE

Is there any influence on investors in increasing constituent stocks?

1. After the adjustment, you can still hold on to your position.

2. The contract name (DAX30) and the specification in the contract will maintain as usual.

What kind of influence will be if the increased number of the constituent stocks?

1. The increase of the constituent stock means the market movement of diverse and liquidity will be improved.

2. From the influence of stock price: The number of constituent stocks increases can reduce the effect from the sudden individual stock price fluctuates sharply, let the long-term index price trend to steady.

We predict that DAX30 market price will not fluctuate by the increasing number of constituent stock.

However, Investors should pay attention at the investors emotions causes by this adjustment, and market change.

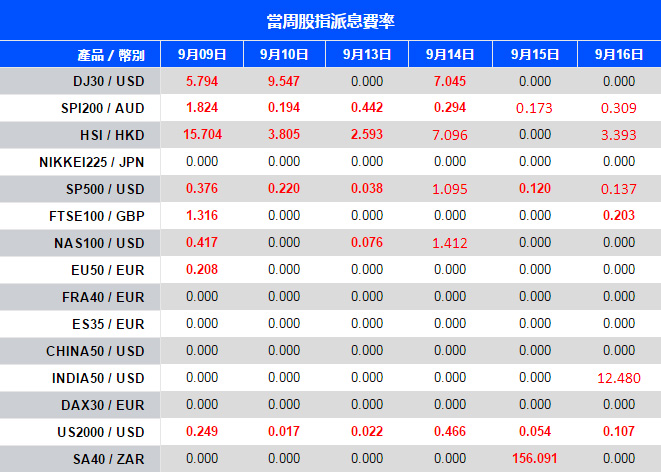

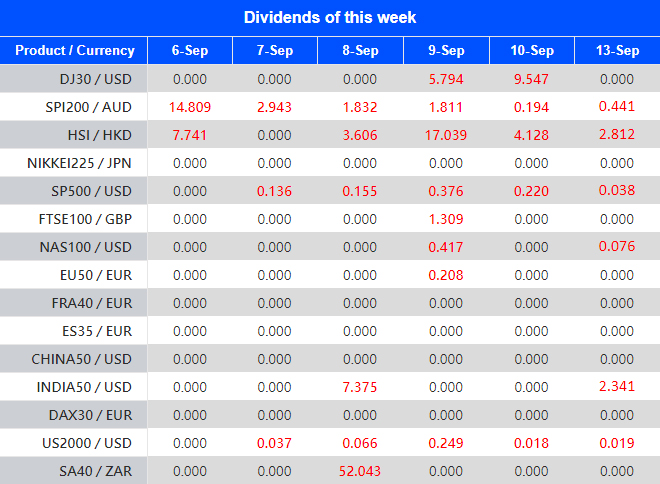

3. From the perspective of the distribution of shares: we can find that in the weekly update of the “Dividend Assignment Adjustment of the Week” data, DAX30 has maintained a value of 0 for a long time.

This is not because DAX30 does not pay dividends, but the dividends distributed by Deutsche Börse DAX30 will be directly reinvested in the stock market.

This is also the biggest difference between DAX30 and other stock indexes.

As result, DAX30 when the constituent stocks pay dividends, the price change of DAX30 will be slightly more severe than other stock indexes.

The increase in constituent stocks is accompanied by an increase in the frequency of dividend assignments, and price changes due to dividends may be more frequent.

Warming tips:

The adjustment will be Monday September 20, if you still hold on to DAX30 position before the market is closed at 4 AM on September 18 Saturday (GMT+8), please make sure that there is sufficient available margin in your account to deal with the market risk that may exist when the market opens on Monday.

If you have any questions, our team will be happy to answer your questions. Please mail to [email protected] or contact the service online.