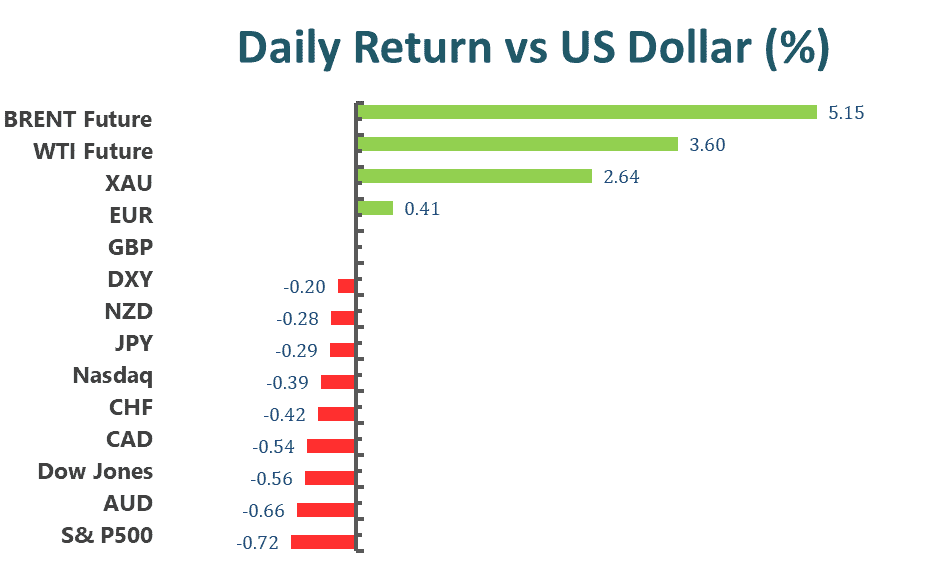

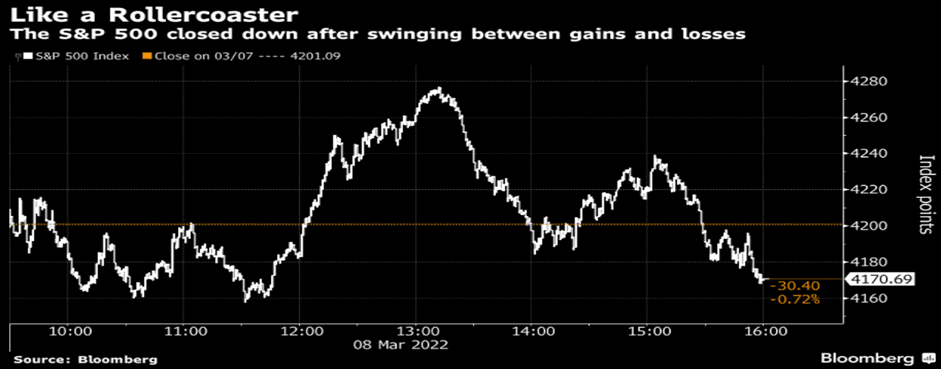

US equities ended higher following a decline the previous day, and the market views this as an opportunity to re-enter the market. Additionally, the market is awaiting the outcome of President Joe Biden’s NATO and G7 summit visits. The Dow Jones Industrial Average concluded the day 1.11 percent higher; the S&P 500 ended the day 1.50 percent higher, and the Nasdaq Composite ended the day 2.08 percent higher.

NATO and G7 leaders met in Brussels to discuss beefing up NATO military forces in Ukraine’s border county, humanitarian assistance, and escalating penalties against Russia’s leadership.

This uncertainty undoubtedly prompts the most hawkish ECB board members to contemplate extending the QE program beyond the summer if the EU economies enter a recession.

Due to the region’s reliance on Russia for oil and natural gas, oil prices in the region have increased due to supply problems. After the summit, the availability of oil and natural gas may worsen further as the Russian government compels payment in rubles for these commodities.

Main Pairs Movement

NVIDIA shares rose 7.18 percent to their highest level since mid-January, while INTEL rose 5.70 percent, helping to boost the S&P500 and Nasdaq.

Meanwhile, AAPL increased marginally to 1.18 percent, marking the company’s eighth straight day of advances, and bringing the stock to its March high.

Following Wednesday’s significant increase, oil prices fell as much as 2.79 percent as the Russian government mandated that these commodities be paid in rubles.

Meanwhile, the Forex Market has been reasonably stable, although it still reacts when US Jobless Claims fall below 200K.

Technical Analysis

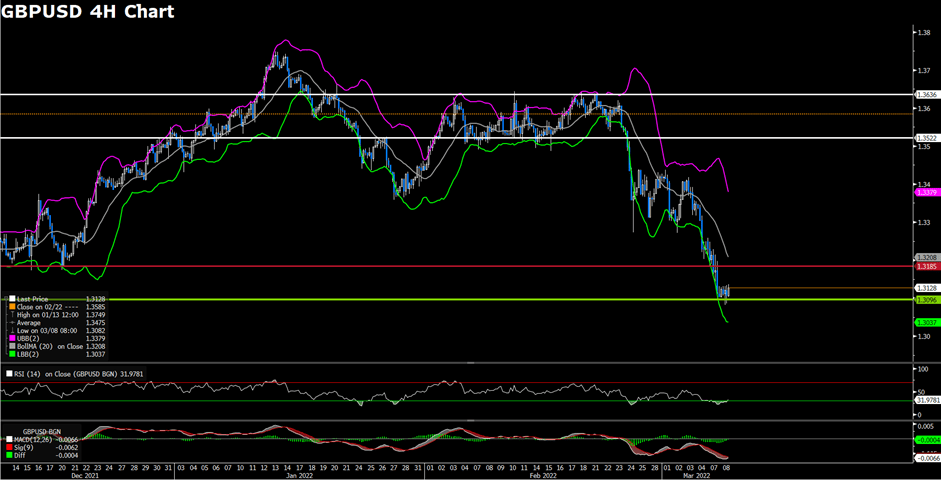

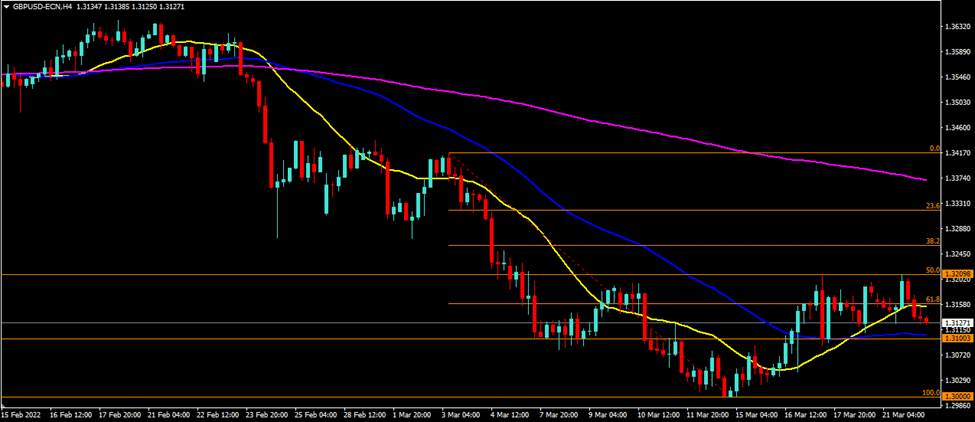

GBPUSD (4-Hour Chart)

The cable continues to be relatively stable; our resistance level of 1.3209 has not been broken, however, upward momentum continues towards the next resistance area of 1.3269 – 1.3300. The cable’s current support ranges between 1.3125 and 1.3150. On the four-hour chart, the cable is trading above its 50- and 100-day SMAs but below its 200-day SMA.

Resistance: 1.3209, 1.3269

Support: 1.3125-1.3150

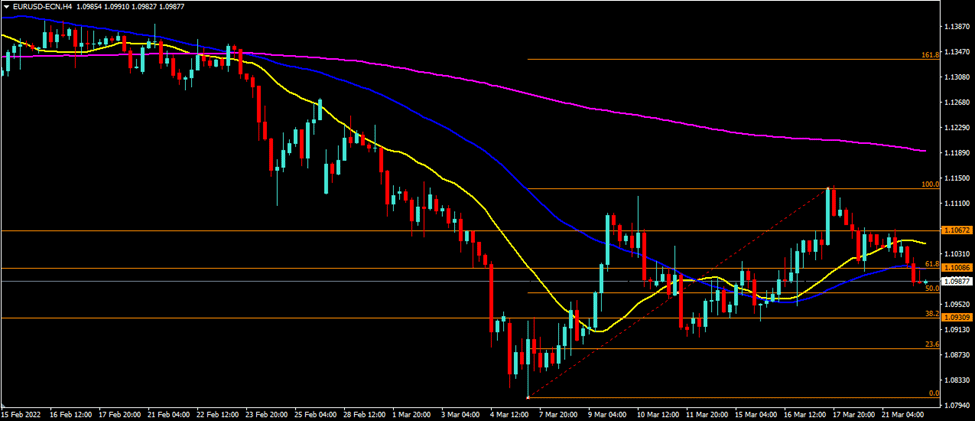

EURUSD (4-Hour Chart)

The EURUSD has just broken our resistance level of 1.1008 and moving towards our next resistance area of 1.1046 – 1.1070, while the nearest support level is at the broken resistance at 1.1008 and 1.0969. EURUSD is currently trading above its 100-day SMA, trying to move above 50-days SMA but below its 200-day SMA.

below its 50-day, 100-day, and 200-day SMAs on the four-hour chart.

Resistance: 1.1046-1.1070

Support: 1.1008, 1.0969

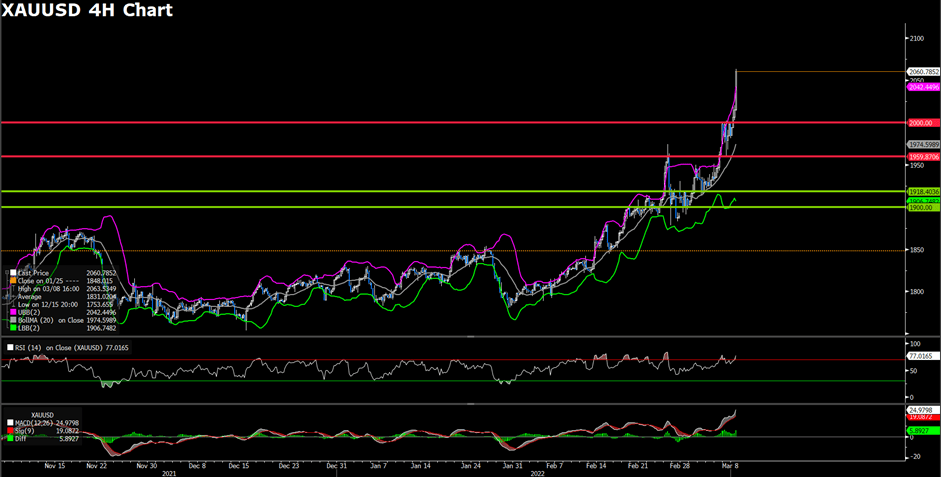

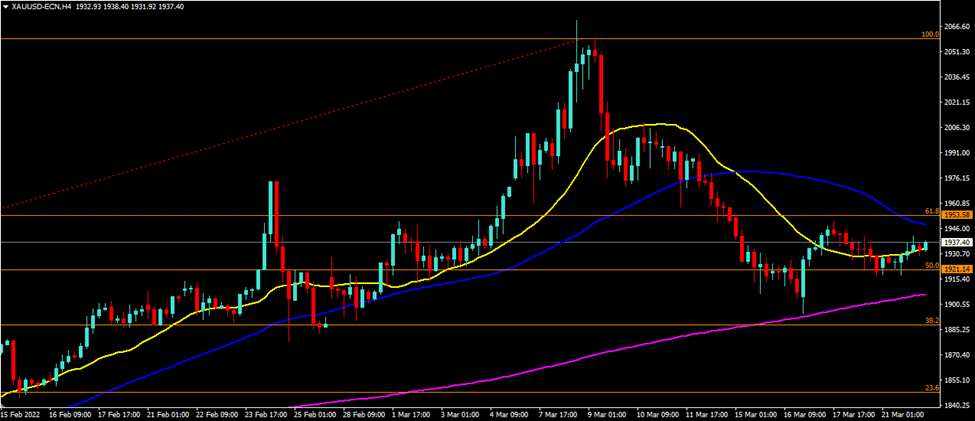

XAUUSD (4-Hour Chart)

XAUUSD broke our 61.8 Fibonacci level at $1953 per ounce and chasing higher with the uncertainty of global geopolitical conditions. Our next resistance will be at $1974 and $2000 per ounce. Meanwhile, our support levels will be at $1948 and $1921 per ounce. XAUUSD is currently trading above its 50-day, 100-day, and 200-day SMAs on the four-hour chart.

Resistance: $1974, $2000

Support: $1948, $1921