The economic data from Australia, New Zealand, and Canada will be interesting this week. The markets are looking forward to the release of Australia’s Employment Data on 18 August 2022, which will provide an insight into whether the country’s jobs market is in good shape.

In addition, the Reserve Bank of New Zealand’s Rate Statement will be released on 17 August 2022, which could give investors a clue about how much rates would rise if inflation remains high.

Image source: forexfactory.com

Australia’s Monetary Policy Meeting Minutes | 16 August 2022

This month, the Reserve Bank of Australia (RBA) raised the cash rate by 50 basis points (bps) to 1.85% — the third consecutive hike since June 2022. The last time the cash rate was this high was in April 2016.

The bank believes inflation will return to its target level while paying attention to the global outlook, which remains clouded by geopolitical tensions in Ukraine and its potential effect on energy and commodity prices as well as China’s zero-COVID policy.

Canada’s Consumer Price Index | 16 August 2022

The Consumer Price Index (CPI) in Canada increased 0.7% in June of 2022, according to Statistics Canada. The CPI is one of the many indicators that Canadian analysts use to assess the health of the domestic economy and the likelihood that the Bank of Canada might raise interest rates.

Analysts forecast that Canada’s CPI for July would be slower at 0.1%.

Reserve Bank of New Zealand Rate Statement | 17 August 2022

The Reserve Bank of New Zealand will release its cash rate decision on Wednesday, 17 August 2022.

The Reserve Bank of New Zealand’s most recent interest rate hike will push up the official cash rate to a level not seen since March 2016. The central bank raised its benchmark rate by 50 bps to 2.5%. According to the bank’s statement, it would continue to tighten policy until it was sure that monetary conditions were sufficient to cool inflation and bring it in line with the target range of 1-3%. Acknowledging medium-term downside risks to economic activity, policymakers said they were aware that the global economic outlook had weakened amid ongoing supply issues, geopolitical tensions, and health curbs in China.

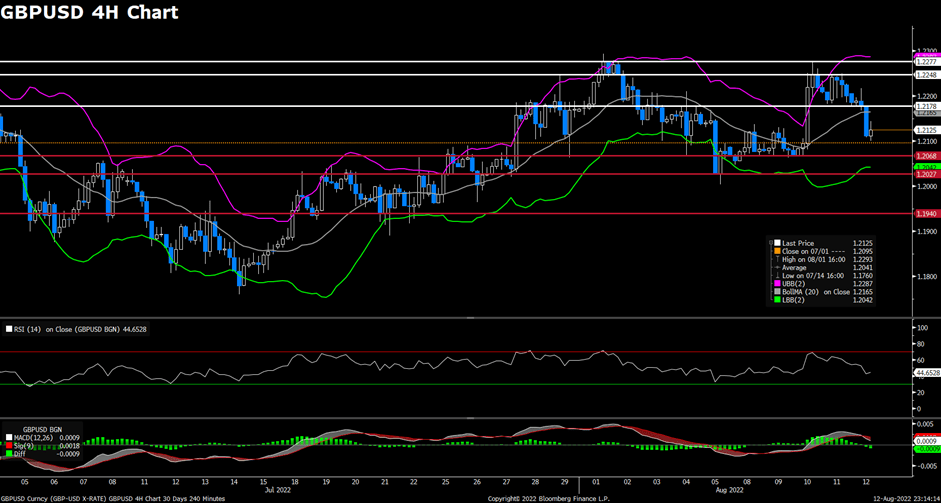

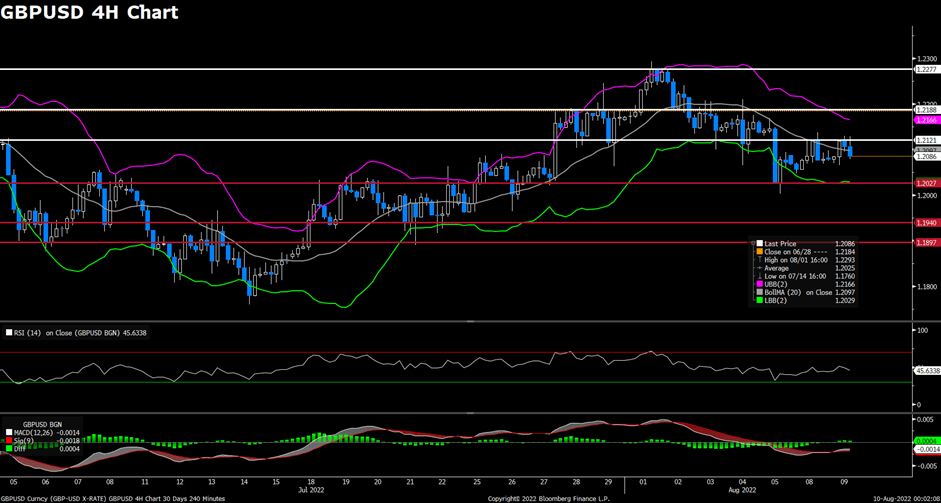

UK’s Consumer Price Index | 17 August 2022

The CPI in the UK increased 0.8% in June over the previous month. The CPI data is a key indicator to measure inflation in that country.

Analysts forecast that UK CPI for July would be slower at 0.4%.

US Retail Sales | 17 August 2022

Retail sales in the US rose 1% in June of 2022, edging up from a 0.1% decline in May and beating forecasts of 0.8% growth. The jump reflects robust consumer spending but also marks an increase in prices for goods and services.

July forecasts for retail sales will be higher by 0.2%.

FOMC Meeting Minutes | 18 August 2022

In its July 2022 statement, the Federal Reserve raised the target range for the fed funds rate by 75 bps to 2.25%-2.5% and indicated that it would continue to increase rates as long as projected inflation remains in line with or below its target of 2%.

Fed Chair Jerome Powell said he was unable to predict what the target range for next year’s fed funds rate might be, but that he expected rates to increase moderately over the course of the rest of this year.

Australia’s Employment Data | 18 August 2022

In June 2022, employment in Australia jumped sharply to a fresh record high of 13.6 million while unemployment fell to a fresh record low of 3.5%. Forecasters expect the unemployment rate to fall further, to 3.6%, while employment is expected to grow by another 25,000.

The Australian economy has been going through a rough patch over the past few years, but it looks like things are now turning around with this recent boost from employment data.