US stocks advanced higher on Monday, witnessing upside strength, and ended the previous day with broad gains amid the market’s mildly positive sentiment. The better market mood during European trading hours pushed the US Dollar into the red across the FX board and provided firm support to equity markets.

Investors now waiting for the release of the January United States Consumer Price Index (CPI), which is foreseen raising at an annualized pace of 6.2% and has a high impact on financial markets. On top of that, Fed Governor Michelle Bowman said on Monday that the Federal Reserve will need to continue to raise interest rates to bring inflation back down to the central bank’s target rate. Market sentiment improved as fears surrounding the United States and China eased afterward on comments from the US General, who turned down the fears while rejecting calls to believe that those flying objects were from China. On the Eurozone front, bets for additional jumbo rate hikes from the European Central Bank (ECB) in the coming month lend some support to the Euro.

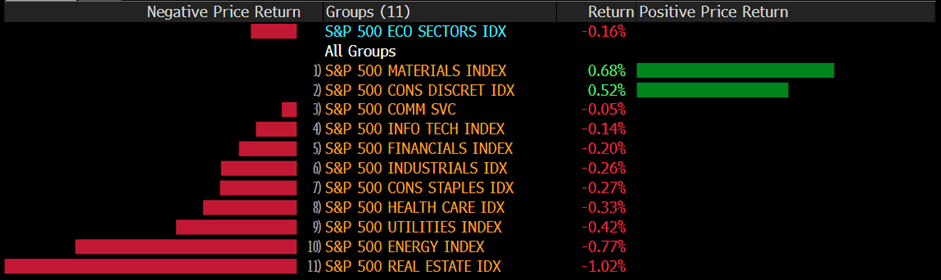

The benchmarks, S&P 500 and Dow Jones Industrial Average both advanced higher on Monday as the S&P 500 closed higher when traders brace for the Consumer Price Index (CPI) for January amid mixed clues. The S&P 500 was up 1.1% daily and the Dow Jones Industrial Average also climbed higher with a 1.1% gain for the day. Ten out of eleven sectors in the S&P 500 stayed in positive territory as the Information Technology sector and the Consumer Discretionary sector are the best performing among all groups, rising 1.77% and 1.46%, respectively. The Nasdaq 100 meanwhile rose the most with a 1.6% gain on Monday and the MSCI World index was down 0.3% for the day.

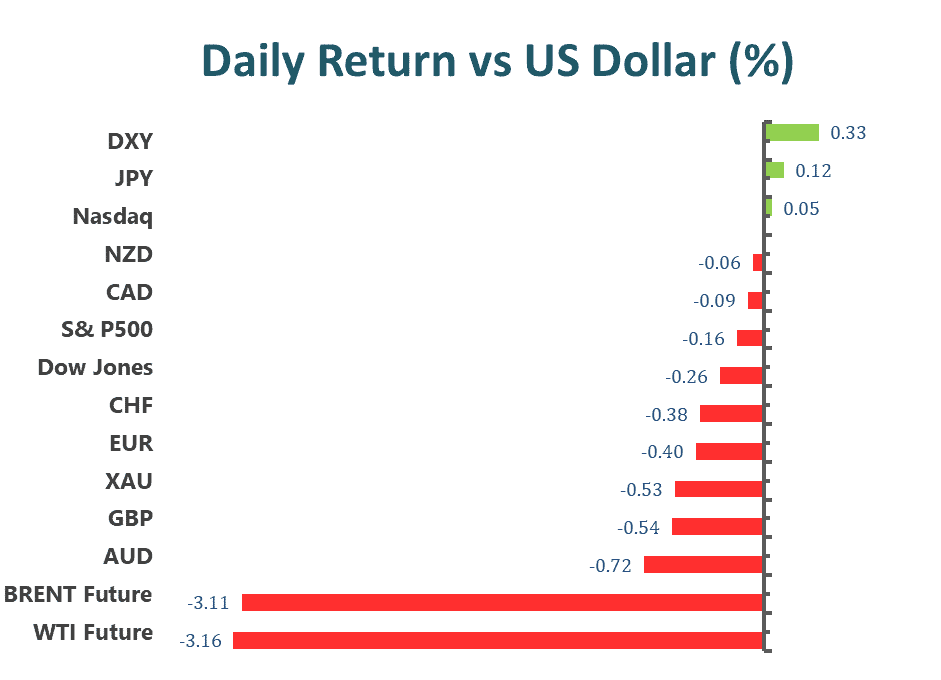

Main Pairs Movement

The US dollar retreated lower on Monday, remaining under pressure, and dropped to a daily low below 103.30 level amid the upbeat market mood. The upbeat US equities and a pullback in the US Treasury bond yields after multiple days of run-up both acted as a headwind for the greenback. However, the absence of relevant macroeconomic releases and the upcoming US CPI report limited the intraday US Dollar slide.

GBP/USD advanced higher on Monday with a 0.64% gain after the cable preserved its upside traction and touched a daily high above the 1.2140 mark amid a modest recovery in the global risk sentiment. On the UK front, the country will publish its latest employment figures on Tuesday. Meanwhile, EUR/USD also witnessed buying interest and climbed to a daily high of around the 1.0725 area. The pair was up almost 0.42% for the day.

Gold declined lower with a 0.65% loss for the day after witnessing selling momentum and extended its slide towards the $1850 area during the US trading session, as the hawkish Fed comments keep the market’s fears of tighter monetary policy and weigh on the Gold price. Meanwhile, WTI Oil advanced higher with a 0.53% gain for the day.

Technical Analysis

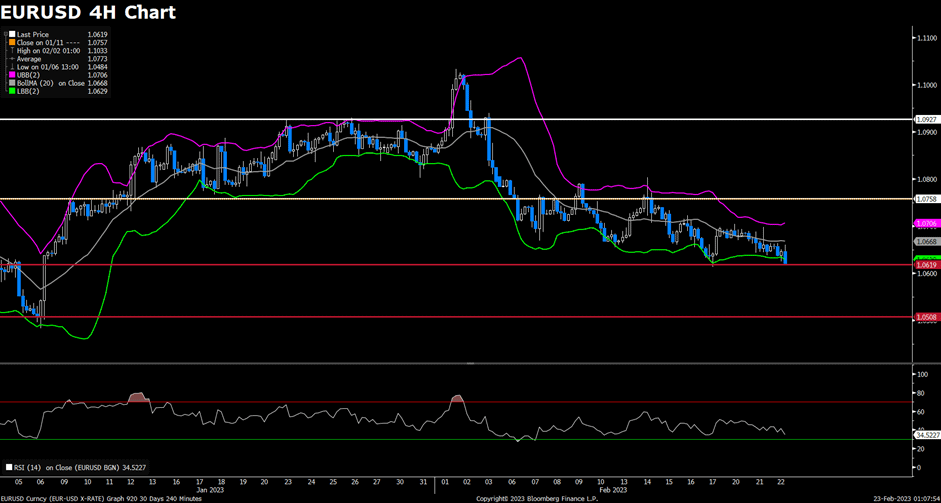

EURUSD (4-Hour Chart)

The EURUSD regained its recovery momentum near the 1.071 level during the early American trading session, as investors waited for Tuesday’s highly-anticipated inflation data. The US dollar erased most daily gain in US trading hours amid the upbeat Wallstreet’s major indices opening, the DXY index was trading at 103.35 level as of writing. The market participants put all their focus on US Consumer Price Index (CPI) released on Tuesday and continued to reassess the future Federal Reserve(Fed) decisions, favoring the market move in a volatile path. In Eurozone, the European Commission released the quarterly Economic Growth Forecast report. The report failed to provide a boost for the Euro currency, despite showing upward revisions to economic growth and downward revisions to inflation.

From a technical perspective, the four-hour scale RSI indicator regathered bullish strength, reading 51 as of writing, which suggested that the pair mildly corrected toward the upside. As for the Bollinger Bands, the pair was pricing above the 20-period moving average, showing that the pair currently attracted some positive traction.

Resistance: 1.0930, 1.1022

Support: 1.0662, 1.0508

GBPUSD (4-Hour Chart)

The GBPUSD gathered recovery momentum and extended its daily rebound in the American trading session toward the 1.2150 level. The positive shift witnessed in risk sentiment seems to be causing the haven US Dollar to lose interest and fueling the pair’s upside ahead of Tuesday’s key macroeconomic data releases. Rising bets for further policy by the Federal Reserve (Fed) should help limit the downside for the USD and cap gains for the pair. Apart from this, a dovish assessment of the Bank of England (BoE) decision last week warrants some caution before placing aggressive bullish bets around the pound pairs.

From the technical perspective, the four-hour RSI indicator climbed to 56 as of writing, suggesting that the pair now was surrounded by bullish momentum. As for the Bollinger Bands, the pair was priced above the 20-period moving average and wandered in a range from 1.2000 to 1.2200, showing the pair have no clear path in near future.

Resistance: 1.2264, 1.2391, 1.2492

Support: 1.1927, 1.1859

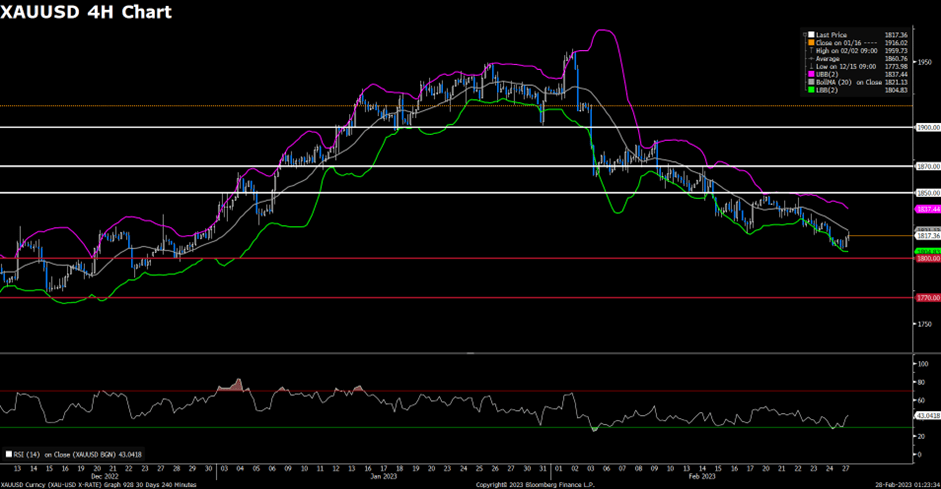

XAUUSD (4-Hour Chart)

Gold prices were struggling to hold above the $1850 mark after having advanced toward $1870 in the early European trading session. The prospects for further policy tightening by the Federal Reserve (Fed) continue to underpin the US Dollar and act as a headwind for the non-yielding Gold price. A slew of Federal Open Market Committee (FOMC) policymakers, including Fed Chair Jerome Powell, last week stressed the need for additional interest rate hikes to fully gain control of inflation. Now, the market focus remains glued to the crucial CPI inflation report. The data could influence the Fed’s rate-hike path and determine the near-term trajectory for the XAUUSD.

From the technical perspective, the four-hour scale RSI indicator further declined to 37 figures as of writing, suggesting that the pair was confronting heavy selling pressure. As for the Bollinger Bands, the gold continued to price along with the lower band, showing the pair was amid strong bearish traction. We think the yellow is more favorable to the downside path shortly before the CPI inflation report.

Resistance: 1898, 1913, 1956

Support: 1832, 1800

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

| GBP | Average Earnings Index +Bonus (Dec) | 15:00 | 6.20% |

| GBP | Claimant Count Change (Jan) | 15:00 | 17.9K |

| GBP | Core CPI (MoM) (Jan) | 21:30 | 0.40% |

| USD | CPI (MoM) (Jan) | 21:30 | 0.50% |

| USD | CPI (YoY) (Jan) | 21:30 | 6.2% |