The Dow Jones Industrial Average saw a robust rally, achieving its strongest performance in over a month, propelled by renewed excitement in Wall Street’s IPO sector and positive economic signals. The Dow surged by 331.58 points, or 0.96%, closing at 34,907.11, marking its first close above the 50-day moving average since September 1st. This substantial gain, the best since August 7th, was mirrored in the S&P 500, which rose by 0.84%, reaching 4,505.10, and the Nasdaq Composite, which saw a 0.81% increase, reaching 13,926.05. Arm, the chip design firm, also made headlines with a 24.7% surge following its successful IPO, injecting confidence into a previously dormant IPO market. Additionally, encouraging economic reports, including moderate core inflation and robust retail sales, suggested a balanced approach between inflation control and economic stability, aligning with the Federal Reserve’s goals. The US dollar strengthened due to the euro and pound weakening against it, influenced by the European Central Bank’s rate hike. Traders are closely monitoring the EUR/USD pair, considering its potential to fall below May lows, impacting speculative positions and Treasury-bond yield spreads after the Federal Reserve meeting. The rise in oil prices added to the risk-on sentiment, but concerns about its effects on inflation and discretionary spending complicated the Fed’s rate hike decisions. Amid global economic uncertainties, traders are closely watching various indicators to determine the future of the US dollar and its implications for financial markets.

Stock Market Updates

The Dow Jones Industrial Average experienced a significant rally, marking its strongest performance in over a month, driven by renewed enthusiasm in Wall Street’s IPO market and positive economic indicators. The Dow surged by 331.58 points, or 0.96%, reaching 34,907.11, with this being the first time it closed above its 50-day moving average since September 1st. This substantial gain was also the best day for the blue-chip average since August 7th. Similarly, the S&P 500 gained approximately 0.84%, reaching 4,505.10, while the Nasdaq Composite saw a 0.81% increase, reaching 13,926.05. Notably, chip design company Arm made headlines as its shares surged by 24.7% following its initial public offering (IPO), which was priced at $51 a share and closed at $63.59 a share on its first day of trading. This successful IPO has injected confidence into the market, suggesting the possibility of a revitalized IPO market after a relatively dormant 18-month period.

Additionally, investors received encouraging economic reports, with indications of moderate core inflation and a resilient consumer. The August producer price index showed that core PPI, excluding food and energy, rose by 0.2%, in line with economists’ expectations. However, the headline number increased by 0.7%, surpassing the expected 0.4% rise. August retail sales also outperformed expectations, surging by 0.6%, compared to the forecasted 0.1% increase, with a similar increase of 0.6% when excluding auto sales. These reports suggest a favorable balance between inflation control and economic stability, potentially aligning with the Federal Reserve’s efforts to achieve a soft landing. While the Fed is expected to maintain its current policies in its September meeting, the European Central Bank raised rates by a quarter of a percentage point but indicated that inflation was easing, hinting at a potential end to its rate-hiking campaign. Meanwhile, Adobe was anticipated to release quarterly results after the market closed on Thursday.

Data by Bloomberg

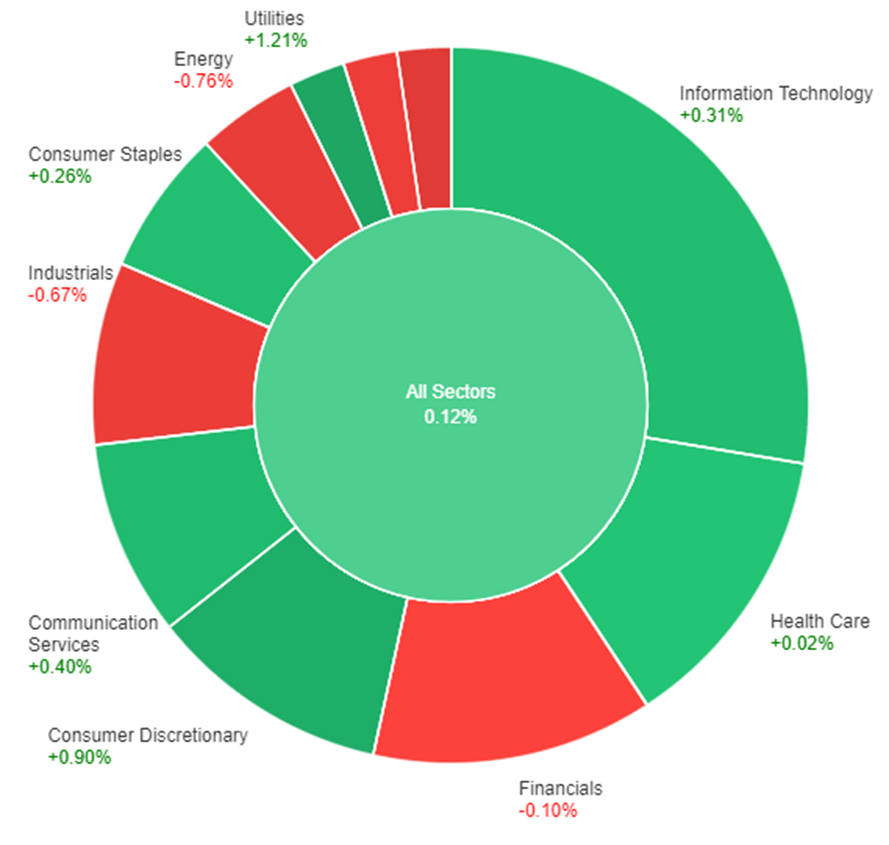

On Thursday, across all sectors, the market showed a positive performance, with a gain of 0.84%. The Real Estate sector performed exceptionally well, with an increase of 1.71%, followed closely by Utilities at 1.47% and Materials at 1.40%. Other sectors also saw gains, with Energy rising by 1.26%, Communication Services by 1.18%, Industrials by 0.99%, Consumer Discretionary by 0.88%, Financials by 0.87%, Consumer Staples by 0.82%, Information Technology by 0.70%, and Health Care lagging behind with a modest increase of 0.25%.

Currency Market Updates

The US dollar saw a notable rise in value, with the dollar index increasing by 0.6%. This increase was primarily driven by the weakening of the euro (EUR) and the British pound (GBP) against the dollar (USD), resulting in a 0.85% decline in the EUR/USD pair. This drop in the EUR/USD pair was influenced by the European Central Bank (ECB) raising rates, indicating that it might be their last hike before a rate cut in the following year. Despite higher inflation in the eurozone, the market perceived minimal risk of further rate hikes by the ECB. This shift in currency dynamics was further reinforced by positive US economic data, including above-forecast retail sales and Producer Price Index (PPI) reports, which were attributed to rising prices. As a result, traders and investors are closely monitoring the EUR/USD pair, expecting it to potentially fall below its May lows, with broader implications on speculative positions and Treasury-bund yield spreads, especially after the upcoming Federal Reserve meeting.

The US dollar also faced pressure from the Australian and Canadian dollars due to increased risk-on sentiment, driven in part by perceptions that the ECB and the Federal Reserve have concluded their tightening cycles. The rise in oil prices, with WTI prices up 7.8% in the current month, raised concerns about the impact on discretionary spending, tightening credit conditions, and rising inflation, potentially complicating the Federal Reserve’s decision-making regarding rate hikes. As the global economic landscape remains uncertain, traders are closely monitoring various economic indicators, including Chinese data and US industrial production and Michigan sentiment figures, to gauge the future direction of the US dollar and its implications for financial markets.

Picks of the Day Analysis

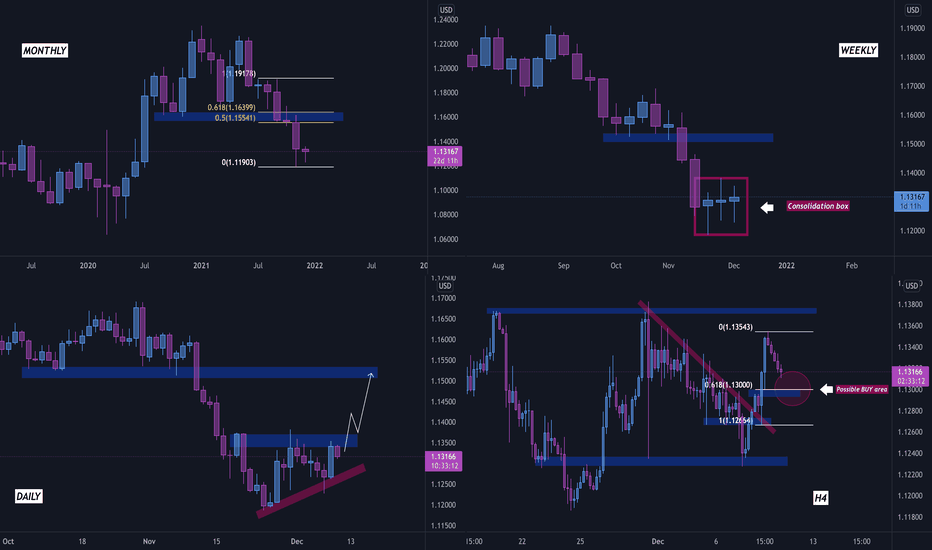

EUR/USD (4 Hours)

EUR/USD Downtrend Continues After ECB’s Final Rate Hike

The Euro faced a significant decline following the European Central Bank’s unexpected 25 basis point rate hike, which the market interpreted as the final move in this direction. Despite some analysts and Governing Council members hoping for a pause, ECB President Lagarde’s decision spurred the Euro’s fall. The US Dollar, on the other hand, gained strength during the American session thanks to better-than-expected US economic data, including a notable increase in the Producer Price Index and positive retail sales figures. With the Euro’s vulnerability persisting due to the combination of robust US data and the dovish ECB rate hike, further losses may occur in response to changing market sentiment.

According to technical analysis, EUR/USD moved flat on Wednesday and is currently trading just around the middle band of the Bollinger Bands. This movement suggests the possibility of further consolidation. The Relative Strength Index (RSI) is currently at 50, indicating that EUR/USD is in a neutral stance.

Resistance: 1.0759, 1.0803

Support: 1.0702, 1.0653

XAU/USD (4 Hours)

XAU/USD React to ECB Rate Hike and Mixed US Data

Gold prices initially declined following the European Central Bank’s (ECB) unexpected 25 basis point rate hike and dovish statement. However, they later rebounded due to optimistic stock market performance, hovering around the $1,910 mark. Meanwhile, the US Dollar experienced mixed results from local data, with strong retail sales offset by higher-than-expected wholesale prices. Despite inflation concerns, investors remained skeptical about the Federal Reserve’s potential for another rate hike, leading to a shift in risk appetite. The market’s sentiment for the upcoming trading day hinges on China’s release of August Industrial Production and Retail Sales data during the Asian session.

According to technical analysis, XAU/USD moved flat on Wednesday and moving between the lower and middle band of the Bollinger Bands. Currently, the price is trading slightly above the lower band with the potential for further downward movement. The Relative Strength Index (RSI) is currently at 39, indicating that the XAU/USD pair is still biased towards the bearish side.

Resistance: $1,916, $1,925

Support: $1,903, $1,893

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| USD | Empire State Manufacturing Index | 20:30 | -9.9 |

| USD | Prelim UoM Consumer Sentiment | 22:00 | 69.0 |