On Monday, the Dow Jones Industrial Average achieved a historic high above 38,000, accompanied by a surge in United Airlines’ stock following strong fourth-quarter results. However, concerns about the grounding of Boeing 737 Max 9 planes led to an anticipated first-quarter loss for the airline. The broader market witnessed milestones, with the S&P 500 and Nasdaq Composite reaching all-time highs. Despite the bullish trend, investors remain cautious, especially amid a tech-focused rally. Currency markets showed calm consolidation, and Treasury yields led to a bull yield curve steepening. Market attention turned to the BoJ’s policy meeting, upcoming economic events, and central bank decisions impacting major currencies. The week’s developments include expectations for the Fed’s role in USD/JPY dynamics and varying rate cut predictions for the BoE and ECB, influencing currency performance.

Stock Market Updates

U.S. stock futures showed minimal movement on Monday night, with the Dow Jones Industrial Average reaching a historic high above 38,000. Notably, United Airlines experienced a more than 6% surge in extended trading following robust fourth-quarter results but anticipated a first-quarter loss due to the grounding of Boeing 737 Max 9 airplanes involved in a recent emergency. Other airline stocks, including American Airlines and Southwest Airlines, rose around 3%, while Alaska Air Group and Delta Air Lines climbed approximately 2%.

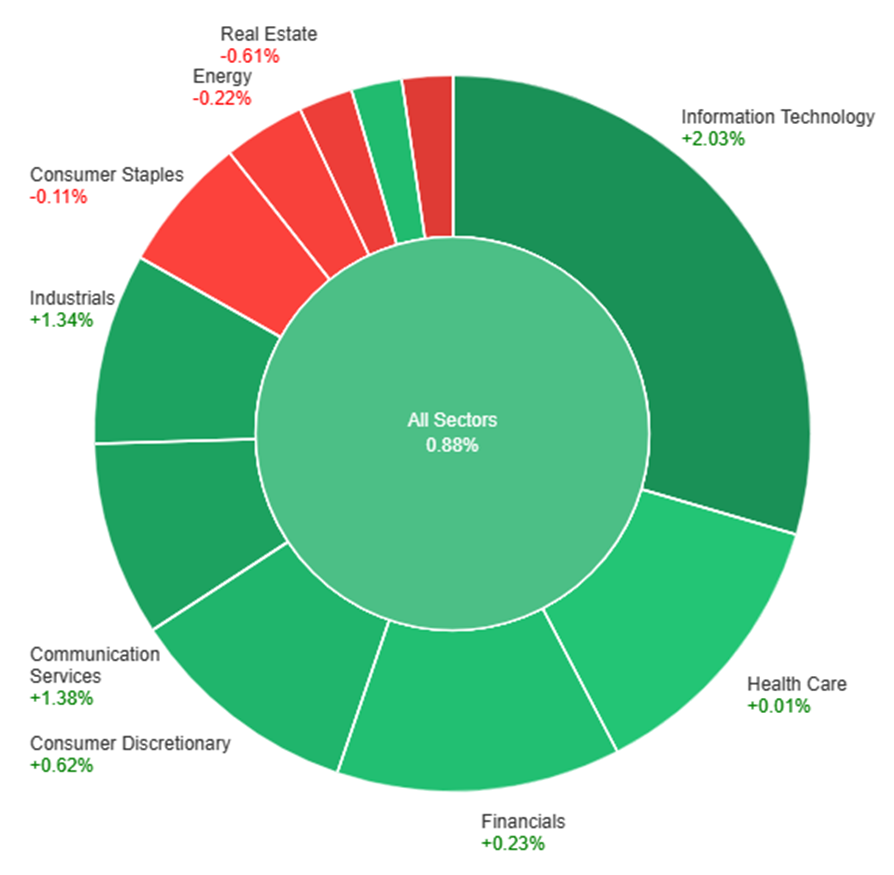

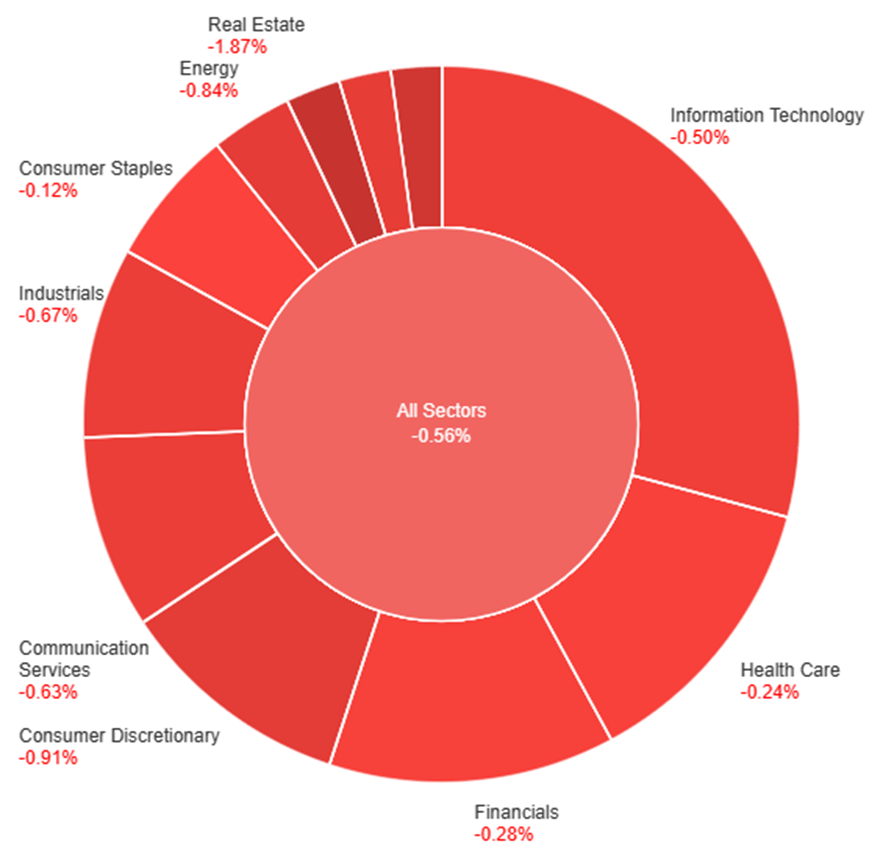

Monday’s trading session marked significant milestones as the Dow advanced over 100 points, closing above 38,000 for the first time, and both the S&P 500 and Nasdaq Composite reached new all-time highs. Despite the bullish trend, investors are cautious about the sustainability of gains, particularly as the tech-focused rally contrasts with lackluster broader market participation. The ongoing corporate earnings season adds to market scrutiny, with notable reports expected from Johnson & Johnson, Procter & Gamble, Lockheed Martin before the open, and Netflix after the close on Tuesday.

Data by Bloomberg

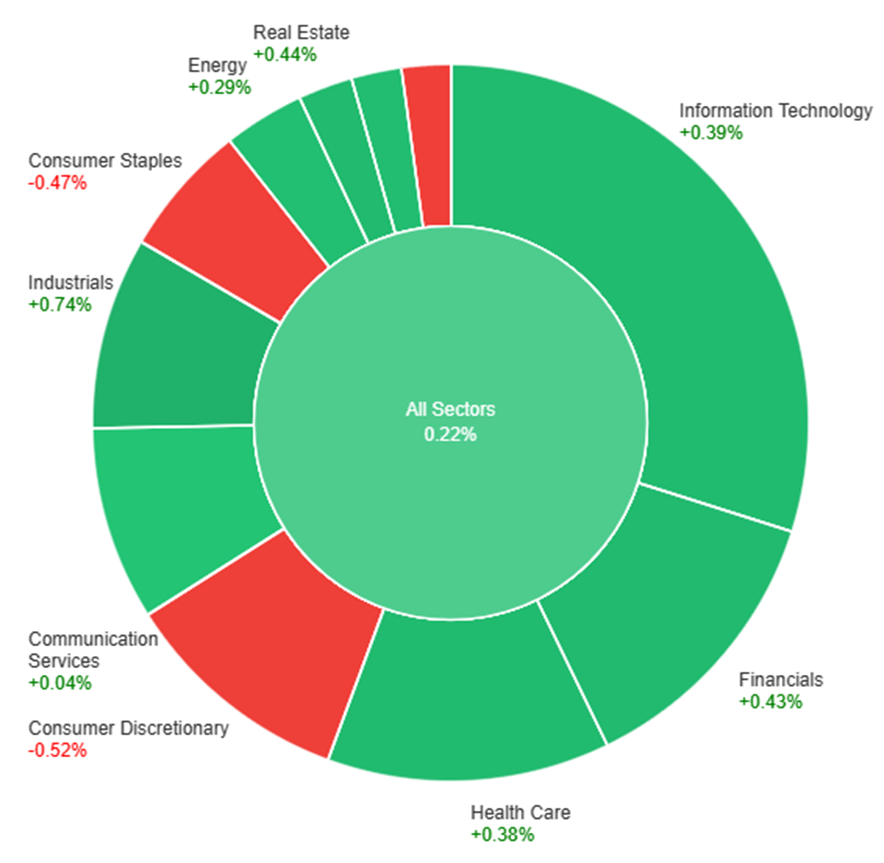

On Monday, the overall market saw a modest gain of 0.22%. Several sectors contributed positively, with Industrials leading the way with a notable increase of 0.74%, followed by Real Estate (+0.44%), Financials (+0.43%), Information Technology (+0.39%), and Health Care (+0.38%). Materials and Energy also experienced slight upticks of 0.30% and 0.29%, respectively. However, not all sectors fared well, as Consumer Staples (-0.47%), Utilities (-0.52%), and Consumer Discretionary (-0.52%) witnessed declines, dragging down the overall market performance. Communication Services showed a marginal decrease of 0.04%.

Currency Market Updates

In the currency markets, the dollar, euro, and sterling showed a calm consolidation at the beginning of the week, with profit-taking observed on stretched short yen trades ahead of the BoJ meeting on Tuesday. The dollar index remained flat, EUR/USD held steady, USD/JPY experienced a slight dip of 0.1%, and sterling saw a 0.14% increase. Treasury yields led a broader bull yield curve steepening and a risk-on trend in major government bond and equity markets, except for China. The market’s expectations for a March Fed cut decreased to a 42% probability, down from being fully discounted at the turn of the year, and the expected 150bp of Fed cuts in 2024 was adjusted to 135bp.

The focus turned to the BoJ’s two-day policy meeting concluding on Tuesday, where no significant rate hike expectations were priced in. Modest policy normalization expectations for the yen may be revised lower, leaving Fed policy as the primary driver for USD/JPY. Additionally, upcoming events such as U.S. Q4 GDP, jobless claims, and the Fed’s favored PCE on Friday, as well as the ECB meeting on Thursday, added to the week’s potential market impact. EUR/USD continued to consolidate below key levels, while USD/JPY followed Treasury yields lower but held above crucial support. Sterling outperformed the euro, influenced by the expectation that the BoE would cut rates less than the ECB in the coming year. The yuan remained supported amid a 2.7% dive in the Shanghai Composite, affecting AUD/USD negatively.

Picks of the Day Analysis

EUR/USD (4 Hours)

EUR/USD Navigates Indecision Amidst Diverging Central Bank Sentiments

The new trading week for EUR/USD opened with uncertainty and fluctuating price action tied to the U.S. dollar, accompanied by low volatility on Monday. As market participants anticipate around 120 basis points in rate cuts for the year, a debate ensues between them and the ECB’s rate-setters regarding the timing of the central bank’s decision to reduce the region’s policy rate. Despite inflation surpassing the bank’s target, European policymakers appear inclined to maintain a restrictive stance, hindered by weak fundamentals in the bloc, limiting the upside potential for the European currency. Meanwhile, across the Atlantic, investors are assigning just over a 40% probability to a Federal Reserve rate cut at the March 20 meeting, according to the FedWatch Tool tracked by CME Group.

On Monday, the EUR/USD moved in consolidation, able to reach the middle band of the Bollinger Bands. Currently, the price moving just above the middle band, suggesting a potential upward movement to reach the upper band. Notably, the Relative Strength Index (RSI) maintains its position at 48, signaling a neutral outlook for this currency pair.

Resistance: 1.0954, 1.1000

Support: 1.0863, 1.0814

XAU/USD (4 Hours)

XAU/USD Retreats Amidst Dollar Weakness and Cautious Market Sentiment

Spot Gold experienced a shift in trajectory, rebounding from an early dip to $2,016.42 to trade around $2,024 during the American session, showcasing modest intraday losses. The weakened demand for the US Dollar, influenced by the strength in global indexes and Wall Street’s positive momentum fueled by robust earnings reports, played a pivotal role. However, market participants remain cautious as the upcoming week brings critical economic data releases, including the preliminary estimate of the Q4 Gross Domestic Product (GDP) in the United States. With various central banks revealing their monetary policy decisions, Gold faces a dynamic landscape, navigating uncertainties surrounding economic indicators and inflationary pressures.

On Monday, XAU/USD moved lower and was able to reach the middle band of the Bollinger Bands. Currently, the price moving just above the middle band suggesting a potential upward movement to reach the upper band. The Relative Strength Index (RSI) stands at 46, signaling a neutral outlook for this pair.

Resistance: $2,035, $2,052

Support: $2,010, $1,993

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| JPY | BOJ Policy Rate | Tentative | -0.10% |

| JPY | Monetary Policy Statement | Tentative | |

| JPY | BOJ Press Conference | Tentative |