Betting markets have shown rising odds for a Trump victory in the upcoming US election. Traders are considering the potential inflationary effects of policies like tariffs under a possible second term.

Market participants are closely assessing what his potential win could mean for the upcoming U.S. presidential election. At the heart of this analysis is the so-called “Trump Trade.”

What is a Trump Trade?

The “Trump Trade” describes how markets and investors react to the economic policies and political moves tied to a Donald Trump presidency. This concept became prominent after his 2016 election, as markets responded to his agenda of deregulation, tax cuts, and expanded infrastructure spending. It mainly captures the expectation of a pro-business environment and economic stimulus that could bolster U.S. growth.

How the “Trump Trade” Affected Monetary Policy

To understand what the markets expect, it’s helpful to look back at market reactions during Trump’s previous term.

With expectations of stronger economic growth, the Federal Reserve adjusted its policies:

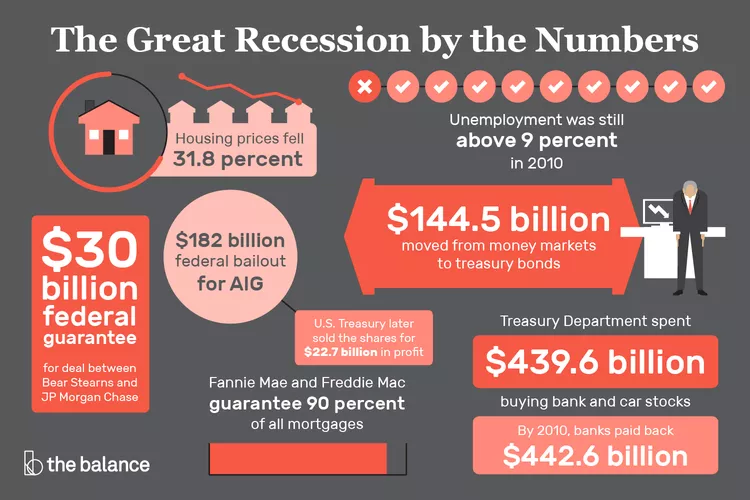

- Interest Rate Increases: As the economy gained momentum and inflation pressures rose, the Fed raised interest rates to keep growth steady. This was a change from the low-interest rates seen after the 2008 financial crisis.

- Balance Sheet Reduction: The Fed also began looking at reducing its large balance sheet, which had grown due to years of economic support. This shift signaled a move toward tighter monetary policies.

US Election 2024: Will All Roads Lead to Inflation?

Regardless of who wins the upcoming election, two billionaire investing legends remain focused on the US bond market due to the unsustainable trajectory of large US deficits.

“I have moved in that direction for sure,” Jones told CNBC when asked if he was adjusting his strategy for a possible Trump win over Vice President Kamala Harris.

“It just means more in inflation trades,” Jones added, joining other top investors in voicing concerns about the U.S. government’s fiscal outlook, regardless of the election outcome, given both candidates’ commitments to tax cuts and spending.

The Growing U.S. Debt Crisis

On the alarming US deficit and debt path: Jones didn’t hold back here—it’s worth watching as he breaks down the US debt problem in simple terms. He compares it to someone earning $100,000 a year but borrowing $700,000 and planning to add $40,000 more in debt annually. So, why would anyone still lend to the US government?

U.S. debt situation has spiraled out of control. Just 25 years ago, the national debt was a little under 60% of GDP. Today, that rate has doubled to 120%.

Source: OMB; St. Louis Fed; US Global Investors

Paul Tudor Jones warns the U.S. faces a fast-approaching debt crisis unless it tackles government spending. He notes that political promises of increased spending or tax cuts only deepen the issue, saying the U.S. will be “broke really quick” without serious fiscal action.

Stanley Druckenmiller, billionaire investor and former chairman of Duquesne Capital and former chief portfolio manager for George Soros’ Quantum fund, shared his views on the Fed, criticising its overly easy policies during the pandemic, when he believed rate hikes should have started sooner.

He also expressed concern that the Fed may be making a new mistake by cutting rates too aggressively, which could trigger another inflation spike if the economy stays strong and potentially compromise the Fed’s independence.

In case you missed, read our article on the 2024 September Fed cut here.

What can you do to protect your portfolio from election uncertainty

It’s worth noting that Druckenmiller is less interested in discussing the equity markets and is more focused on the risks to the bond market, which could impact stocks negatively. He specifically indicates that he is taking a strong position against US long-term treasury bonds, hoping to profit from a sharp further rise in US yields.

With Jones taking a similar stance, he said, “I’m long gold, I’m long bitcoin…Commodities are ridiculously underowned.”

Important: The interaction between bond yields and stock markets is crucial for understanding currency movements. If bond yields rise, it may lead to a stronger U.S. dollar (creating challenges for equities) as investors seek higher returns, thereby increasing demand for dollars to purchase U.S. bond.

3 strategies to navigate these market shifts

The “Trump Trade” meant reevaluating and adjusting their portfolios to adapt to the changing economic environment:

Fixed Income Strategy

Investors needed to be careful with long-term bonds because rising yields could decrease their value. Instead, they shifted their focus to shorter-duration bonds, which are less affected by interest rate changes. This approach helps reduce the risk of losing money if interest rates rise further.

Currency Considerations

For portfolios that include foreign investments, implementing hedging strategies has become increasingly important. This is to protect against potential losses due to a strong U.S. dollar, which can make foreign assets less valuable when converted back to dollars.

Geopolitical Hedging

It became wise to diversify investments into assets that are not heavily influenced by U.S. political events. Including safe-haven assets, such as gold or Swiss Franc, provides a buffer against market volatility caused by political uncertainty. These assets tend to hold their value better in turbulent times.

You might be interested: How to Manage Market Volatility in the US Elections

Why trade CFDs with VT Markets?

When considering wise words of these investing legends, one key observation is that they are extremely quick to change their mind if something dramatically new happens.

In fast-moving markets where prices can shift direction rapidly, you can trade CFDs across a wide range of assets, from forex to precious metals, capitalising on breaking news and political changes.

It takes less than 5 minutes to open your CFD trading account here.