Market Focus

Stocks declined Tuesday on intensifying tension between the West and Russia over Ukraine, a standoff that leads investors to seek the relative safety of bonds and gold. Equities in Japan, Australia and South Korea fell, while U.S. futures pointed to a lower open when Wall Street trading resumes later following a holiday Monday.

President Vladimir Putin announced he’s recognizing two self-proclaimed separatist republics in eastern Ukraine, a dramatic escalation in Russia’s standoff with the West as the U.S. and its allies continue to warn it could soon invade its neighbor.

Those fears were likely heightened by the detail of the decrees signed by Putin, including an order for the Defense Ministry to send what he called “peacekeeping forces” to the breakaway regions. There were no details so far on how many troops might go in, or when, but Russia has previously accused Ukraine of having a significant deployment of its own soldiers on the line of contact with the separatists.

While Russia will argue that Putin’s recognition of the separatist regions gives a legal basis for the presence of its troops, the move will likely fuel U.S. and European concerns that Moscow is moving to take control of territory internationally recognized as part of Ukraine, and would put his forces closer to direct confrontation with Ukrainian soldiers.

“The question is now whether the U.S. and its partners are ready to pursue dialog in these new conditions,” said Andrey Kortunov, head of the Kremlin-founded Russian International Affairs Council. “We can say the worst hasn’t happened — a major new war hasn’t started, at least for now — but after the recognition we’re likely to see Russian troops deployed up to the border with the rest of Ukraine and this will be seen as an act of aggression with all the consequences.”

Main Pairs Movement:

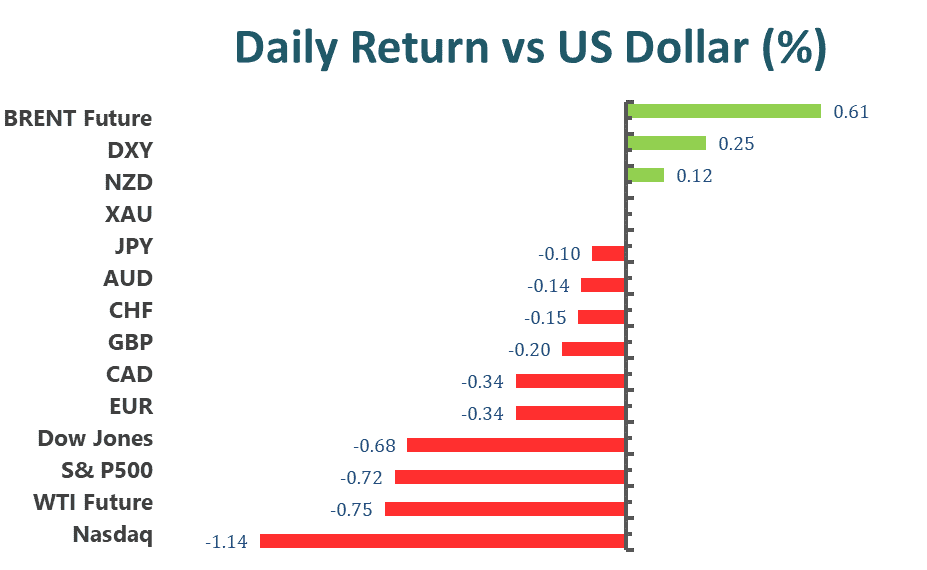

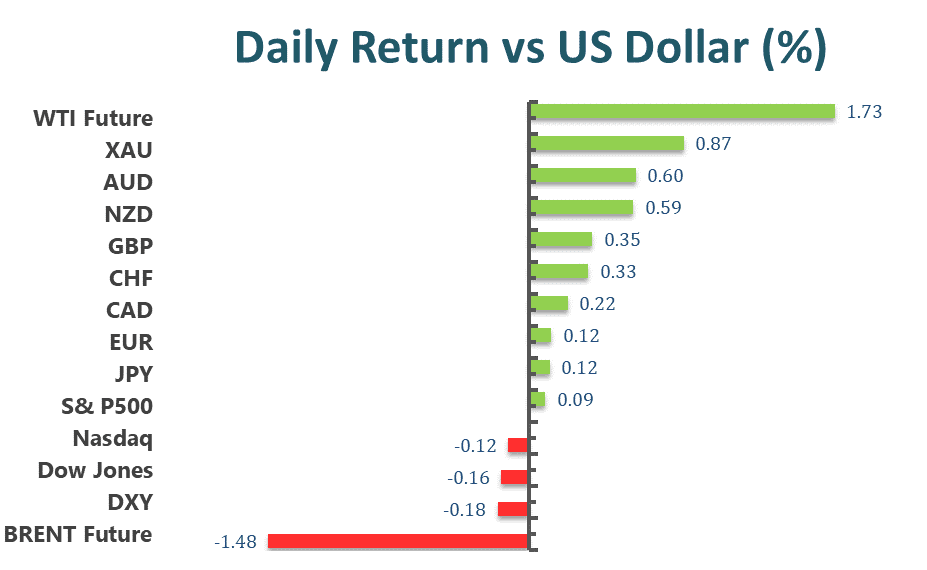

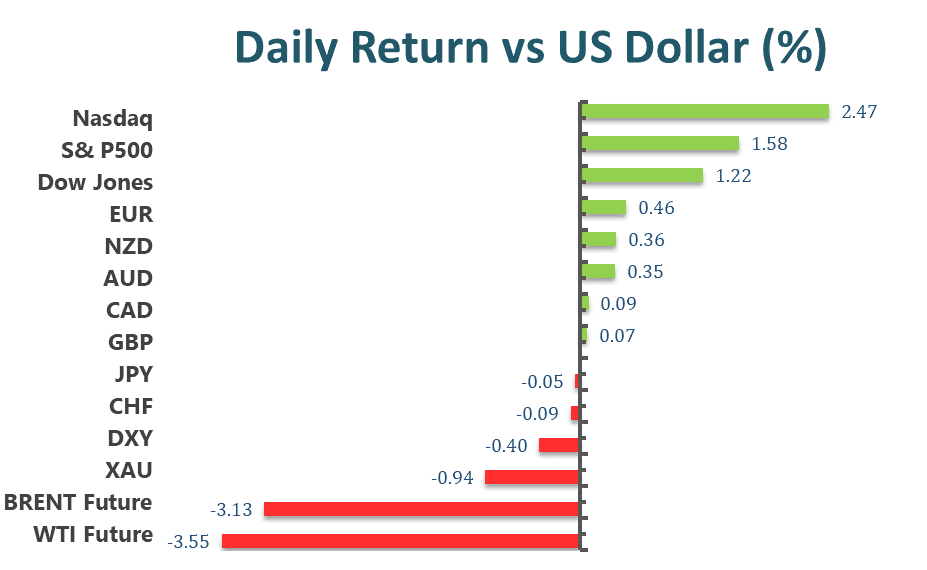

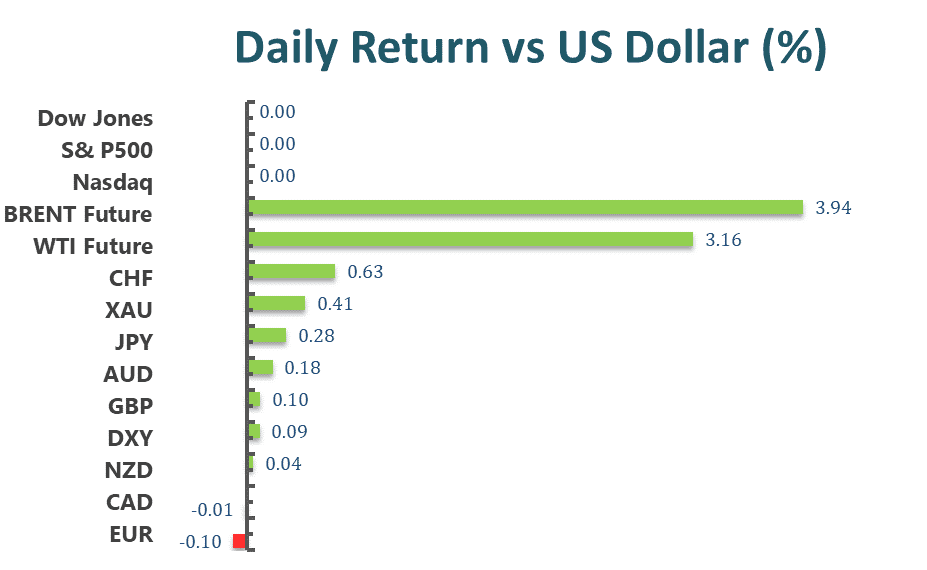

Risk-off mood took over financial markets at the start of the week amid escalating geopolitical tensions in Eastern Europe. The greenback managed to advance against its high-yielding rivals but lost ground against safe-haven ones.

Mid US-afternoon on Monday, Russian President Vladimir Putin recognized Donetsk and Luhansk in Eastern Ukraine as independent states signed a decree “on friendship and cooperation.” The world sees this decision as the first step towards an invasion, which also invalidates talks with Western nations.

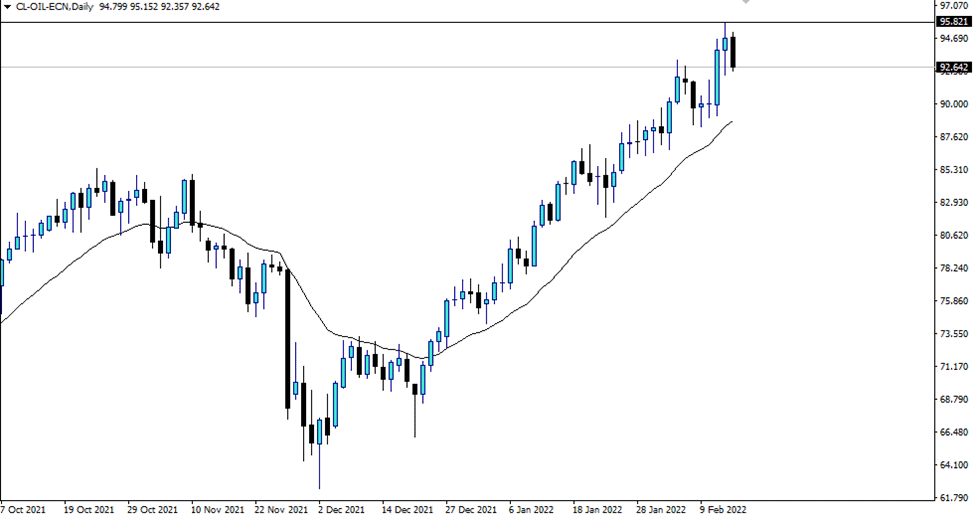

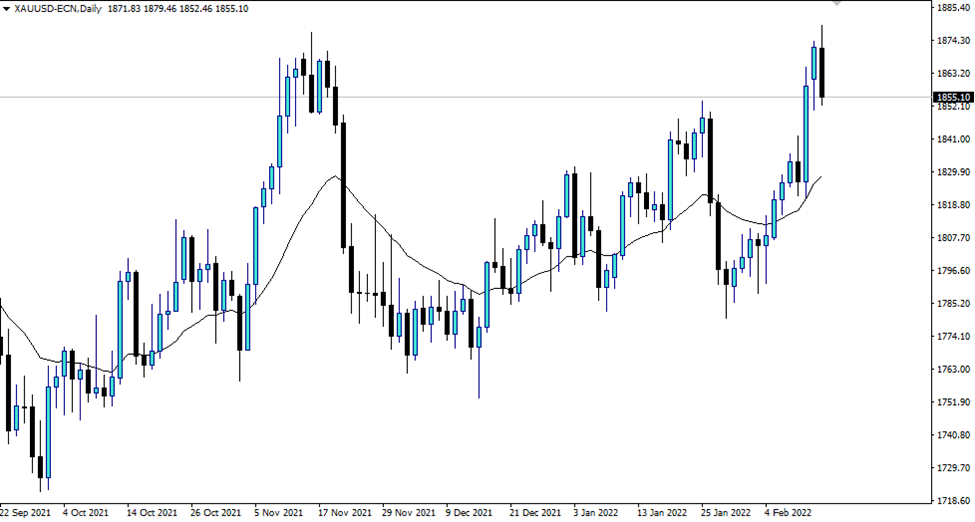

The Euro pair dived below 1.1300 in the early Asian session and now hovers around the 1.1310 levels. Cable fell over 1.3600, now trades at 1.3590. Commodity-linked currencies traded mixed against greenback for another day, as gold pushed past $1,910 a troy ounce amid demand for safety, and crude oil prices continue to climb on disruption fears. WTI now changes hands at $92.40 a barrel, while Brent at $97.30.

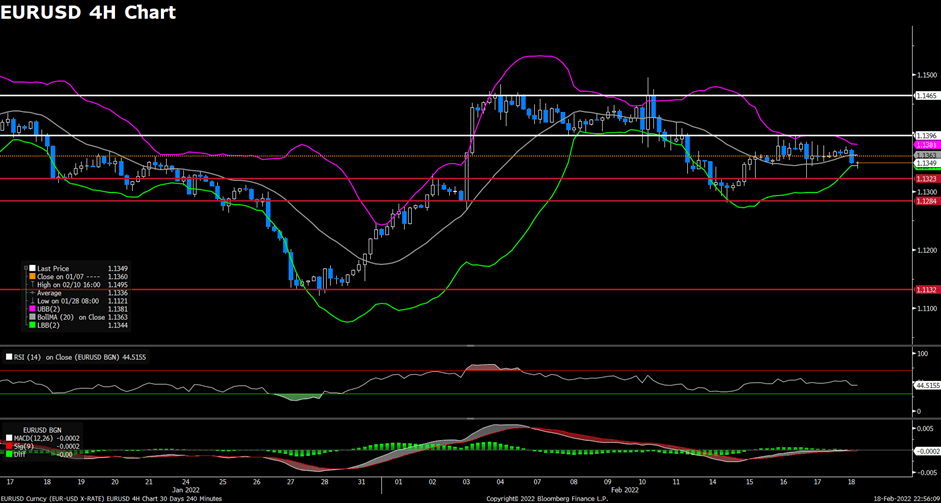

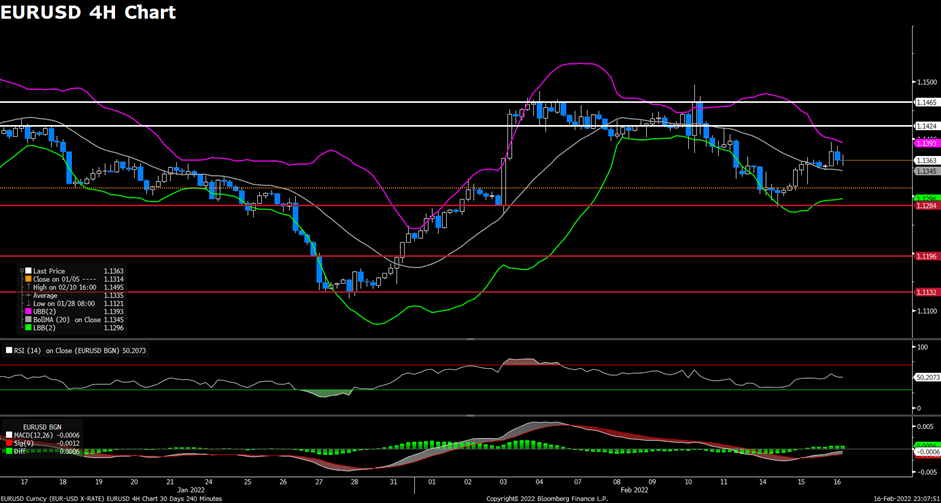

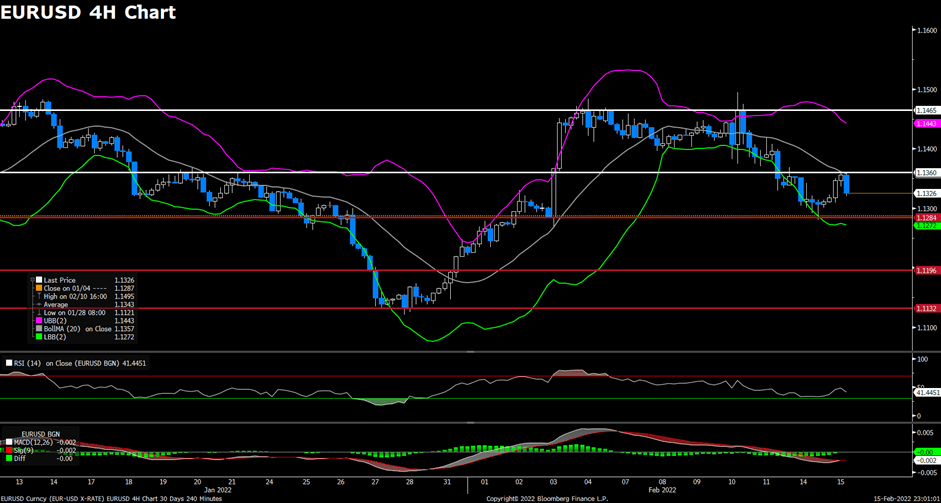

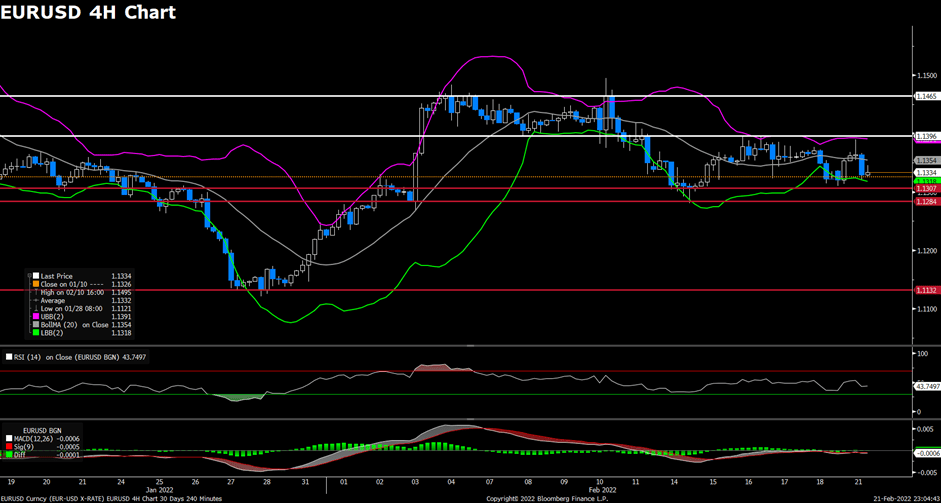

EURUSD (4-Hour Chart)

The EUR/USD pair advanced on Monday, rebounding from 1.1310 area amid recovering market mood. The pair saw fresh buying and touched a daily high near 1.1390 mark in early European session, but failed to preserve its bullish strength while surrendering most of its intraday gains. The pair is now trading at 1.1333, posting a 0.13% gain on a daily basis. EUR/USD stays in the positive territory amid weaker US dollar across the board, as the news reported that French President has arranged a meeting between US President Joe Biden and Russian president Vladimir Putin this week boosted market sentiment and weighed on the greenback. For the Euro, the better-than-expected Eurozone PMI data released today acted as a tailwind for EUR/USD pair, showing a rebound in service sector sentiment and falling Omicron infection rates.

For technical aspect, RSI indicator 43 figures as of writing, suggesting bear movement ahead. As for the Bollinger Bands, the price is now struggling around the lower band, which indicates that the pair remain directionless. In conclusion, we think market will be slightly bearish as the pair might test the 1.1307 support. The continuing escalation in violence in Ukraine’s Donbass region could keep weighing on EUR/USD, and the pair could extend its slide toward 1.1300 after breaking that support.

Resistance: 1.1396, 1.1465

Support: 1.1307, 1.1284, 1.1132

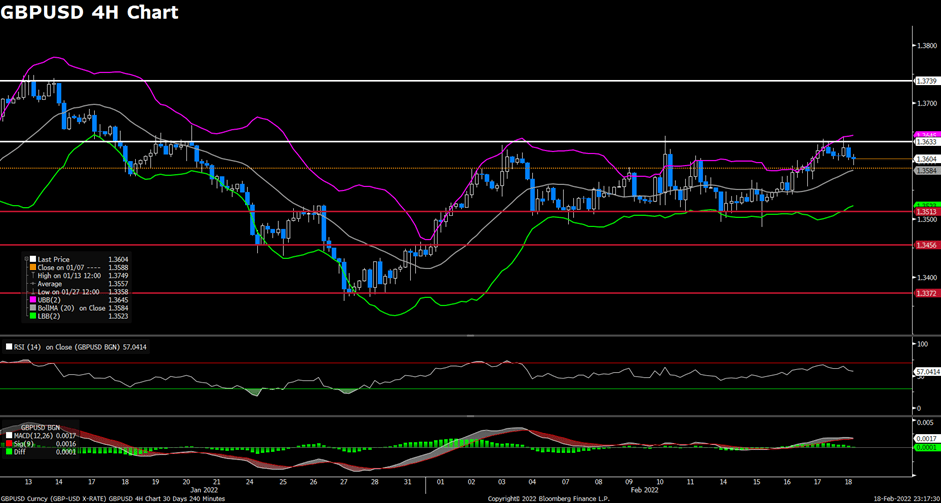

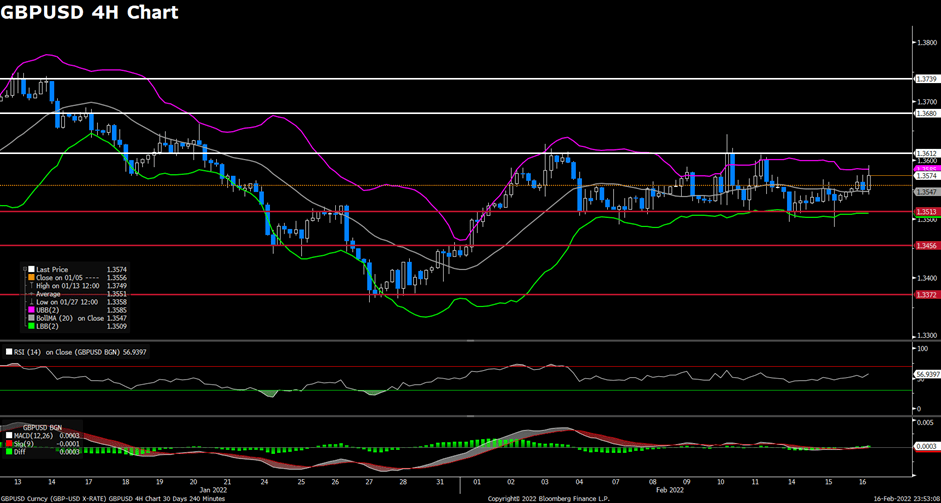

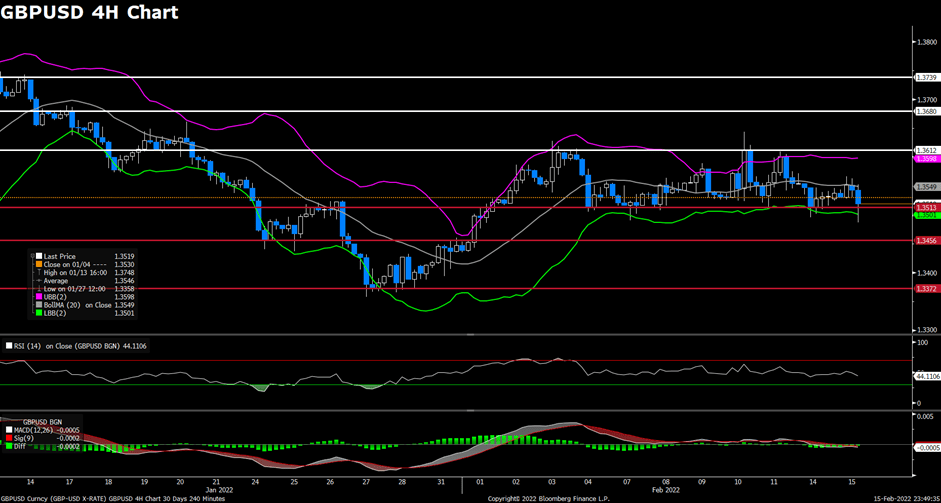

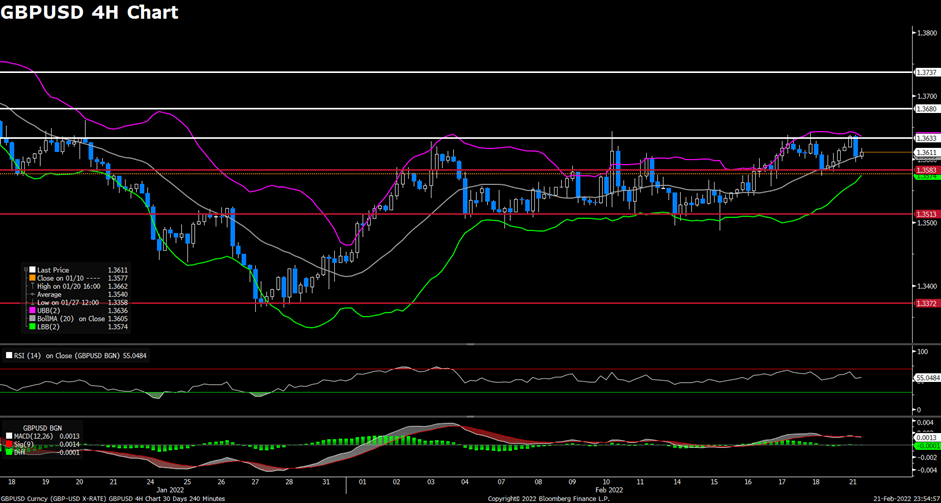

GBPUSD (4-Hour Chart)

The pair GBP/USD edged higher on Friday, retreating toward 1.3600 level and lost its upside traction amid renewed concerns about tensions between Russia and Ukraine. The pair was pushed higher to near 1.3640 mark by the positive shift witnessed in risk sentiment, but then dropped to 1.3600 area amid renew selling. At the time of writing, the cable stays in positive territory with a 0.22% gain for the day, lacking upside momentum. The weaker US dollar lend support to the cable, but the news that US received information suggesting that Russia was preparing for military action against Ukraine might limit the losses for greenback. For British pound, the UK Preliminary Services PMI jumps to 60.8 in February, which surpassed market expectations of 55.5 and underpinned the GBP/USD pair.

For technical aspect, RSI indicator 56 figures as of writing, suggesting that upside is more favored as the RSI stays above the mid-line. For the Bollinger Bands, the price is now rising towards the upper band again after touching moving average, indicating a possible upside traction for cable. In conclusion, we think market will be bullish as the pair might re-test the 1.3633 resistance. A break above that level could open the road for near-term gains.

Resistance: 1.3633, 1.3680, 1.3737

Support: 1.3583, 1.3513, 1.3372

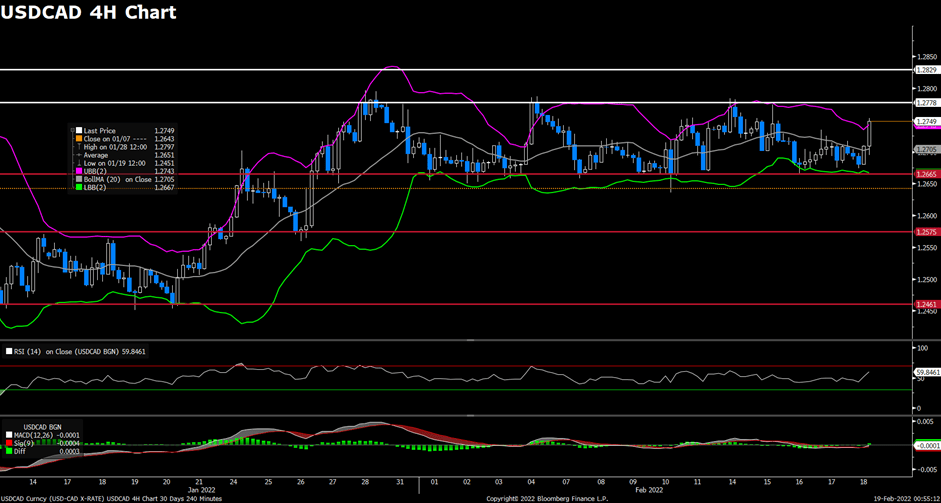

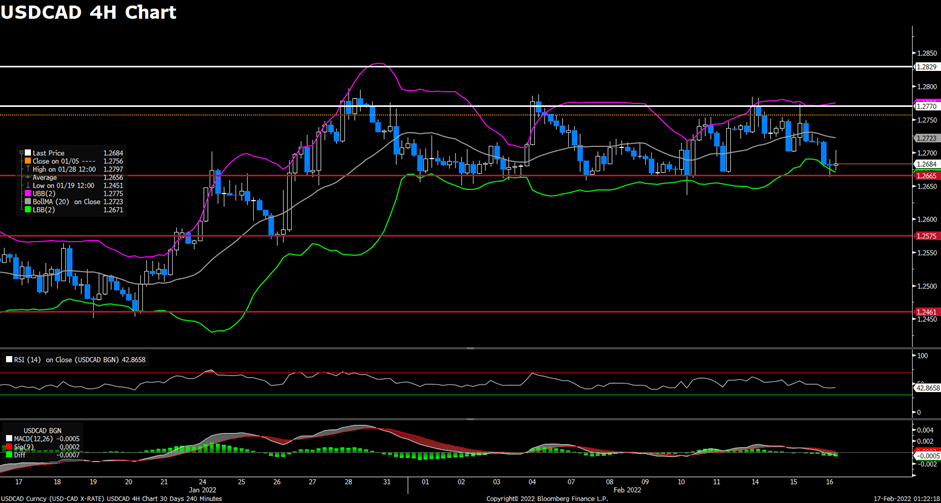

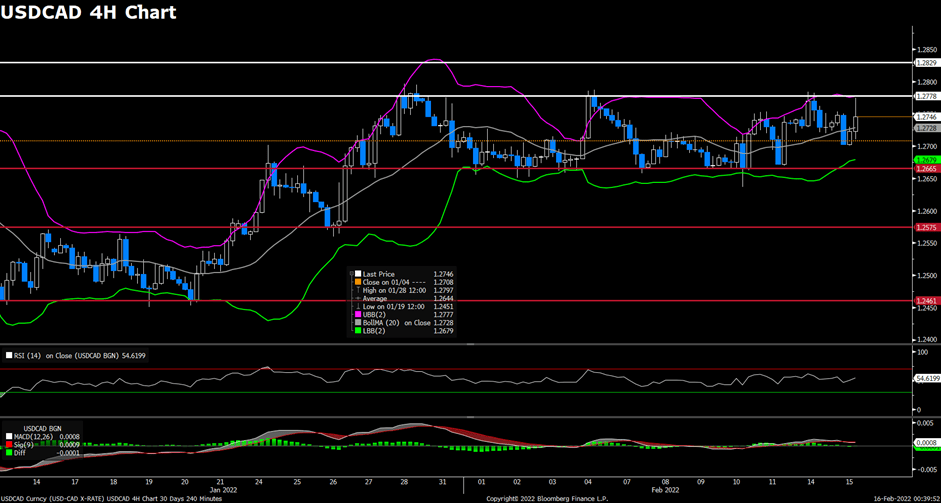

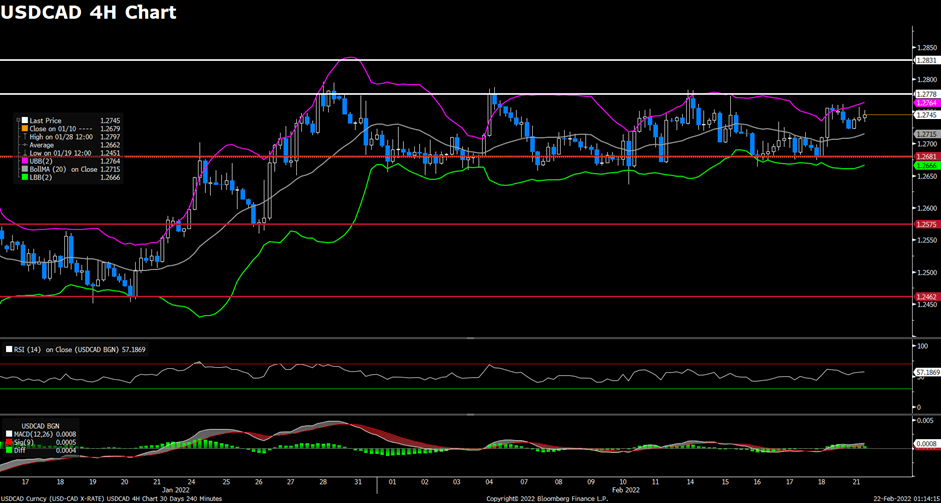

USDCAD (4-Hour Chart)

As the concerns about conflicts between Russia and Ukraine eased earlier today, the pair USD/CAD witnessed some selling and remained under pressure on US dollar weakness. The pair dropped to a daily low below 1.2730 level in early European session, then rebounded towards 1.2760 area to recover most of its daily losses. USD/CAD is trading at 1.2745 at the time of writing, losing 0.07% on a daily basis. Positive news on Ukraine-Russia fears has favored the market mood, as US President Biden agreed to participate the meeting with Russia President Putin later this week if an invasion hasn’t happened. On top of that, rising crude oil prices also undermined the USD/CAD pair, now WTI is trading flat in the $92.00 per barrel area. But traders continue to weigh ongoing escalation in the Russia/Ukraine crisis, which might disrupt global oil supply.

For technical aspect, RSI indicator 57 figures as of writing, suggesting that upside is preserving strength as the RSI is approaching 60. As for the Bollinger Bands, the price is now climbing towards the upper band, which showed that upside momentum could be expected. In conclusion, we think market will be bullish as the short-term technical outlook for USD/CAD remains bullish with the RSI indicator on the four-hour chart holding above 50.

Resistance: 1.2778, 1.2831

Support: 1.2681, 1.2575, 1.2462

Economic Data:

| Currency | Data | Time (GMT + 8) | Forecast |

| EUR | German Ifo Business Climate Index (Feb) | 17:00 | 96.5 |

| USD | CB Consumer Confidence (Feb) | 23:00 | 110.0 |