US stocks edged lower on Friday, as a hot jobs report fueled bets the Federal Reserve will keep tightening even if officials downshift the pace of hikes this month.

Now, the equities and bonds market faced a lot of instability, with the surge in 10-year yields fizzling out while two-year rates remained higher. US employers added more jobs than forecast and wages surged by the most in nearly a year. Nonfarm Payroll increased by 263K in November, while the unemployment rate held at 3.7%. Average hourly earnings rose twice as much as predicted. The resilient labour market is heaping pressure on the Federal Reserve to continue raising rates.

Market participants are all keeping eye on the dot plot, which the central bank uses to signal its outlook for the path of policy. According to Bank of America Corp. strategists, stock investors’ optimism around a cooling labour market and a Fed pivot are overdone.

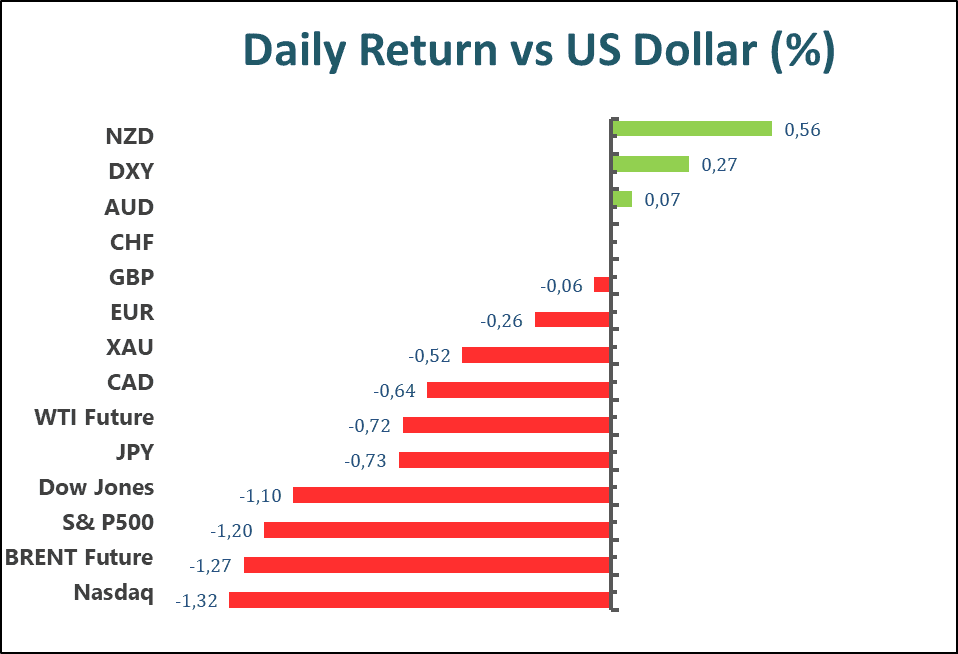

The benchmarks, S&P 500 and Dow Jones Industrial Average both little changed on Friday, as the S&P 500 almost erased a slide that earlier topped 1% and slid 0.12% daily. Six out of eleven sectors on the S&P 500 stayed in negative territory as the Energy sector is performing the worst among all groups, losing 0.60% for the day. It’s also worth noting that the Materials and Industrials sectors got the best performance on Friday with 1.10 % and 0.62% gain, respectively, daily. Meanwhile, the Nasdaq 100 fell 0.4% on Friday and the MSCI World index slid 0.2% for the day.

Main Pairs Movement

The US dollar edged lower on Friday, with a 50 basis point rate hike remaining favoured despite the full Nonfarm Payrolls report. The US economy added 263K jobs during the last month and the unemployment rate remained at 3.7%, while Average Hourly Earnings rose more than expected by 0.6% MoM and 5.1% from a year earlier. The DXY index was moving a little lower in the first half of Friday but underpinning by a better-than-forecast jobs report. However, the US Dollar failed to hold its ground and dropped to a level of around 104.5.

GBP/USD records modest growth with a 0.27% gain daily following dropping to a daily low of 1.2134 level. The pair ended at the 1.2288 level on Friday, with investors betting more on 50 bps rate hikes in December despite a better-than-expected jobs report. Meanwhile, the EURUSD also confronted heavy selling pressure when the release of the US NFP, dropped to a daily low of 1.0428 level. However, the pair managed to rebound back above the 1.0500 level and rallied by 0.14% for the day.

Gold declined by 0.30 % for the day, witnessing strong selling transactions when the US Payrolls report was released. The XAUUSD managed to stand firmly above the $1795 mark during the late American trading session following a daily low of $1778 marks ahead of the US trading hour.

Technical Analysis

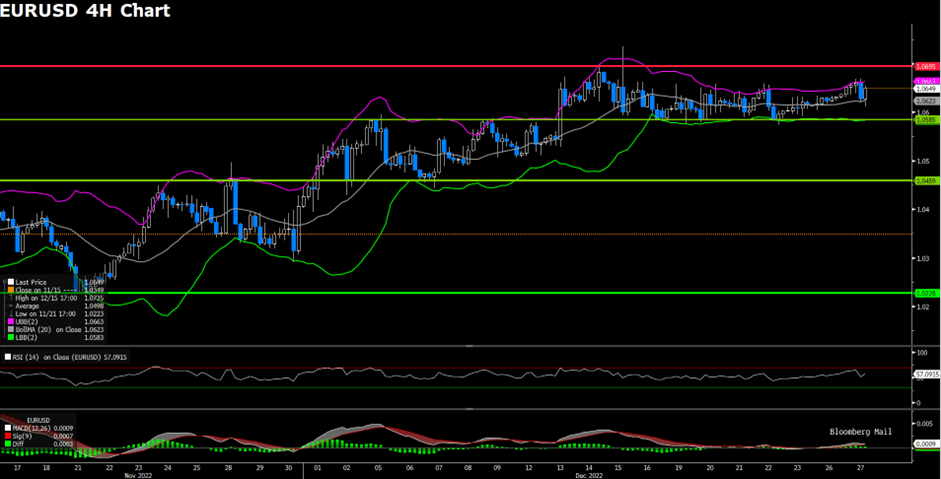

EURUSD (4-Hour Chart)

The EURUSD managed to stage a modest rebound after dropping below 1.0450 with the data from the US showing that Nonfarm Payrolls rose by 263K in November. The pair was climbing back above 1.0500 at the moment of writing. The US. Nonfram Payrolls, measuring the change in the number of people employed without the farming industry during the previous month, printed a surprising 263K figure compared to market forecast of 200K. This report showed that the US labor market remain highly resilient, despite a series of big techs have announced massive layoffs. Further data saw the Unemployment Rate unchanged at 3.7% and the key Average Hourly Earnings, a proxy for inflation via wages, rise 0.6% MoM and 5.1% from a year earlier.

From the technical perspective, the four-hour scale RSI indicator rebounded to 63 figures as of writing, suggesting that the pair was surrounded by strong upside traction. As for the Bollinger Bands, the euro was stably trading above the 20-period moving average, and the size between the upper and lower bands became larger. As a result, we think the pair’s positive tendency would persist shortly.

Resistance: 1.0605, 1.0773

Support: 1.0315, 1.0228, 0.9961

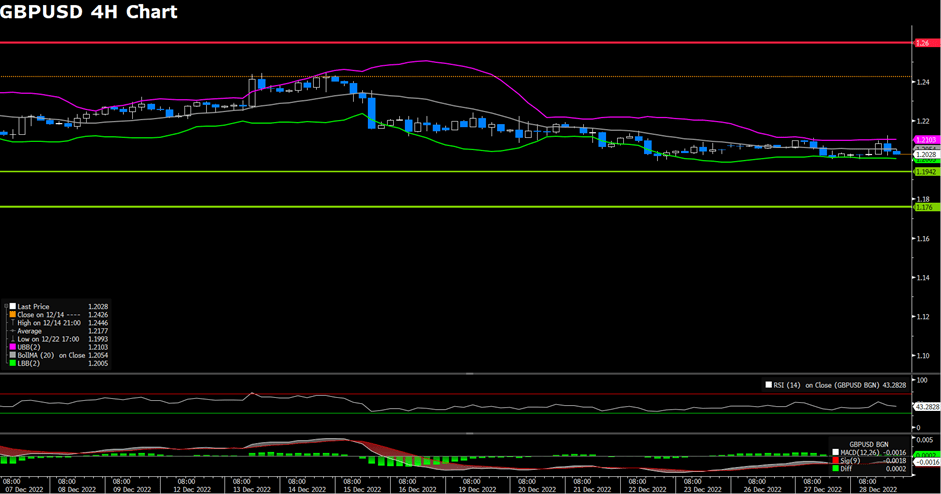

GBPUSD (4-Hour Chart)

The GBPUSD has erased its losses from the early American trading session after diving around 100 pips caused by a better-than-foreseen labour market report in the United States (US). The Department of Labor (DoL) report showed November US Nonfarm Payrolls rose by 263K following an upward revision of 284K jobs added in October. Delving into the information, the Unemployment Rate stood at 3.7%, while Average Hourly Earnings put upward pressure on inflation, jumping 5.1% YoY, vs. 4.6%, consensus. Given that Federal Reserve (Fed) policymakers agreed that moderating the pace of rate hikes is appropriate, how Fed officials look into this would be critical. Apart from this, a weaker Institute for Supply Management (ISM) Manufacturing PMI report for November on Thursday flashed signs of activity contraction, shifted sentiment sour, spurring flows towards safety, except for the US Dollar (USD).

From the technical perspective, the four-hour scale RSI indicator changed its direction suddenly and climbed to 65 figures as of writing, suggesting the pair amid strong bullish momentum. As for the Bollinger Bands, the pair continued to trade in the upper area, meaning the upside traction would persist. As a result, we think if the pound could successfully break through the psychological 1.2400 level, the bulls have a chance to target 1.2600.

Resistance: 1.2400, 1.2600

Support: 1.2154, 1.1927, 1.1765

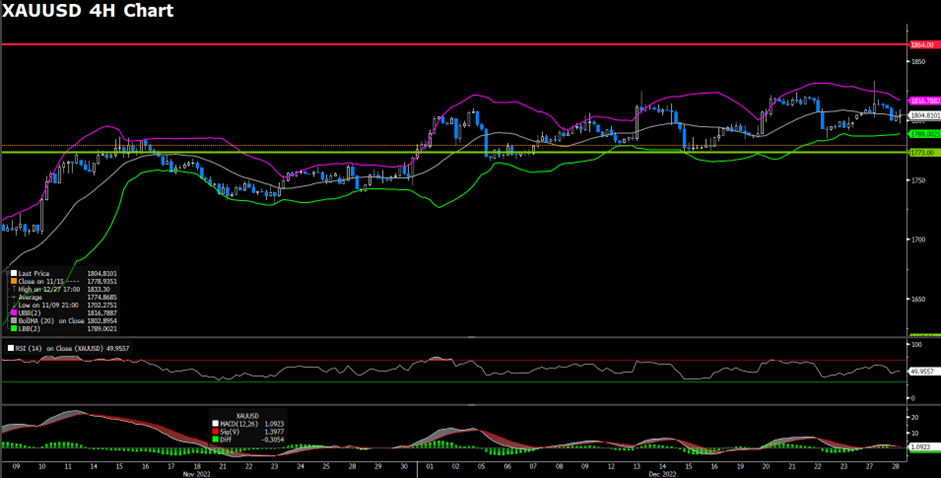

XAUUSD (4-Hour Chart)

The Gold managed to rebound to above the $1795 mark following a sharp retreat caused by upbeat jobs data. The closely-watched Nonfarm Payroll (NFP) from the United States showed that the economy added 263K new jobs in November, beating consensus estimates pointing to a reading of 200K. Adding to this, the previous month’s print was also revised higher to show an addition of 284K vacancies as compared to the 261K reported initially. Meanwhile, the unemployment rate held steady at 3.7% during the reported month, the same as market expectations. Furthermore, additional details of the report showed that Average Hourly Earnings grew 0.6% in November and 5.1% YoY rate, suggesting a further rise in inflationary pressures. The data validates Federal Reserve Chair Jerome Powell’s forecast that the peak rate will be higher than expected, which triggers a sharp rise in the US Treasury bond yields. This, in turn, prompts an aggressive US Dollar short-covering move and weighs heavily on the Dollar-denominated Gold price.

From the technical perspective, the four-hour scale RSI indicator 63 figured as of writing, suggesting that the gold regained positive strength. As for the Bollinger Bands, the pair held its ground above the 20-period moving average, meaning the upside tendency is more favoured in the near term.

Resistance: 1814

Support: 1740, 1706, 1671

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

| EUR | ECB President Lagarde Speaks | 09:45 | |

| GBP | Composite PMI | 17:30 | 48.3 |

| GBP | Services PMI (Nov) | 17:30 | 48.8 |

| USD | ISM Non-Manufacturing PMI (Nov) | 23:00 | 53.1 |