What are the best forex pairs to trade? If only this question had a straightforward answer — it would make learning how to trade forex and speculating on currency movements far more reliable. Unfortunately, this is not the case, and deciding on the best currency pairs to trade is always a personal choice and depends exclusively on your own trading strategy.

However, examining the most traded currency pairs in the market can be helpful. This gives you some idea of the most liquid options when trading currency pairs and provides you with a wealth of data you can use to develop your future strategies.

EUR/USD — European Euro and United States Dollar

The EUR/USD currency pair is the most traded in the market regarding volume and trading frequency. In forex trading, this high volume builds momentum, making the most frequently traded pairs very popular among currency speculators. This is because of the high liquidity of frequently traded pairs, which helps keep spreads tight.

Traders must remain aware of actions from the European Central Bank and the United States Federal Reserve. These financial institutions set the interest rates that dictate the relative values of the currencies. If one institution increases interest rates relative to the other, that institution’s currency may grow in value — this will dictate whether the trader needs to open a long or short position.

USD/JPY — United States Dollar and Japanese Yen

The USD/JPY pair puts the United States Dollar in the base position and uses the Japanese Yen as the quote currency. This pair is sometimes referred to as the gopher, another highly liquid option for traders. The liquidity is supported by the proliferation of trading on the Japanese Yen in the Asian market — a huge portion of the global forex trading landscape.

Again, the Federal Reserve sets interest rates on the USD, but the Bank of Japan dictates Japanese domestic rates. Traders will need to be aware of changes in these rates as they decide on their strategy for the USD/JPY.

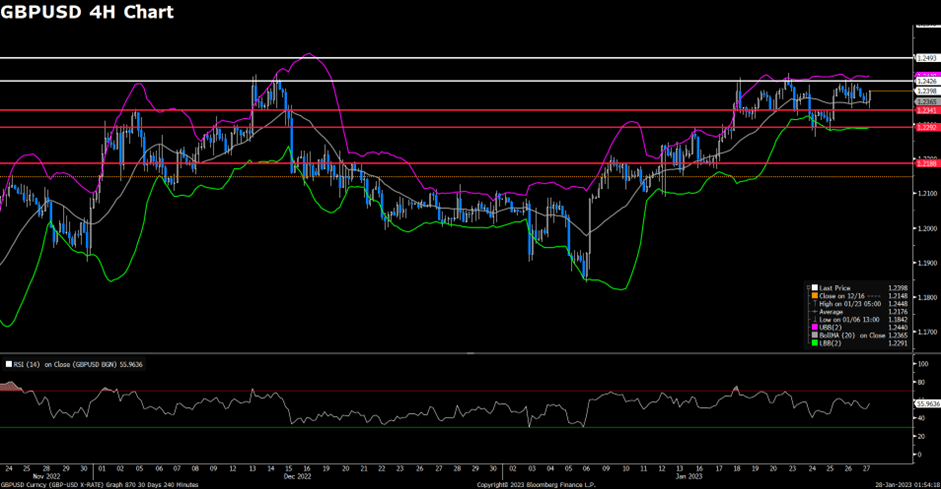

GBP/USD — British Pound and United States Dollar

With the British Pound as the base currency and the United States Dollar as the quote currency, the GBP/USD pair is sometimes referred to as “cable” among forex traders. This is because of the long history of trading across the pair, and it refers directly to the wire cables that used to be utilised to execute transatlantic trades.

Traders must remain aware of the actions of the Federal Reserve in the United States and the Bank of England in London. Both of these factors will impact the performance of the GBP relative to the quoted USD value.

AUD/USD — Australian Dollar and United States Dollar

Traders may call the AUD/USD pair “the Aussie” simply because the Australian Dollar is in the base position, while the United States Dollar is the quote currency. While many other pairs use the Australian Dollar as the base currency, the AUD/USD is the most frequently traded and liquid, so this one receives the colloquial nickname.

The Reserve Bank of Australia determines the country’s official cash rate, so traders need to be aware of this in relation to the current Federal Reserve interest rate. The Australian Dollar also depends on the performance of the natural resources that bolster the country’s economy.

USD/CAD — United States Dollar and Canadian Dollar

The USD/CAD is another pair on this list, with the United States Dollar in the base position while the neighbouring Canadian Dollar takes the quote position. This pair may also be called “the loonie”, a nickname for the physical Canadian Dollar coin.

In addition to the interest rates across the two nations, traders will need to be aware of the price of oil on the global market. This is an important influence on the Canadian economy and will affect the currency’s value relative to the United States Dollar south of the border.

USD/CNY — United States Dollar and Chinese Yuan

This currency pair puts the United States Dollar and the Chinese Yuan in the base and quote positions, respectively. As the two biggest economies in the world, the United States and the People’s Republic of China have a huge influence on the forex market, and this pair has grown to become one of the most frequently traded in the world.

The Chinese central government exerts control over the country’s economy and the value of its currency. It has intentionally allowed the value of the Yuan — sometimes referred to as the Renminbi — to depreciate relative to other global currencies. This makes the USD/CNY a unique pairing on this list, and the potential volatility of the pair has been compounded in recent years by the unfolding trade war and political tensions between the two countries.

USD/CHF — United States Dollar and Swiss Franc

When forex platform users are trading currency pairs, they may notice “the Swissie” — this is another name for the United States Dollar and Swiss Franc currency pair, or the USD/CHF.

The Swiss Franc is often considered a stable currency, so traders may be tempted to invest in the CHF during periods of uncertainty in the broader market. If the market is generally stable, traders are less likely to turn to the Swiss Franc. Despite this, the USD/CHF, or Swissie, remains one of the most traded currency pairs.

USD/HKD — United States Dollar and Hong Kong Dollar

One of the most traded currency pairs in recent years has been the United States Dollar and the Hong Kong Dollar, or USD/HKD. This is a somewhat unique entry on this list simply because of the relationship between the two currencies. The HKD quote currency is pegged directly to the USD base currency, which means the value of the quote currency will rise and fall with that of the base currency.

There is still room for speculation, however. The HKD can fluctuate by several cents up or down from the current United States Dollar value. When extrapolated out over larger trade values and volumes — or trades made with leverage in the FX market — this can still represent a significant level of fluctuation.

EUR/GBP — European Euro and British Pound

Bringing together the European Euro in the base currency slot, up against the British Pound in the quote position, the EUR/GBP currency pair is among the most interesting options around. This is because of the geopolitical and economic speculation that has taken place in this part of the world over the last few years. While Britain was never in the Eurozone, it was a member of the European Union until several years ago. Its recent exit has caused serious fluctuations in the relative values of the two currencies.

Of course, fluctuations and volatility do not always mean bad news for investors, and many traders will actively welcome this kind of movement in the market. This is why the EUR/GBP has become one of the most popular choices for speculation, although traders are always advised to tread carefully.

USD/KRW — United States Dollar and Korean Won

The tenth and final pair on this list of the most traded currency pairs is the USD/KRW. With this pair, we find the United States Dollar in the base currency position again, while South Korea’s Won fills the quote currency position.

Huge economic growth in South Korea in the last few decades, as well as its status as one of the leaders in the global tech market, has led to considerable interest in this currency. And, of course, the United States Dollar remains one of the most commonly traded currencies in the world, making for a natural base option.

A few things to bear in mind when trading currency pairs

The above list is not definitive. The market’s most commonly traded currency pairs can change at any time, with new pairs emerging and other pairs falling out of favour. As you decide on the best currency pairs to trade, you’ll need to pay attention to market movements, examine the dashboard of your trading platform and identify trends.

Examining the market means you’ll need to stay aware of pips. Pips in FX are small movements, typically at the fourth decimal place of the currency pair value. However, with smaller denomination quote currencies like the Japanese Yen or Korean Won, these movements may be at the second decimal place. While a single pip movement may not look like much, this can represent a significant amount of money on a large trade. Even on smaller trades, pip movements decide whether the position is successful or not.

Trade the main currency pairs at VT Markets

Here at VT Markets, we provide traders with the tools and platforms they need to grow their experience in the market. This may include trading with some of the common most traded currency pairs out there, or it may involve emerging and exotic pairs. Whichever strategy you choose, begin your journey with a demo account and open real positions on the live trading account. Want to discover more? Reach out to our team today.