On Thursday, the Dow Jones Industrial Average experienced a significant rally, surging over 400 points, and the S&P 500 reached a 13-month high. Investors speculated that the Federal Reserve would refrain from further interest rate hikes after the central bank decided to skip a hike this week.

The Dow Jones rose by 428.73 points (1.26%), closing at 34,408.06, while the S&P 500 increased by 1.22% to finish at 4,425.84, and the Nasdaq Composite gained 1.15% to close at 13,782.82. The market saw lower bond yields and continued strong performance in the technology sector.

Investors are now considering whether value and cyclical stocks can catch up to the growth and tech sectors. If this occurs, it could fuel further market gains. The S&P 500 is currently on its longest winning streak since November 2021 and is poised for its strongest weekly gain since March.

The index has risen 23% from its October low and 15% year-to-date. The Nasdaq has also performed well, with a gain of over 31% in 2023. Tech giants like Microsoft, Oracle, and Alibaba experienced notable stock increases, further contributing to the market upswing.

During a post-meeting press conference on Wednesday, Fed Chair Jerome Powell stated that the Federal Open Market Committee would consider the cumulative impact of monetary policy tightening over the next six weeks before making a decision on the July policy move. Investors responded positively to Powell’s remarks, indicating a willingness to take risks despite lingering uncertainty.

Powell reiterated that the central bank is likely to raise rates later this year but emphasized that their decisions would depend on monthly data. Economic data released on Thursday, including jobless claims and retail sales figures, provided investors with a better understanding of the labour market and consumer spending trends.

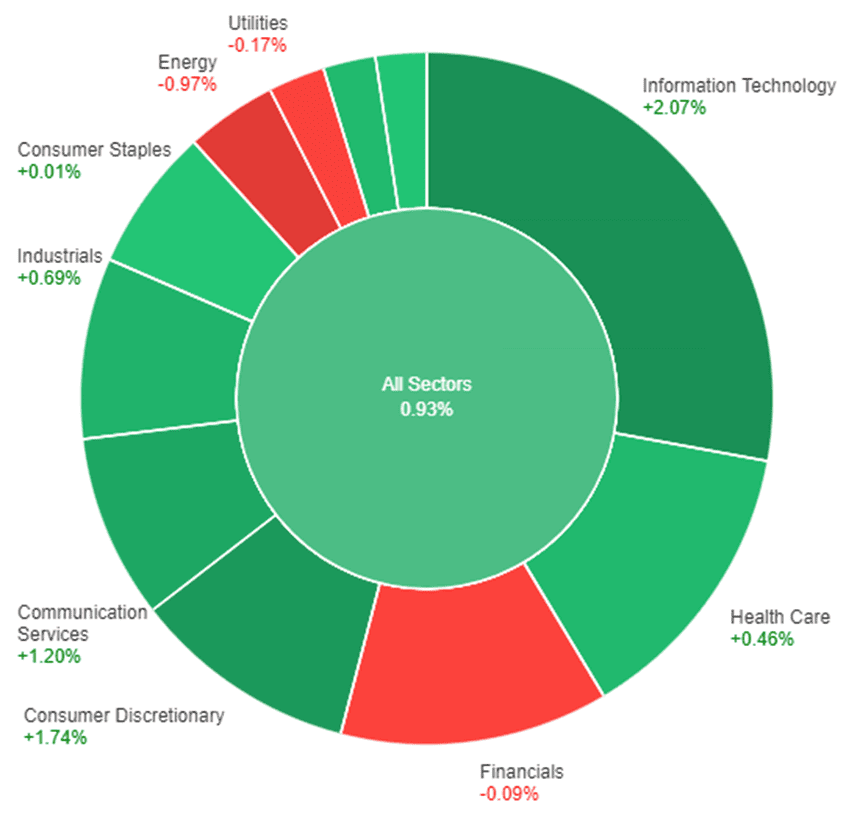

Data by Bloomberg

On Thursday, all sectors in the market experienced gains, with the overall market increasing by 1.22%. The health care sector led the way with a notable increase of 1.55%, followed closely by communication services and industrials, both rising by 1.54% and 1.51%, respectively. Information technology also performed well with a gain of 1.28%, while financials saw a rise of 1.26%. Other sectors that recorded gains include utilities (1.06%), energy (1.04%), consumer staples (0.93%), materials (0.85%), consumer discretionary (0.68%), and real estate (0.34%).

Major Pair Movement

The dollar index experienced a decline of 0.78% following recent meetings and underwhelming U.S. economic data. The spread between the 2-year bund and Treasury yields tightened by 21 basis points, contributing to the dollar’s decrease. Although the Federal Reserve’s median dot plot forecast indicated two more 25 basis point rate hikes this year, the market’s expectations were slightly lower, anticipating less than one rate hike before the year’s end.

Despite disappointing U.S. reports on jobless claims, retail sales, industrial production, and regional Federal Reserve surveys, the euro (EUR/USD) and the British pound (GBP/USD) both rose by approximately 1%. The yen (USD/JPY), which initially reached new highs for 2023, experienced a modest gain after encountering resistance.

The anticipation of the Bank of Japan’s meeting and potential continued negative rates impacted the low-yielding yen. The proximity of USD/JPY to the levels where substantial intervention took place in November added to the pressure.

EUR/USD surged above key Fibonacci levels, surpassing the 50% and 61.8% retracements of its April-May decline and moving closer to the 76.4% level at 1.0987. Sterling (GBP/USD) broke out above its downtrend line encompassing highs from 2021, 2022, and 2023, as well as previous peaks from 2023 and the 61.8% retracement of its 2021-2022 decline at 1.2751.

Despite recent volatility in the bond market, the market is still pricing in at least 125 basis points of additional rate hikes from the Bank of England, given the UK’s strong economic growth and elevated inflation.

The Australian dollar (AUD/USD) gained 1.3% as part of the broader decline of the safe-haven U.S. dollar. Support came from positive sentiment surrounding Australia’s economic recovery and improved conditions in China, one of Australia’s key trading partners. Looking ahead, the U.S. economic calendar for the next week is relatively light, with the Bank of England meeting on June 22 being a notable event to watch.

Picks of the Day Analysis

EUR/USD (4 Hours)

EUR/USD Surges to One-Month High on ECB’s Hawkish Tone and Dollar Weakness

The EUR/USD pair experienced a significant surge on Thursday, reaching its highest level in a month at 1.0952. The pair maintained its gains, indicating that the rally may continue. The European Central Bank (ECB) played a key role in this upward movement by raising interest rates as anticipated, while keeping the forward guidance unchanged. ECB President Lagarde’s remarks suggested another rate hike in July, alongside higher inflation forecasts.

This news, combined with rising German bond yields and declining US Treasury yields, further bolstered the EUR/USD. Despite Federal Reserve Chair Powell’s hawkish stance, the US Dollar remained weak due to improving risk sentiment and positive US economic data. The upcoming release of Eurozone inflation data and the University of Michigan Consumer Sentiment Index in the US is anticipated to influence market sentiment.

According to technical analysis, the EUR/USD pair experienced an upward movement on Thursday and was able to reach the upper band of the Bollinger Bands. The Relative Strength Index (RSI) is currently at 78, indicating that the EUR/USD is now in a bullish trend.

Resistance: 1.0982, 1.1034

Support: 1.0892, 1.0803

XAU/USD (4 Hours)

XAU/USD Retreats as Fed Maintains Neutral Stance, US Recession Fears Linger

The price of gold (XAU/USD) faced selling pressure after a tentative recovery, falling back from its near $1,934.74 level during the London session. The retreat came as the Federal Reserve (Fed) delivered a neutral interest rate decision, signalling that further rate hikes are on the horizon to combat persistent inflation. Market sentiment remained cautious amid concerns of a US recession, fueled by the Fed’s emphasis on ongoing inflation and tight labour market conditions.

Additionally, the US Dollar Index (DXY) experienced a decline, hovering around 103.15, as investors awaited the release of monthly Retail Sales data. Preliminary reports indicated a contraction of 0.1%, prompting a closer examination to determine if reduced prices for essentials or economic weakening were the cause.

According to technical analysis, the XAU/USD pair is moving higher and moves above the middle band of the Bollinger Bands. Currently, the Relative Strength Index (RSI) is at 57, indicating that the XAU/USD is in a neutral stance.

Resistance: $1,963, $1,972

Support: $1,939, $1,932

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| JPY | Monetary Policy Statement | Tentative | |

| JPY | BOJ Press Conference | Tentative | |

| USD | Prelim UoM Consumer Sentiment | 22:00 | 60.1 |