Imagine you’re planning a road trip across the country. To make the journey smoother and safer, you rely on your GPS. This trusty device provides you with a simple yet powerful tool – the estimated time of arrival (ETA).

Now, think of Forex trading as a similar journey filled with twists and turns, where your goal is to reach your profit destination. To navigate this path effectively, you’ll need a reliable tool, and that’s where Simple Moving Average (SMA) crossovers come in.

Just like your GPS calculates your ETA by smoothing out real-time data, SMAs do something similar in Forex trading. They provide a clear view of market trends, helping you stay on the right route to potential profits. In this comprehensive guide, we’ll not only explore the mechanics of SMAs but also show you how to use them for a successful trading journey. So, fasten your seatbelt, and let’s embark on this exciting Forex adventure together.

Understanding Simple Moving Averages (SMA)

Simple Moving Averages (SMAs) are fundamental tools in Forex trading. They provide a smoothed average of an asset’s price over a specified time period, helping you spot trends amidst market noise. SMAs are excellent for beginners because they are easy to calculate and interpret.

In practical terms, let’s consider a chart displaying daily closing prices of a currency pair. SMAs operate by systematically summing up the closing prices over a defined time frame, such as 10 days, and then dividing this sum by the number of days in that period (in this case, 10). This calculation yields a single data point on the chart that signifies the average price over that specific duration.

For example, suppose you have daily closing prices for a currency pair over the last 10 days:

- Day 1: 1.1000

- Day 2: 1.1020

- Day 3: 1.1035

- Day 4: 1.1050

- Day 5: 1.1080

- Day 6: 1.1075

- Day 7: 1.1070

- Day 8: 1.1065

- Day 9: 1.1055

- Day 10: 1.1075

To calculate the 10-period SMA, you sum these closing prices (1.1000 + 1.1020 + 1.1035 + 1.1050 + 1.1080 + 1.1075 + 1.1070 + 1.1065 + 1.1055 + 1.1075 = 11.075) and then divide by 10. The resulting value, approximately 1.1075, represents the 10-period SMA for the current day.

By performing this calculation consistently for each day, you generate a line on your chart. This line effectively smooths out the short-term price fluctuations, making it easier to discern the prevailing market trend. SMAs provide traders with factual data to assess whether the market is trending upward, downward, or trading sideways, offering valuable insights for informed trading decisions.

Different SMA Periods

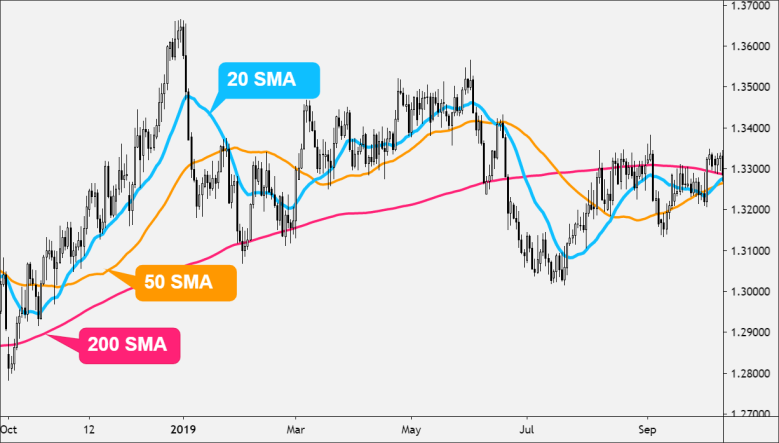

In Forex trading, Simple Moving Averages (SMAs) are not one-size-fits-all. Traders can choose from various SMA periods, including 10-period, 50-period, and 200-period SMAs. The choice of period determines how quickly the SMA responds to price changes and offers a distinct perspective on market trends.

- 10-Period SMA: This short-term SMA reacts rapidly to price fluctuations, making it well-suited for identifying immediate market shifts. Traders employing this period are more focused on short-term trends and are likely to make quicker trading decisions.

- 50-Period SMA: The 50-period SMA strikes a balance between short and long-term trends. It provides a moderately smoothed view of price movements, allowing traders to identify medium-term trends with a bit more stability than the 10-period SMA.

- 200-Period SMA: For those with a long-term perspective, the 200-period SMA is the go-to choice. It offers a broader view of the market, filtering out much of the short-term noise. This makes it ideal for capturing long-term trends, helping traders identify significant market shifts over extended periods.

Different SMAs, Different Trends

Each SMA period highlights a specific aspect of the market’s behaviour:

- Short-term SMAs (e.g., 10-period): These respond swiftly to short-lived price changes. Traders using short-term SMAs aim to capture quick, often smaller, price movements. It’s like having a magnifying glass to spot intricate details in the market’s immediate behaviour.

- Long-term SMAs (e.g., 200-period): Long-term SMAs are the patient observers of the market. They provide a more stable and less erratic view of price movements, emphasizing the broader, sustained trends. Using a long-term SMA is akin to stepping back for a panoramic view of the landscape, revealing the grandeur of significant market shifts.

Multiple SMAs on a Chart

Forex traders frequently employ multiple SMAs simultaneously to gain a comprehensive understanding of the market. By plotting different SMAs on their charts, such as 10, 50, and 200-period SMAs, they can visually compare short-term and long-term trends. This approach enhances decision-making by providing a layered perspective:

- Short-term SMAs quickly respond to price changes, offering insights into immediate market shifts.

- Medium-term SMAs (e.g., 50-period) offer a balanced view, capturing trends that last several weeks or months.

- Long-term SMAs (e.g., 200-period) reveal the overarching, enduring trends that span years.

Comparing these SMAs helps traders make informed decisions, especially when the signals from multiple periods align, strengthening the conviction behind a particular trade. It’s like having a toolkit with different tools for different tasks, ensuring you’re well-equipped to tackle the complexities of the Forex market.

The SMA Crossover Strategy

SMA crossovers are a widely embraced trading strategy, known for their simplicity and effectiveness. They revolve around the interaction of two Simple Moving Averages (SMAs) on a price chart, highlighting potential shifts in market trends. This strategy is a cornerstone for traders aiming to seize opportunities at crucial turning points in the market.

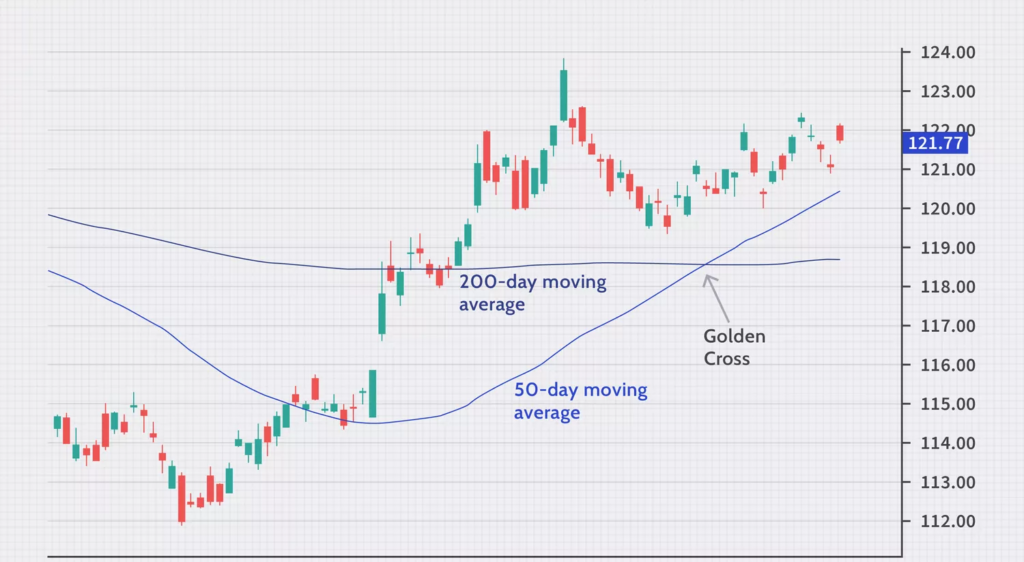

Golden Cross

A Golden Cross is one of the most recognisable and coveted signals in technical analysis. It unfolds when a short-term SMA (typically a 50-period SMA) gracefully glides above a longer-term SMA (usually a 200-period SMA). This event signifies a bullish trend reversal, indicating that the market sentiment is turning positive. It’s akin to a green light for traders, suggesting a potential buying opportunity is on the horizon.

Death Cross

Conversely, the Death Cross is a notable signal for traders looking to profit from bearish market movements. This occurs when the short-term SMA, once again usually the 50-period SMA, crosses beneath the long-term SMA, typically the 200-period SMA. The Death Cross serves as a red flag, indicating a bearish trend reversal and suggesting that market sentiment is turning negative. For traders, this can be an alert to consider selling positions or opening short positions.

Combining SMAs with Other Indicators

In Forex trading, relying solely on Simple Moving Averages (SMAs) may not suffice for effective decision-making. To enhance your trading accuracy and confidence, consider using SMAs in conjunction with other technical indicators. These complementary tools offer a more comprehensive perspective on market trends and potential entry points.

Commonly used indicators for this purpose include:

- Relative Strength Index (RSI): RSI assesses trend strength by measuring recent price changes. It identifies whether an asset is overbought or oversold and can help confirm the direction of a trend when used alongside SMAs.

- Moving Average Convergence Divergence (MACD): MACD is a versatile indicator that identifies trend changes, strength, and duration. When combined with SMAs, it provides more precise signals, especially for trend reversals.

- Stochastic Oscillator: This indicator measures a currency pair’s momentum by comparing its closing price to its trading range over a specific period. Incorporating the Stochastic Oscillator with SMAs assists traders in pinpointing entry and exit points more accurately.

Using SMA Crossovers for Entry

While SMA crossovers can be powerful signals on their own, it’s crucial to exercise caution and thorough analysis when executing trades. To enter a trade based on a Golden Cross (50-period SMA crossing above the 200-period SMA), consider the following steps:

- Confirmation of the Golden Cross: Ensure that the crossover is valid and not a temporary blip on the chart. Look for a sustained separation between the SMAs to confirm the strength of the signal.

- Additional Indicators: As mentioned earlier, incorporate other technical indicators (such as RSI or MACD) to corroborate the upward trend. This multi-indicator approach adds an extra layer of confidence to your decision.

- Risk Management: Implement sound risk management practices by setting stop-loss orders to limit potential losses and take-profit orders to secure profits. Calculate your position size based on your risk tolerance and use risk-to-reward ratios to determine whether the trade is worth pursuing.

- Market Context: Consider the broader market context, including economic events, news releases, and geopolitical factors that may influence the currency pair you’re trading. These external factors can impact the success of your trade.

- Entry Timing: Wait for an opportune moment to enter the trade. It’s advisable to wait for a pullback or a retest of the moving averages to confirm the trend’s stability before entering.

- Continuous Monitoring: After entering the trade, keep a watchful eye on it. Adjust your stop-loss and take-profit levels as the trade progresses and stay informed about any developments that may affect your position.

In conclusion, Simple Moving Average crossovers provide a straightforward and effective strategy for beginners in Forex trading. Their simplicity makes them an ideal starting point for those new to the market. Remember to trade cautiously, continuously learn, and never stop exploring new strategies.

Summary:

- SMAs average an asset’s closing prices over a specific time frame to reveal trends.

- Traders can choose from various SMA periods and combining them offers a comprehensive view of trends.

- SMA crossovers like the Golden Cross (bullish) and Death Cross (bearish) are popular, providing straightforward signals.

- To enhance accuracy, combine SMAs with indicators like RSI, MACD, and the Stochastic Oscillator.

- For entry, confirm crossovers, use additional indicators, practice risk management, consider market context, time your entry, and monitor trades closely.