On Wednesday, the stock market showed mixed outcomes, with the Dow Jones and S&P 500 making slight gains, while the Nasdaq Composite faced a decline, influenced by anxiously awaited Nvidia earnings and Federal Reserve insights. Nvidia’s stock dipped ahead of its fiscal report, reflecting investor concerns over its valuation after a significant year-long surge. The market also reacted to Palo Alto Networks’ and SolarEdge Technologies’ disappointing forecasts, alongside the Fed’s minutes indicating a cautious stance on interest rate cuts, emphasizing inflation control. Currency markets saw fluctuations, with the dollar index falling amidst complex global yield dynamics and central bank policies, highlighting the intricate interplay between economic signals, corporate earnings, and monetary policy expectations.

Stock Market Updates

The stock market experienced mixed results on Wednesday, with the Dow Jones Industrial Average slightly gaining by 48.44 points to close at 38,612.24 and the S&P 500 also up by 0.13% at 4,981.80. In contrast, the tech-heavy Nasdaq Composite fell by 0.32%, continuing its downward trend for the third consecutive session, to end at 15,580.87. The market’s attention was particularly focused on Nvidia, ahead of its fiscal fourth-quarter earnings report, amidst growing concerns over the chipmaker’s valuation after its shares surged nearly 230% over the past year. On the day, Nvidia’s stock declined by 2.85%, reflecting investor apprehension about whether it could continue to buoy the market amidst a backdrop of uncertain catalysts for growth.

Market sentiment was further influenced by a combination of corporate news and insights from the Federal Reserve. Palo Alto Networks saw a significant drop of 28.4% after revising its full-year revenue forecast downwards, while SolarEdge Technologies also faced a setback, with its shares falling approximately 12.2% due to weak first-quarter guidance. Adding to the cautious market outlook, minutes from the Federal Reserve’s January meeting revealed a reluctance to cut interest rates anytime soon, emphasizing that any decisions on rate cuts would require greater confidence in the slowing down of inflation. This stance underscores the central bank’s cautious approach to navigating economic signals, leaving the market to look towards corporate earnings and guidance as potential catalysts for future growth.

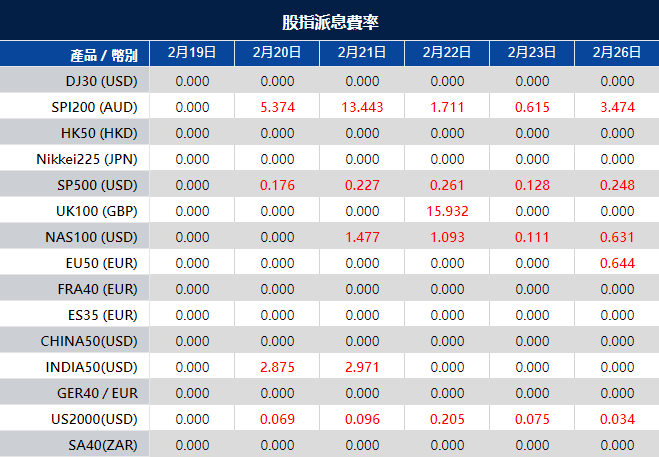

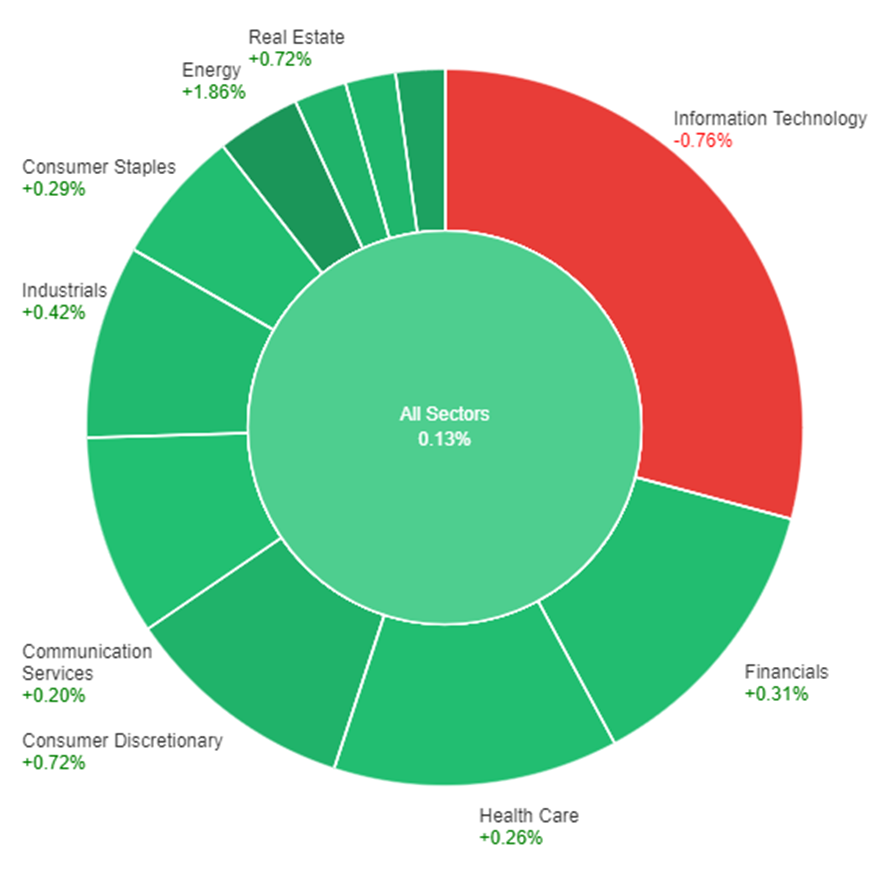

Data by Bloomberg

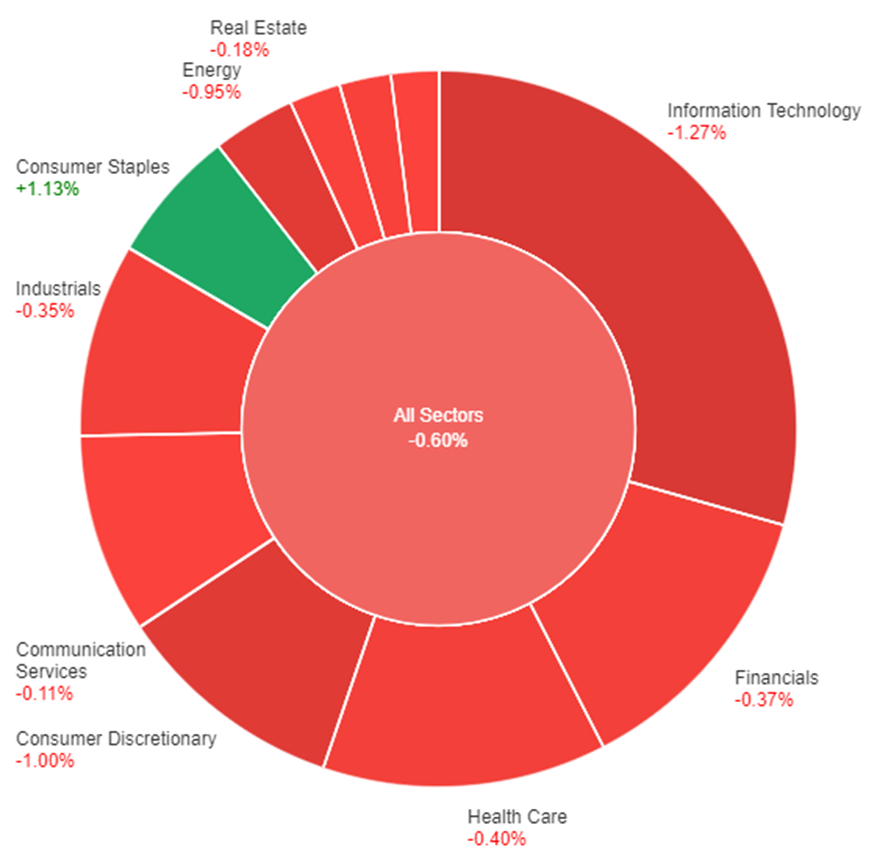

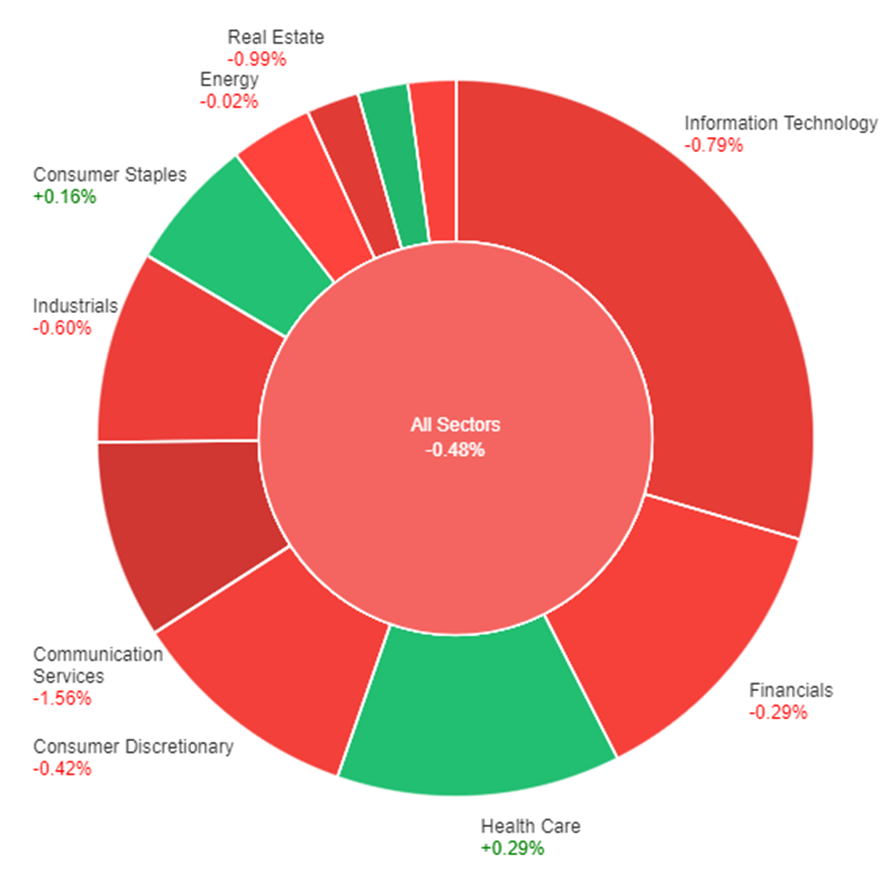

On Wednesday, the market witnessed modest gains across most sectors, with the overall sectors index up by 0.13%. The energy sector led the charge, recording a significant increase of 1.86%, followed closely by utilities, which saw a 1.36% rise. Consumer discretionary and real estate sectors both enjoyed gains of 0.72%, demonstrating a healthy appetite for risk among investors. Other sectors such as materials, industrials, financials, consumer staples, health care, and communication services also experienced growth, albeit at a more moderate pace. However, the information technology sector bucked the positive trend, facing a downturn of 0.76%, indicating sector-specific challenges or profit-taking by investors.

Currency Market Updates

The currency market experienced notable fluctuations, with the dollar index declining by 0.9% amid a complex interplay of treasury yields and central bank policies. The increase in Treasury yields, although outpaced by European yields, failed to keep up with the steadiness of Japanese Government Bond (JGB) yields. This dynamic, alongside the diminishing likelihood of interest rate cuts by major central banks such as the Federal Reserve (Fed), the European Central Bank (ECB), and the Bank of England (BoE), exerted pressure on risk appetite. The anticipation surrounding the Federal Reserve’s minutes and Nvidia’s report further influenced market sentiments. Despite the anticipation, the Fed minutes merely echoed previous statements and comments, offering no new impetus for dollar strength. Meanwhile, the USD/JPY pair saw a slight increase, attributed to the static nature of JGB yields which made the yen less attractive compared to its higher-yielding counterparts.

In Europe, the ECB’s stance, as articulated by Pierre Wunsch, suggested a prolonged period of tight monetary policy, given the persistent wage pressures and tight labor markets. This position was mirrored by the market’s adjustment in expectations for rate cuts, with the first ECB rate reduction now fully priced in for June. The euro found some support against the dollar, benefiting from a tightening in the 2-year bund-Treasury yield spreads. However, the recovery of the EUR/USD pair was tempered by technical resistance and a cautious outlook for the BoE’s policy direction, which also impacted the GBP/USD pair. The British pound struggled against the backdrop of rising Gilts-Treasury yield spreads and comments from BoE officials emphasizing the cost of delayed rate adjustments. These developments underscore the intricate balance of yield dynamics, central bank policies, and economic indicators shaping the currency markets, with implications for the path of the dollar and its major counterparts.

Picks of the Day Analysis

EUR/USD (4 Hours)

EUR/USD Stabilizes Amid Speculations of Fed Rate Cuts

The EUR/USD pair exhibited slight fluctuations, stabilizing around the 1.0800 mark, amidst a backdrop of uncertain US dollar movements and anticipations of Federal Reserve interest rate adjustments. This period of inconclusive price action follows a recent surge to 1.0840, driven by speculations and marginal gains in US bond yields, hinting at possible Fed rate cuts later in the year. Market probabilities lean towards a rate reduction by the Fed, with a 30% chance in May, escalating to 53% in June. Concurrently, the European Central Bank (ECB) faces its rate decision pressures, amidst improved consumer confidence in the Eurozone and ongoing discussions on monetary easing, setting a complex stage for the EUR/USD dynamics as both regions navigate through inflationary pressures and economic forecasts.

On Wednesday, the EUR/USD moved higher and was able to reach near the upper band of the Bollinger Bands. Currently, the price is moving just below the upper band, suggesting a potential upward movement to reach the upper band. Notably, the Relative Strength Index (RSI) maintains its position at 65, signaling a bullish outlook for this currency pair.

Resistance: 1.0845, 1.0896

Support: 1.0783, 1.0723

XAU/USD (4 Hours)

XAU/USD Trajectory Amidst Dollar Strength and Anticipation of FOMC Minutes

As the US Dollar gained momentum with Wall Street’s opening and before the release of the Federal Open Market Committee (FOMC) Minutes, gold prices (XAU/USD) were influenced by a complex interplay of factors. The anticipation surrounding the FOMC minutes, detailing reasons for holding interest rates steady in early 2024, and Chairman Jerome Powell’s remarks on the unlikelihood of a March rate cut, set a cautious tone in the market. Despite recent employment and inflation data backing the Federal Reserve’s wait-and-see approach, shifting rate-cut expectations to June from May, the overall mixed performance of the dollar amidst a lackluster risk appetite and struggling global equities highlights a potentially volatile environment for gold as investors digest these economic cues.

On Wednesday, XAU/USD moved back lower to reach the middle band after reaching near the upper band of the Bollinger Bands. Currently, the price is moving just above the middle band, suggesting a potential upward movement toward the upper band. The Relative Strength Index (RSI) stands at 58, signaling a neutral with a slightly bullish outlook for this pair.

Resistance: $2,030, $2,042

Support: $2,017, $2,004

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| EUR | French Flash Manufacturing PMI | 16:15 | 43.5 |

| EUR | French Flash Services PMI | 16:15 | 45.7 |

| EUR | German Flash Manufacturing PMI | 16:30 | 46.1 |

| EUR | German Flash Services PMI | 16:30 | 48.0 |

| GBP | Flash Manufacturing PMI | 17:30 | 47.5 |

| GBP | Flash Services PMI | 17:30 | 54.2 |

| USD | Unemployment Claims | 21:30 | 217K |

| USD | Flash Manufacturing PMI | 22:45 | 50.5 |

| USD | Flash Services PMI | 22:45 | 52.4 |