Tips and tricks on how to increase your trading win rate

Every trader enters the financial market with dreams of massive gains, inspired by stories of professional traders making fortunes like a degen.

But here’s a question: do these traders win all the time? The simple answer is no.

Even the best in the business have win rates of only about 50% to 55%.

Embracing losses

In trading, just like in sports, it’s not about winning every single time.

It’s important to realise that losses are part of the game, even for the pros. So, successful trading isn’t about never losing—it’s about making sure your wins outpace your losses.

But how exactly can a trading strategy give you an edge, and what win rate do profitable traders actually achieve?

Balancing your win rate with a good reward-to-risk ratio

Risk-Reward Ratio = Potential Profit / Potential Loss

Believe it or not, professional traders don’t win every trade. Yet, they still manage to rake in significant returns. If you know how to manage your risk, you can achieve consistent profits with a win rate as low as 30% to 50%.

Understanding win rates

So, what’s a win rate? It’s simply the number of successful trades divided by the total number of trades, expressed as a percentage.

For example, a 50% win rate means you win half of your trades.

Many traders get fixated on their win rate because, naturally, everyone wants to be right all the time. But even top athletes like Lionel Messi in football or Maximilian Günther in Formula E racing don’t win every point.

Pay close attention to your reward-to-risk ratio, aiming for scenarios where the potential reward significantly outweighs the risk.

Imagine this: if you win 5 out of 10 trades, your win rate is 50%.

If those 5 wins earn you $1,000 and your 5 losses cost you $500, you still come out ahead with a net profit of $500.

This shows how even a 50% win rate can be quite profitable.

For a deeper understanding on reward and win rates, see this: Forex risk: reward and win rates

Risk management plays a huge role here. Professional traders are masters at managing their risk. They use strategies like setting stop-loss orders to limit potential losses and take-profit orders to lock in gains.

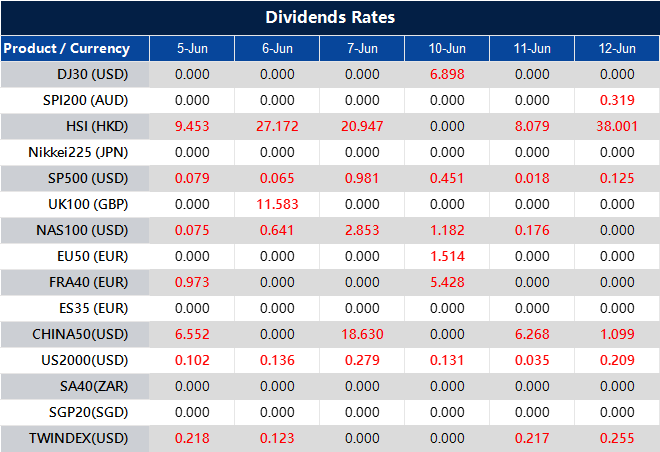

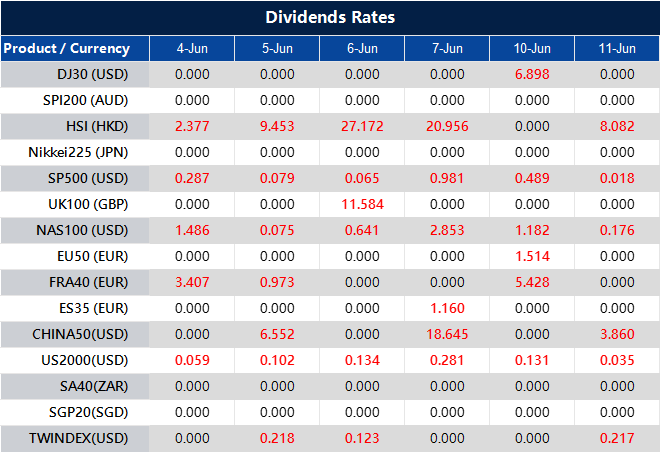

Source: VT Markets

George Soros, a legendary trader, once said:

“It’s not whether you’re right or wrong, but how much money you make when you’re right and how much you lose when you’re wrong.”

In a nutshell…what does all this mean for you?

It means that being right half the time can lead to substantial profits if you manage your risk and develop a solid strategy with a favourable reward-to-risk ratio.

Not every trade will be a winner, but with smart risk management, your profitable trades can cover your losses and still leave you with an overall gain.

So, remember, it’s not about winning every trade—it’s about making your wins count more than your losses.This will pay off in the long run. With this mindset, you’re on your way to a successful trading journey.

Also, practice makes perfect. Need to backtest your trading strategy?