Opening A Forex Trading Account in Hong Kong

Opening a forex trading account in Hong Kong presents an exciting opportunity to access one of the world’s largest financial hubs. Known for its strategic location and strong regulatory environment, Hong Kong is a top destination for forex traders seeking access to global markets. However, starting your forex trading journey requires thoughtful planning and a good understanding of the essential steps involved in setting up your account. This guide walks you through everything you need to know to open a successful forex trading account in Hong Kong.

1. Choose a Reputable and Regulated Broker

Your first step is selecting a trustworthy forex broker. In Hong Kong, it’s important to choose a broker that is regulated by authorities such as the Australian Securities and Investments Commission (ASIC). A regulated broker ensures your funds are protected and that you’re trading in a safe, transparent environment.

Key considerations when choosing a broker:

- Segregated Accounts: Make sure the broker keeps client funds separate from its own, ensuring your money is safe.

- Low Spreads and Transparent Fees: Look for brokers that offer competitive spreads and clear pricing structures to avoid hidden costs.

- Reliable Trading Platforms: Ensure the broker offers platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5), which are known for their ease of use and advanced trading tools.

Example: Brokers like VT Markets, regulated by ASIC, provide a secure trading environment and advanced tools, even though they are not regulated by the SFC in Hong Kong.

2. Understand Account Types and Minimum Deposits

Brokers offer a variety of account types, depending on your experience level and available capital. As a beginner, you might start with a standard account, which usually requires a lower minimum deposit. More experienced traders might prefer a professional account with tighter spreads but higher deposit requirements.

Common account types:

- Standard Account: Ideal for beginners, often with a minimum deposit starting from $100.

- ECN Account: Offers direct market access with lower spreads, but typically requires a higher deposit (around $1,000).

- Demo Account: Practice with virtual funds before risking real money.

- Cent Account: Suitable for those with smaller capital. Your deposit is converted into cents, allowing you to trade micro-lots and test strategies with minimal risk.

- Islamic Account: A swap-free account for traders who follow Sharia law, ensuring no interest is charged on overnight positions.

Tip: Start with a demo account to get comfortable with the platform and practice your strategies without risking real capital.

3. Verify Trading Costs and Fees

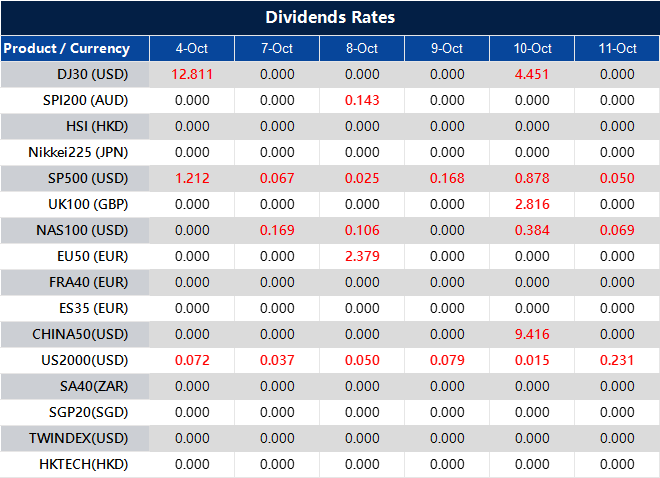

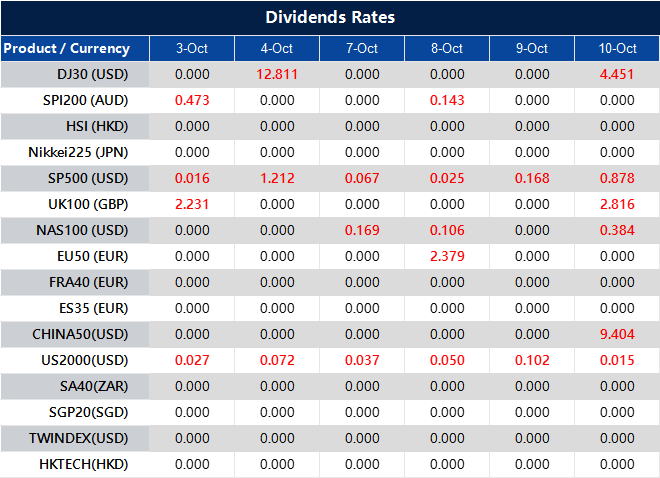

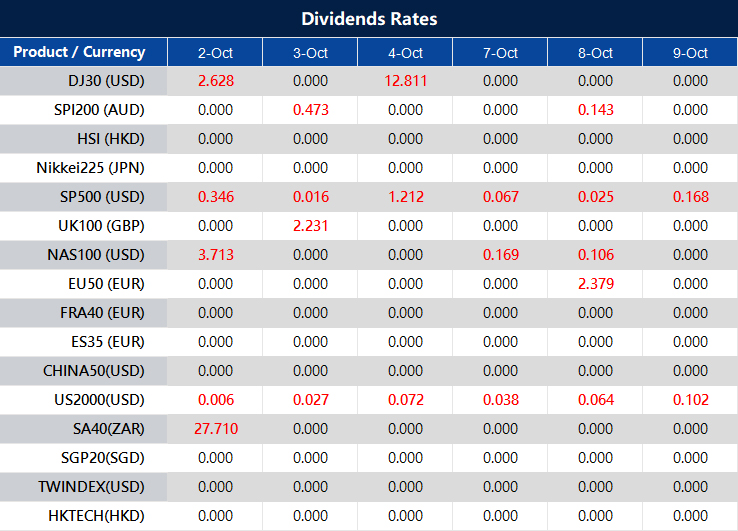

Understanding the costs of trading is key to maximizing your profitability. Trading costs can include spreads, commissions, and swap fees.

Types of trading costs to be aware of:

- Spreads: This is the difference between the bid and ask price. Look for brokers offering low spreads, especially if you plan to trade frequently.

- Commissions: Some brokers charge a flat fee per trade in addition to the spread.

- Swap Fees: These are charged for holding positions overnight, particularly important for long-term traders.

Example: VT Markets offers commission-free trading on standard accounts, which makes it appealing for beginners looking to minimize costs.

4. Leverage and Margin: Use with Caution

Leverage allows you to control larger trades with a smaller amount of capital, but it comes with increased risk. In Hong Kong, many brokers offer leverage up to 1:100 or more, but it’s essential for beginners to use this feature carefully.

Tips for managing leverage:

- Start small: Use low leverage, such as 1:10, to minimize your risk as you become familiar with the market.

- Calculate margin requirements: Ensure you have enough funds in your account to avoid a margin call, which happens when your balance falls below the required minimum.

Pro Tip: Always set stop-loss orders to limit potential losses when using leverage.

5. Prepare Your Documentation for Account Setup

To comply with Know Your Customer (KYC) regulations, brokers in Hong Kong require specific documents to verify your identity. Having these documents ready can speed up the account approval process.

Commonly required documents:

- Proof of Identity: Such as a passport or national ID card.

- Proof of Address: Utility bills, bank statements, or rental agreements.

- Financial Information: Some accounts, especially higher-tier ones, may require proof of income or assets.

Ensure your documents are up-to-date and match the information provided during registration.

6. Utilize Educational Resources and Support

Forex trading can be complex, but most brokers offer educational resources to help you learn the ropes.

Look for brokers that provide:

- Webinars and tutorials on basic and advanced trading strategies.

- Market analysis and insights to stay updated on currency trends and events.

- Customer support available 24/5 to help with account or platform issues.

For instance, VT Markets offers free educational resources, live webinars, and daily market updates to keep traders informed.

7. Practice Risk Management

Effective risk management is critical to long-term success in forex trading. Even experienced traders face losses, but well-managed risk can help protect your capital.

Key risk management tools:

- Stop-Loss Orders: Automatically closes a trade when your losses reach a predetermined level.

- Take-Profit Orders: Locks in profits when the price reaches your target level.

- Position Sizing: Avoid risking more than 1-2% of your account balance on a single trade.

Practicing disciplined risk management will help you avoid significant losses and protect your capital.

8. Stay Informed About Market Conditions

The forex market is influenced by economic events, geopolitical factors, and central bank policies. Staying informed about market conditions will help you make better trading decisions.

Key sources of information:

- Economic calendars: Track important events like interest rate decisions and employment reports.

- Real-time news: Stay updated on major market developments.

Most brokers, including VT Markets, provide tools like economic calendars and real-time news feeds to keep you informed.

9. Ease of Use for Beginners

A user-friendly platform is essential for new traders. Look for brokers that offer intuitive platforms with simple navigation, clear tools, and educational resources.

Example: VT Markets provides a beginner-friendly platform that is easy to use while offering advanced features for experienced traders. A responsive trading platform with quick execution times is crucial for a smooth trading experience.

10. Forex Trading Apps for Trading on the Go

In today’s fast-paced world, being able to trade while on the go is essential for many traders. Most brokers, including VT Markets, we offer Forex trading app that allow you to access real-time data, execute trades instantly, and manage your portfolio no matter where you are. These apps are equipped with advanced charting tools, price alerts, and account management features, ensuring that you never miss a trading opportunity, even when away from your computer.

With mobile apps, you can monitor market movements in real-time, set stop-loss orders, and even access educational content directly through your phone or tablet. For traders in Hong Kong, having a mobile trading app adds flexibility and convenience, allowing you to take advantage of global market opportunities whenever they arise.

Conclusion: Opening a Forex Trading Account in Hong Kong

Opening a forex trading account in Hong Kong is your gateway to accessing global markets through one of the world’s top financial hubs. By choosing a reputable and regulated broker, understanding account types, managing trading costs, and practicing sound risk management, you’ll set yourself up for success. Taking advantage of educational resources, mobile trading apps, and staying informed on market trends will further support your trading journey.

For traders looking to optimize their experience, brokers like VT Markets offer a comprehensive suite of tools and resources, including competitive spreads, various account types, and the Active Trader Program. Whether you’re a beginner or an experienced trader, opening a forex account in Hong Kong with the right broker will ensure you trade confidently and efficiently.