Beginners Day Trading Forex in Hong Kong

Day trading Forex is one of the most popular and fast-paced trading methods globally, and Hong Kong offers a unique environment for beginners to get started. With a well-regulated market, robust platforms like those provided by VT Markets, and the availability of advanced tools, starting your day trading journey in Hong Kong is more accessible than ever. This guide will walk you through how beginners can successfully start day trading Forex in Hong Kong while managing risks and maximizing opportunities.

Understanding Day Trading in Forex

Day trading involves buying and selling currency pairs within a single trading day to capitalize on short-term price movements. Unlike swing or position trading, day traders close all their positions by the end of the day to avoid overnight risk.

For beginners, day trading offers:

- Quick Results: Profits or losses are realized within the same trading day.

- Focused Strategy: Traders only monitor short-term price movements, making it less complex than long-term analysis.

- High Liquidity: Forex markets are highly liquid, particularly with major pairs like EUR/USD, USD/JPY, and GBP/USD.

However, day trading requires discipline, quick decision-making, and proper risk management.

Why Hong Kong is Ideal for Forex Day Trading

Hong Kong’s unique position as a global financial center offers several advantages for forex day traders:

- Regulated Market: Hong Kong’s reputation as a global financial hub attracts reputable brokers offering advanced platforms and competitive trading conditions.

- Time Zone Advantage: Hong Kong’s time zone overlaps with major trading sessions in Europe and the U.S., providing ample trading opportunities.

- No Capital Gains Tax: Forex trading profits in Hong Kong are not subject to capital gains tax, making it more attractive for beginners.

- Access to Advanced Platforms: Brokers like VT Markets provide tools such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5), enabling beginners to trade efficiently.

Benefits of Forex Day Trading for Beginners in Hong Kong

- Low Initial Investment: Forex brokers often allow traders to start with a small deposit, making it accessible for beginners.

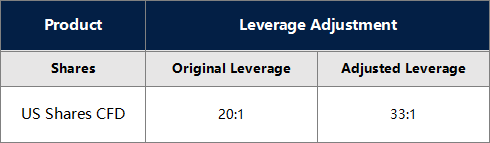

- Leverage Options: Brokers like VT Markets offer leverage, enabling traders to control larger positions with smaller capital.

- High Liquidity: The forex market operates 24/5, offering abundant trading opportunities.

- Learning Opportunities: Many brokers provide educational resources, webinars, and tutorials for beginners.

Risks and Challenges for Beginner Day Traders

- Market Volatility: While volatility creates opportunities, it also increases risk.

- Emotional Trading: Beginners may struggle with decision-making under pressure, leading to impulsive trades.

- Overtrading: Attempting too many trades in a day can lead to losses.

- Leverage Risks: While leverage amplifies profits, it also magnifies losses.

How to Mitigate Risks:

- Stick to a well-defined trading plan.

- Use risk management tools like stop-loss orders.

- Avoid over-leveraging your trades.

How Beginners Can Start Day Trading Forex in Hong Kong

1. Choose the Right Broker

Start by selecting a reputable broker like VT Markets. Key factors include:

- Regulation: Choose brokers that operate under top-tier global regulatory frameworks, providing transparency and fund security. VT Markets, for example, adheres to international standards to ensure a seamless trading experience.

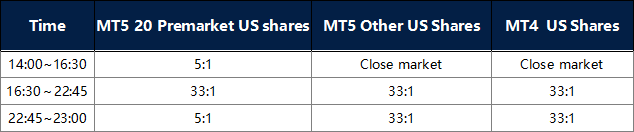

- Trading Platforms: Look for platforms such as MetaTrader 4 (MT4) or MetaTrader 5 (MT5), offering user-friendly interfaces and advanced charting tools.

Quick Tip: VT Markets provides a seamless trading experience with competitive spreads and access to demo accounts for beginners to practice without risk.

2. Use a Demo Account

Before investing real money, practice trading with a demo account. This helps beginners:

- Understand how to place trades and manage orders.

- Get comfortable with using leverage and understanding risk.

3. Learn the Basics of Forex Trading

Understanding fundamental concepts like currency pairs, pips, and spreads is essential. For example:

- Major Currency Pairs: Start with EUR/USD or GBP/USD as they have high liquidity and lower spreads.

- Leverage: Use low leverage to avoid significant losses as a beginner.

Glossary for Beginners:

- Pip: The smallest price movement in Forex.

- Leverage: Borrowed capital allowing you to control larger trades.

- Stop-Loss: An order that automatically closes a trade to minimize losses.

Why VT Markets is Ideal for Beginner Day Traders in Hong Kong

VT Markets stands out as an excellent choice for beginner day traders due to its:

- User-Friendly Platforms: Access to MT4, MT5, and the VT Markets App, equipped with advanced charting tools and intuitive interfaces.

- Demo Accounts: Practice trading with virtual funds to build confidence and refine strategies.

- Educational Support: Access webinars, tutorials, and market analysis to enhance your trading knowledge.

- Competitive Pricing: Enjoy tight spreads and low commissions, reducing trading costs for beginners.

Essential Tools and Platforms for Beginners

1. Trading Platforms

For beginner day traders in Hong Kong, platforms like MT4, MT5, and the VT Markets App offer:

- Advanced charting tools for technical analysis.

- Risk management features like stop-loss and take-profit orders.

- Mobile compatibility for trading on the go.

2. Economic Calendars

Stay updated on key events like interest rate announcements or employment reports. VT Markets integrates economic calendars into their platforms, helping traders plan ahead.

3. Technical Analysis Tools

Leverage tools like moving averages, Fibonacci retracements, and Bollinger Bands to analyze trends and make informed decisions.

Strategies for Beginner Day Traders

1. Start with One or Two Currency Pairs

Focus on highly liquid pairs like EUR/USD or USD/JPY. This reduces complexity and helps you learn market behavior more efficiently.

2. Use Trend-Following Strategies

Identify upward or downward trends using indicators like the Moving Average or Relative Strength Index (RSI). Enter trades in the direction of the trend to maximize your chances of success.

3. Set Clear Entry and Exit Points

Plan your trades ahead of time:

- Set stop-loss levels to limit potential losses.

- Use take-profit levels to lock in gains.

Quick Tip: Avoid overtrading; focus on quality trades rather than quantity.

Real-Life Example for Beginners

Let’s say a beginner in Hong Kong notices an upward trend in EUR/USD during the London-New York session overlap. By using MT5 on VT Markets, they:

- Open a demo account to practice entering trades at key support levels.

- Set a stop-loss order below a recent low to manage risk.

- Exit the trade when the price reaches a pre-set take-profit level based on technical indicators like Fibonacci retracements.

This practice builds confidence before trading with real money.

Risks and How to Mitigate Them

1. Market Volatility

Forex markets are volatile, especially during major news events. Mitigate this by:

- Staying updated with economic calendars.

- Avoiding trading during highly unpredictable times unless experienced.

2. Leverage Risks

While leverage amplifies profits, it also increases losses. Beginners should:

- Use minimal leverage (e.g., 10:1 or lower).

- Only trade with money they can afford to lose.

3. Emotional Trading

Fear and greed often lead to poor decisions. Develop a disciplined approach by sticking to your strategy and avoiding impulsive trades.

Additional FAQs for Beginner Day Traders in Hong Kong

What are the trading costs involved in Forex day trading?

Forex day trading costs include spreads, commissions, and overnight fees (if positions aren’t closed). VT Markets offers competitive spreads to minimize costs.

How can I stay updated with market news for day trading?

Use platforms like MT5, which integrate economic calendars and news feeds. VT Markets also provides market updates to keep traders informed.

Is Forex day trading profitable for beginners in Hong Kong?

Profitability depends on discipline, strategy, and risk management. Beginners can use VT Markets’ demo accounts to practice and build confidence.

How can I ensure my broker is trustworthy?

Look for brokers regulated by recognized international bodies, such as ASIC. VT Markets complies with stringent global standards to safeguard traders’ interests.

What timeframes should beginners focus on for day trading?

Start with 15-minute or hourly charts to identify trends and entry points. Shorter timeframes require faster decision-making.

Conclusion: Starting Your Forex Day Trading Journey in Hong Kong

Day trading Forex in Hong Kong offers immense opportunities for beginners, thanks to the city’s regulated environment and global market access. With platforms like VT Markets providing intuitive tools, competitive spreads, and robust support, getting started has never been easier. By focusing on risk management, practicing on demo accounts, and sticking to proven strategies, beginners can confidently navigate the dynamic Forex market.

Building Confidence with Small Trades

Starting with small trades helps beginners manage risk and build confidence. Use VT Markets’ demo account to practice and gradually move to live trades with minimal capital. Over time, scaling your trade size as you learn market patterns ensures a steady learning curve.