Market Focus

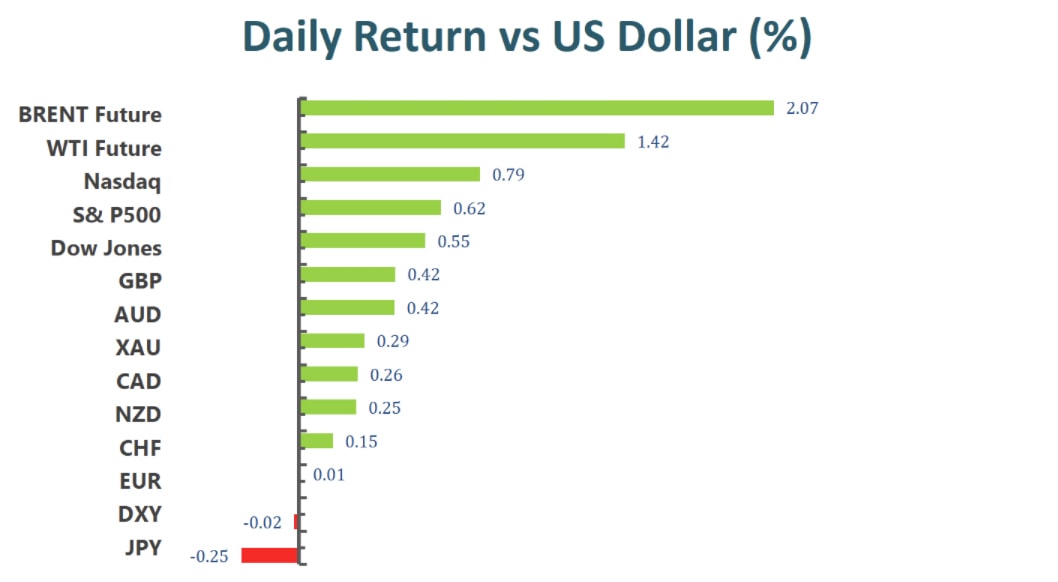

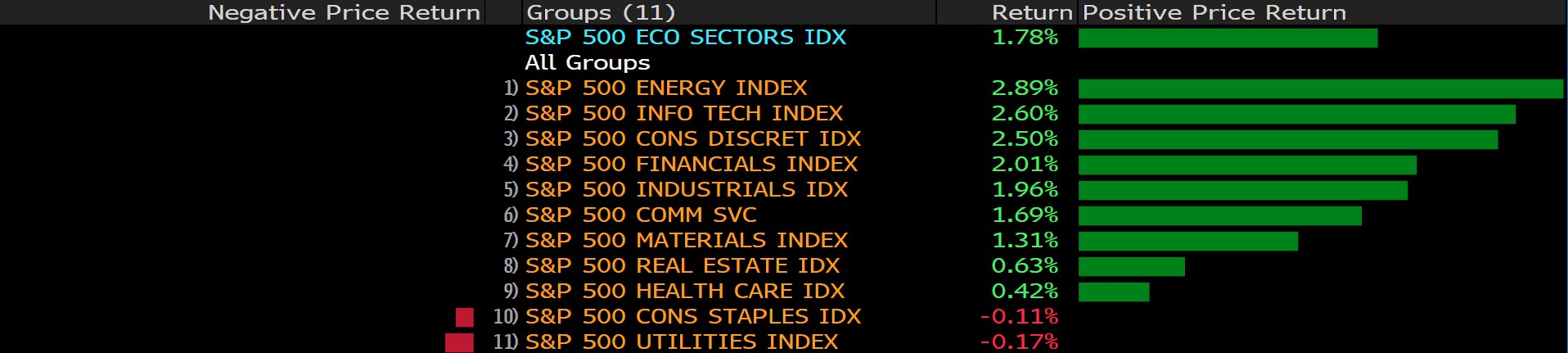

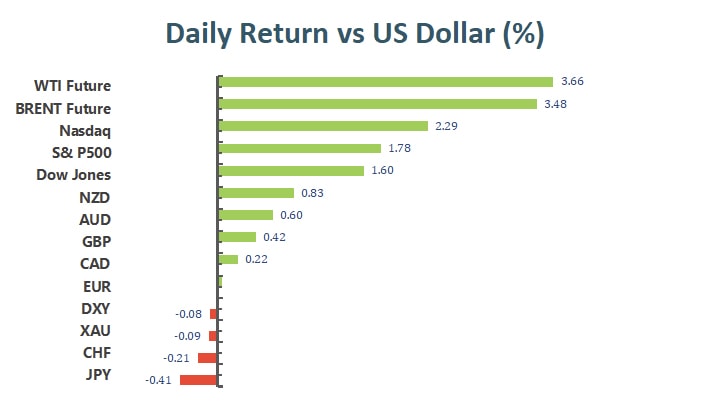

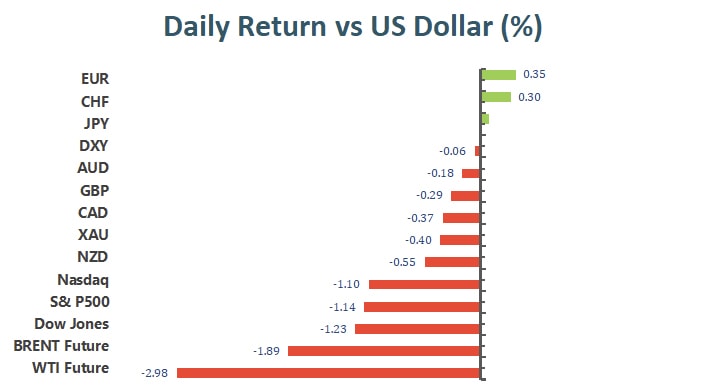

The broad U.S. equity markets closed lower on the last trading day of 2021. The Dow Jones Industrial Average dropped 0.16%, the S&P 500 lost 0..26%, while the Nasdaq lost 0.61%; despite losing ground on the last trading day, all three major indices ended the year with tremendous gains since the beginning of 2021—18.73%, 26.89%, and 21.39%, respectively.

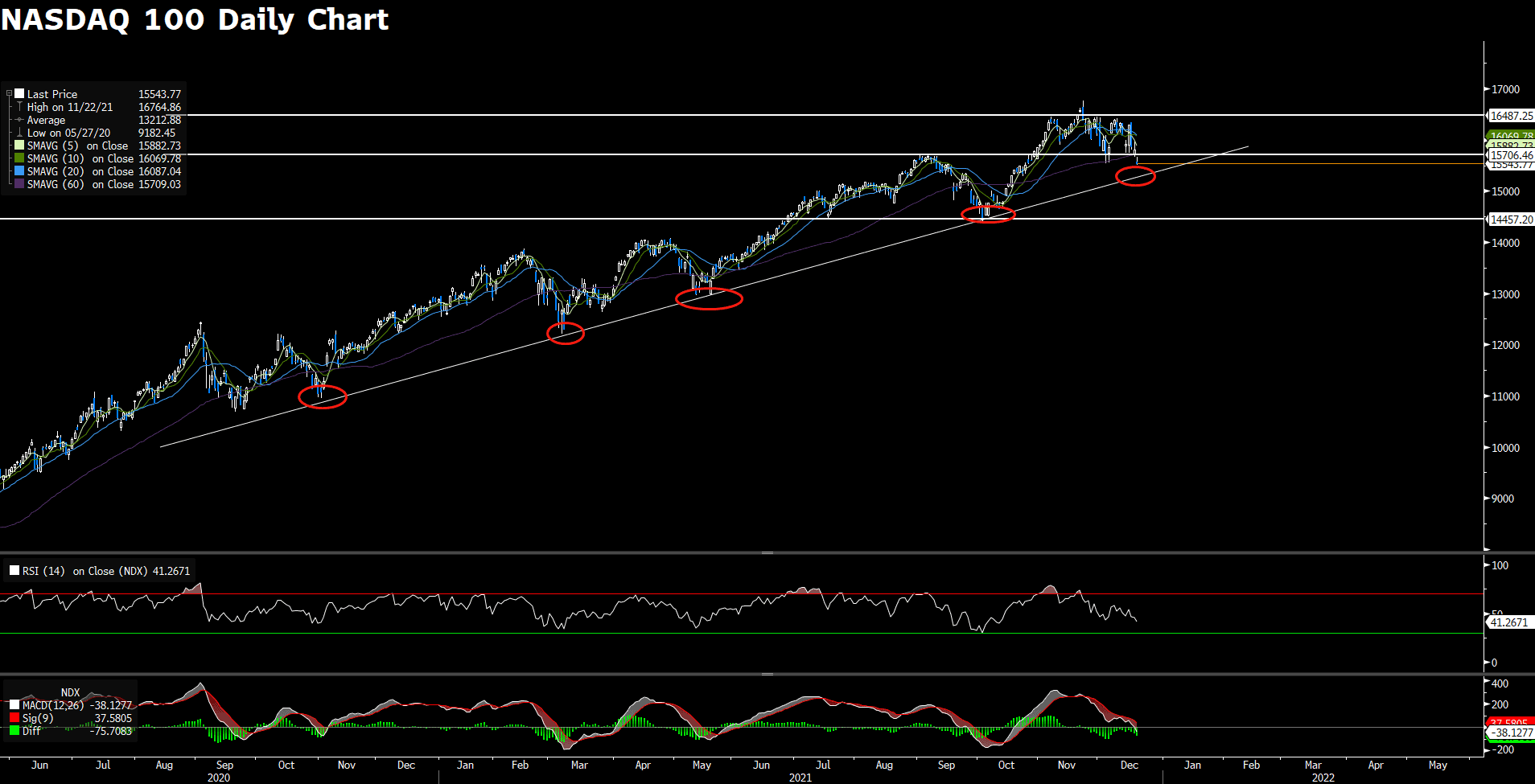

It remains to be seen if equity markets will perform as well as 2021 in 2022. Several challenges are already present. The planned rate hikes by the Federal Reserve will present tremendous pressure on the technology sector, while supply chain issues remain largely unsolved. On the bright side, multiple sources are projecting that COVID-19 will finally end in 2022 as the virus enters its final stage of mutation and begin to exhibit symptoms that are less life threatening and more in line with the flu.

Main Pairs Movement:

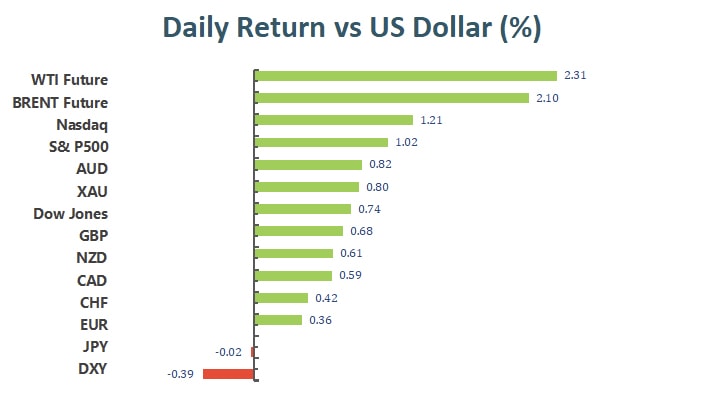

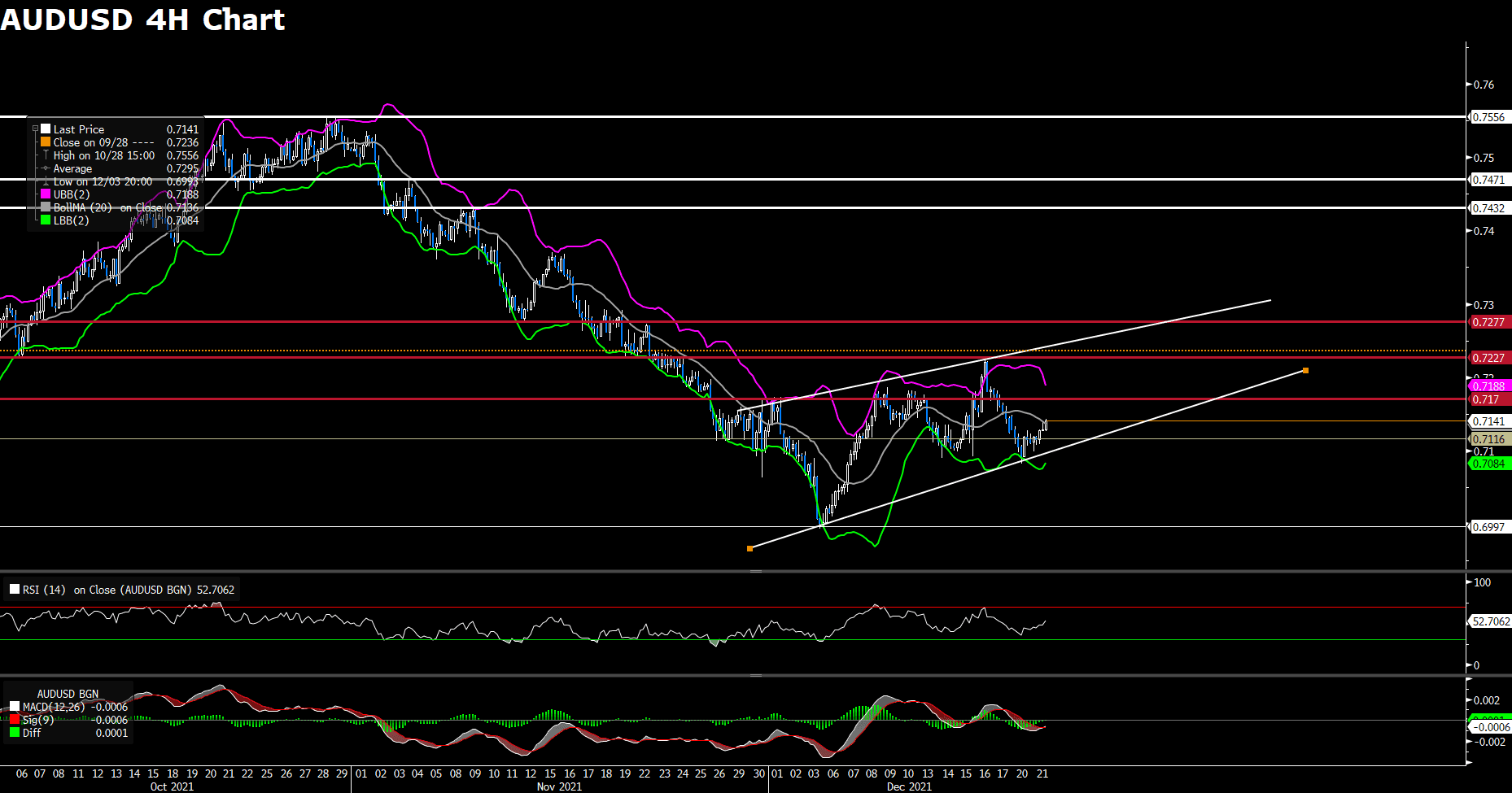

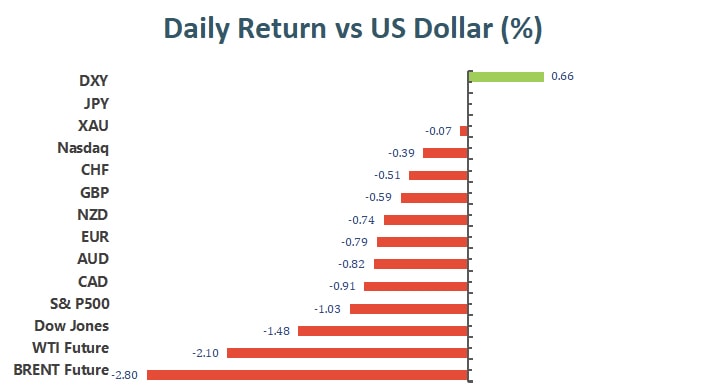

On Friday, the Greenback lost steam as U.S. equity markets retreated. The Dollar Index dropped 0.34%, against a basket of major currencies. As 2022 marks its arrival, so do rate hikes. The Federal Reserves’ plan of raising the Federal Funds Rate 3 times over the course of 2022 should see the Greenback more desirable over other major currencies.

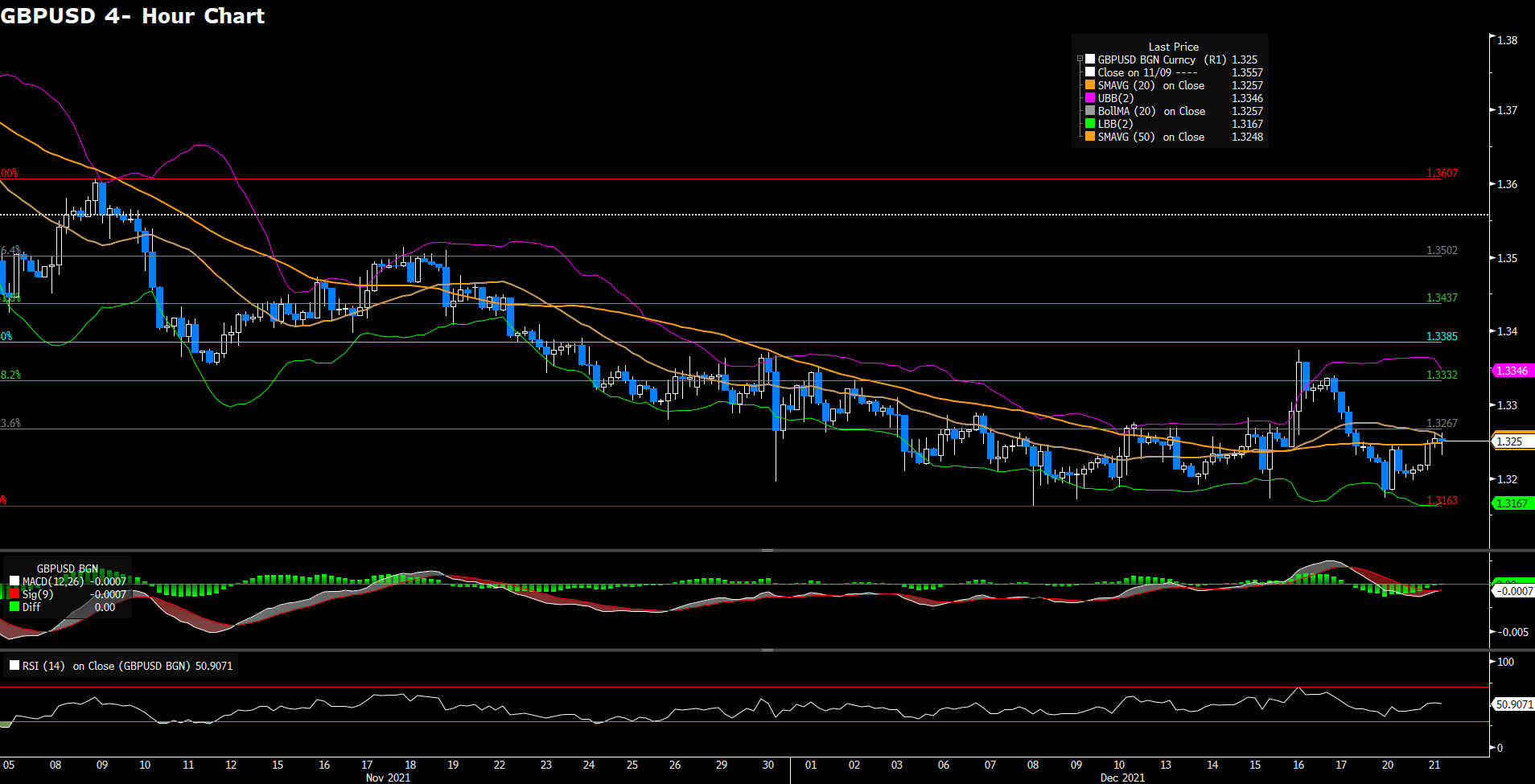

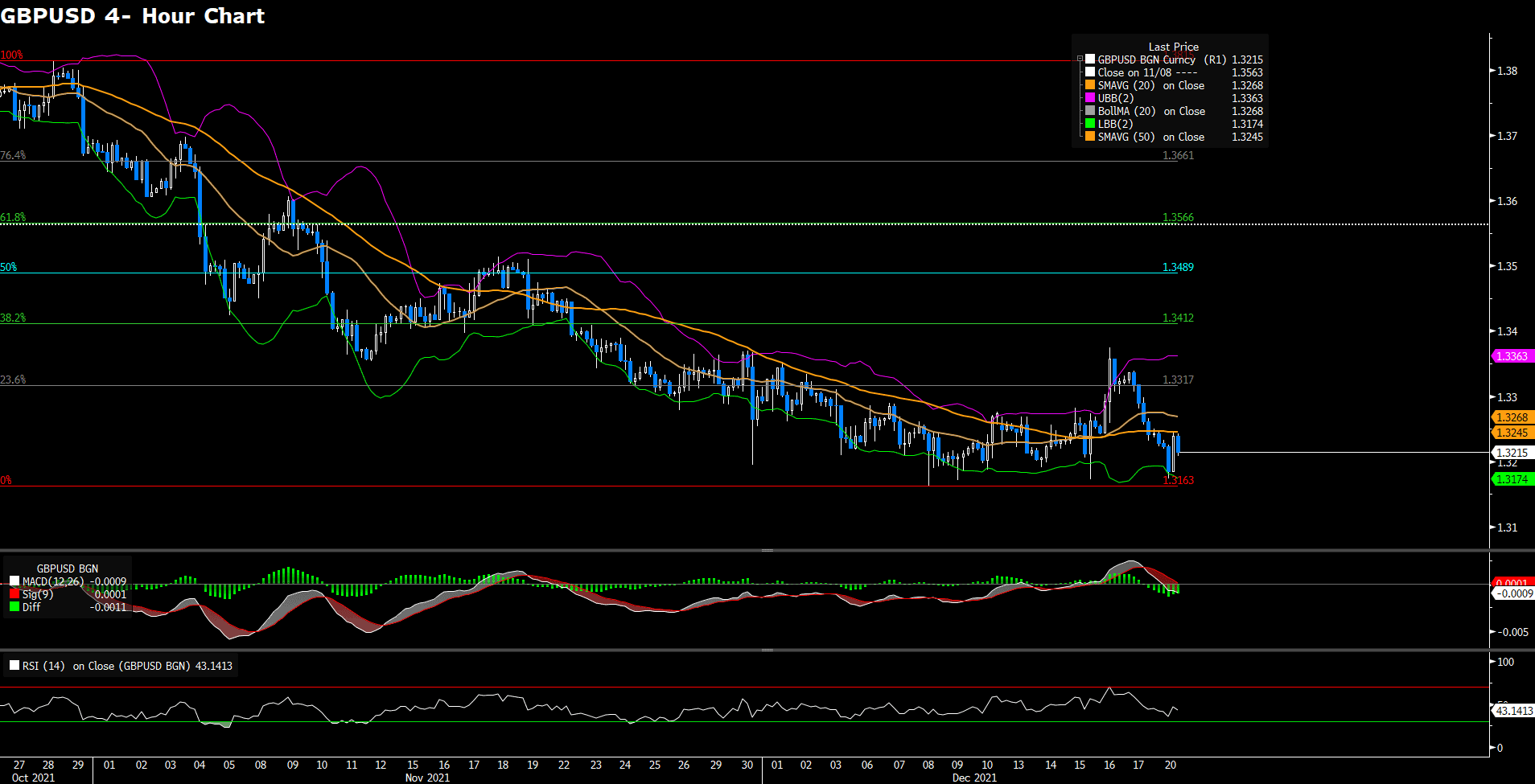

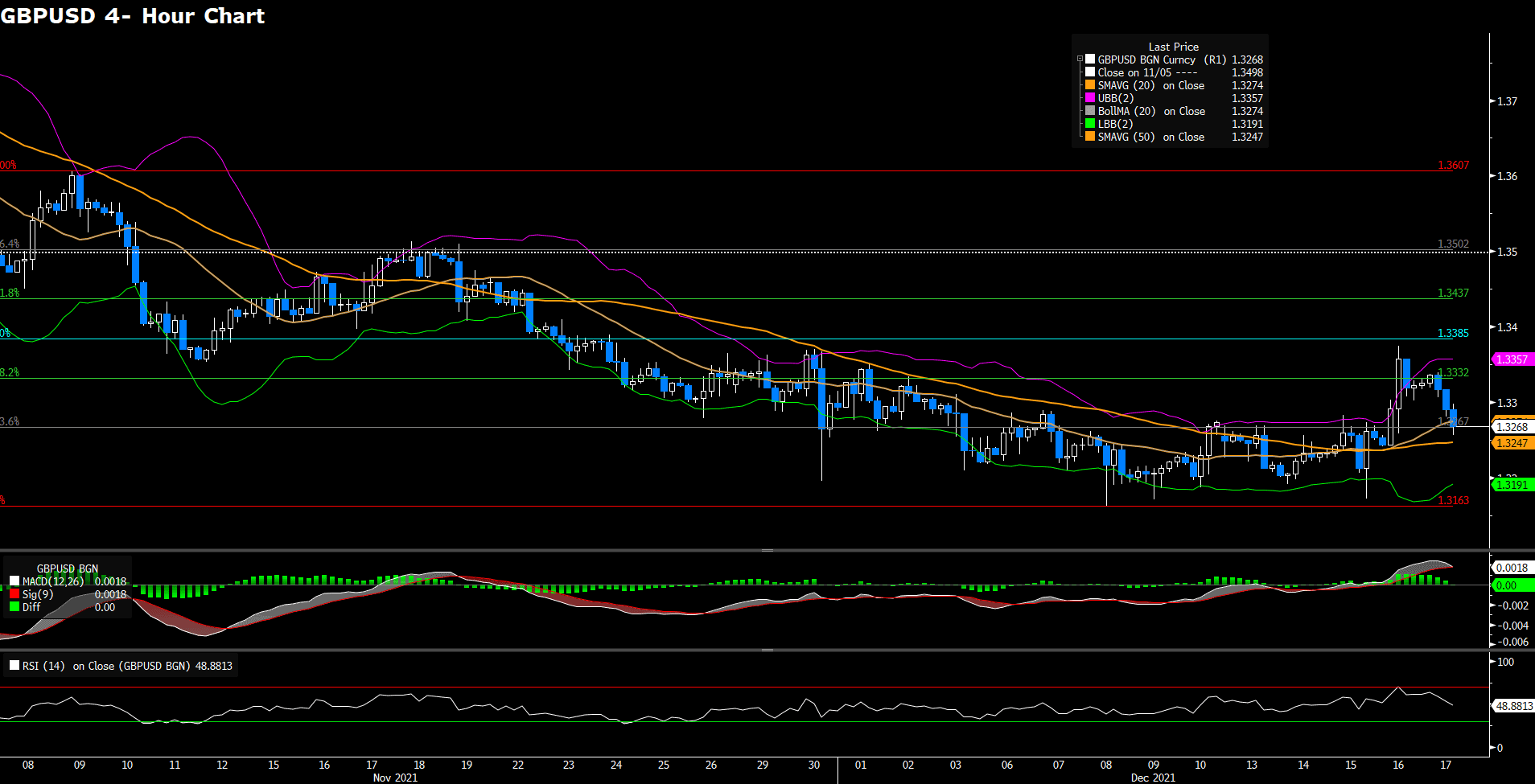

Cable experienced strong growth heading into 2022. The pair gained for the entire last week of 2021, and closed the year losing 1.08%. Falling U.S. treasury yields assisted the Sterling in gaining ground over the last month of 2021.

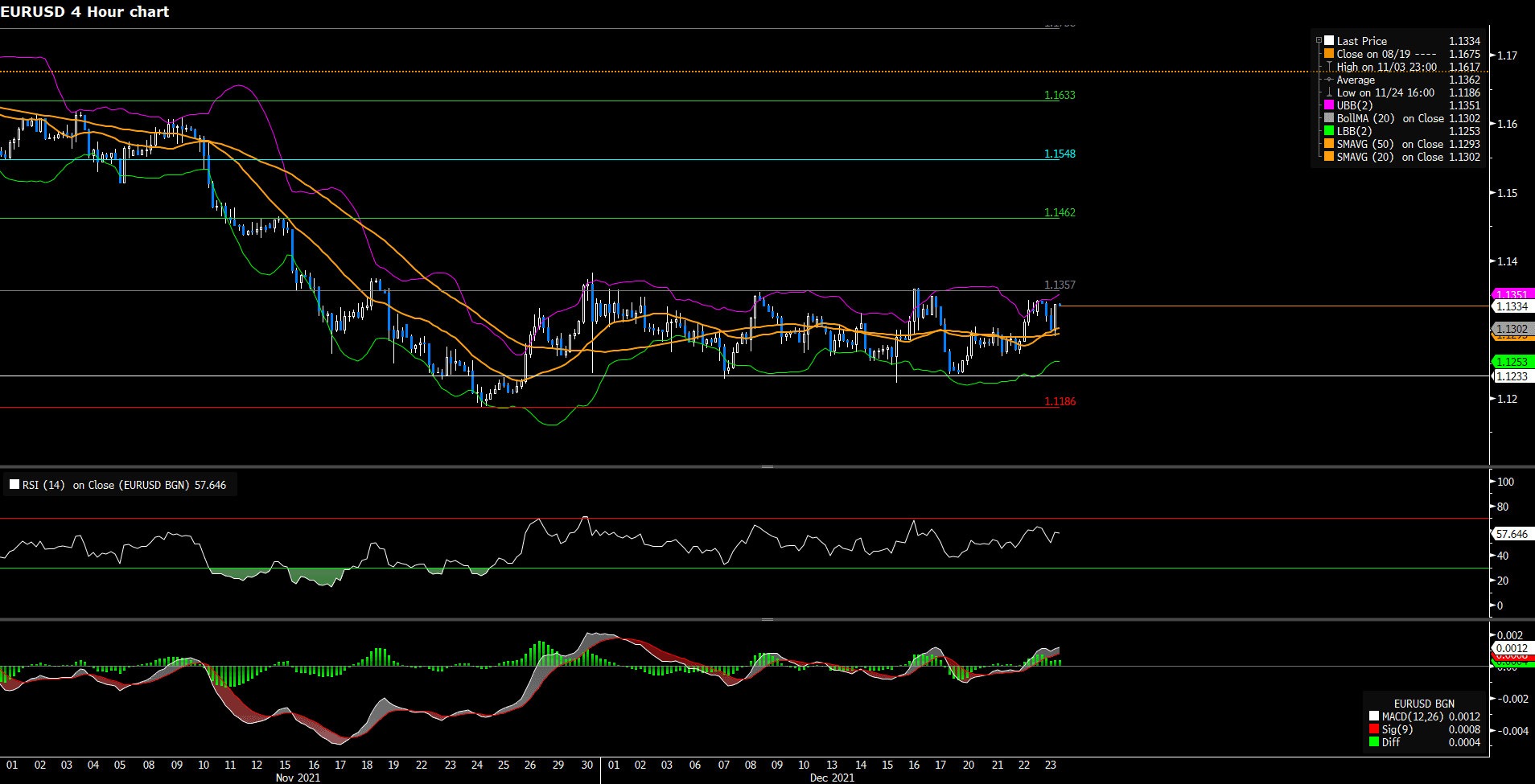

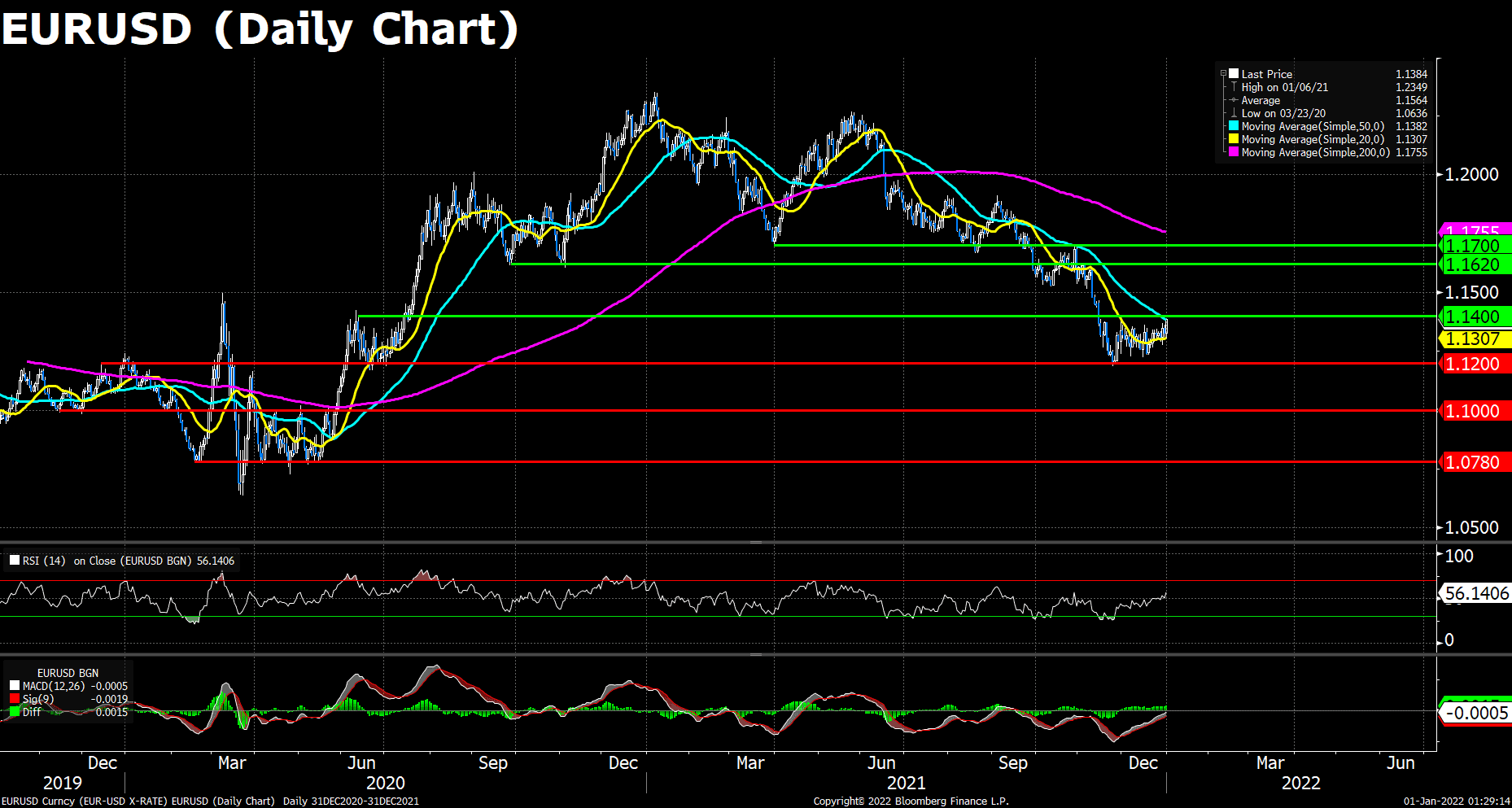

The Eurodollar closed the year losing 0.03%. The ECB’s dovish attitude and its unwillingness to increase interest rates will present Euro with tremendous challenges as we head into a rate increase environment.

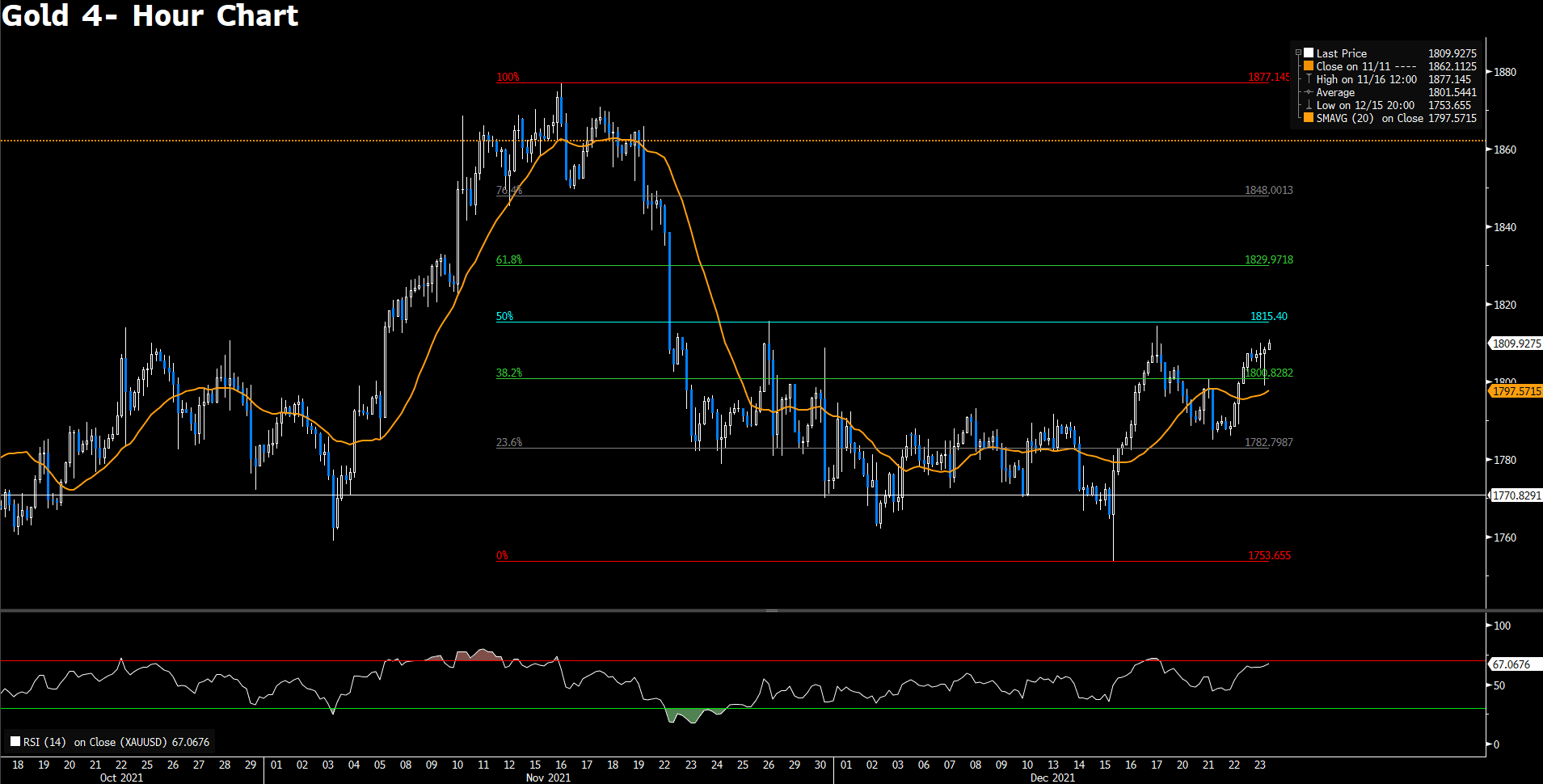

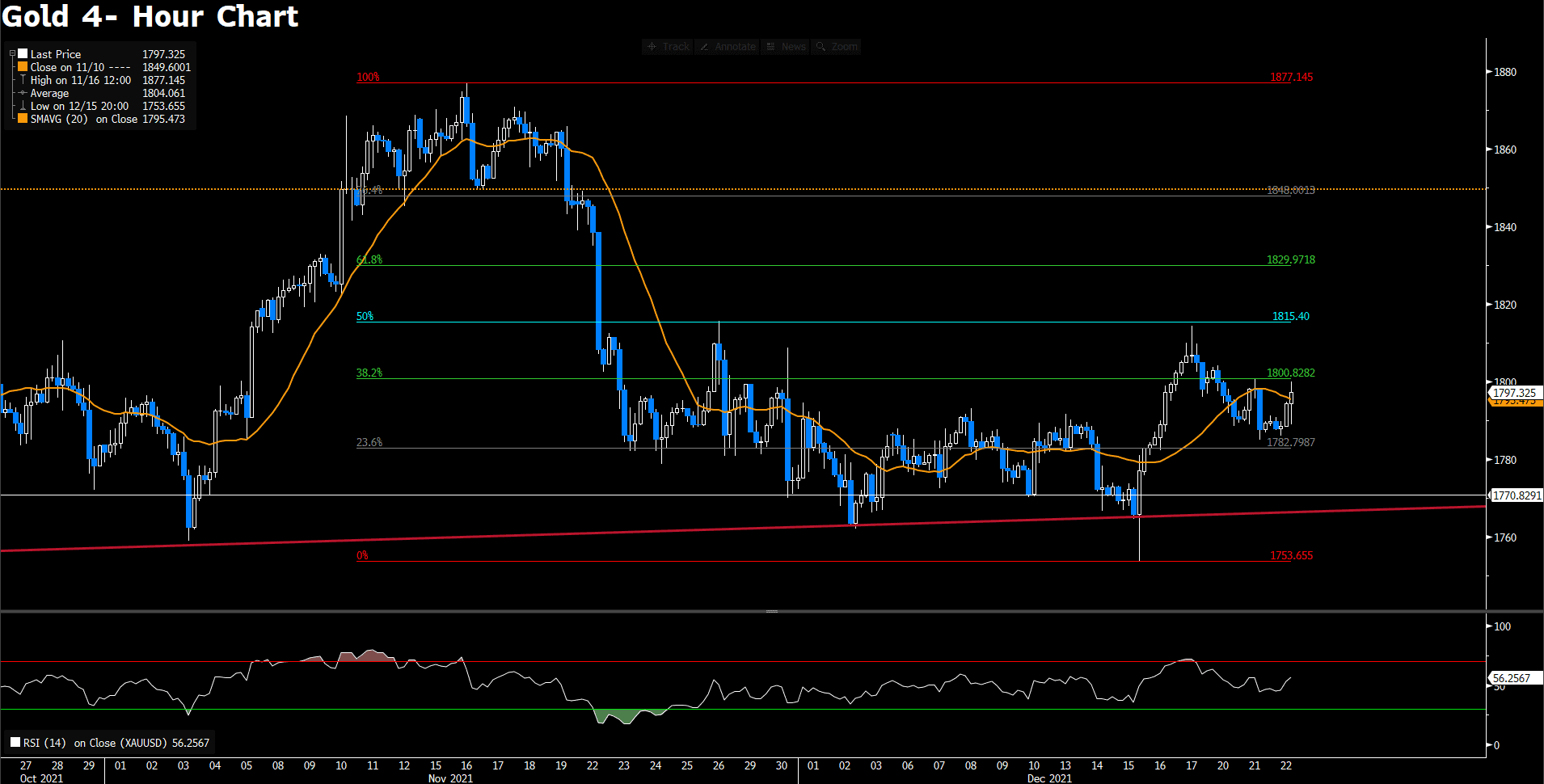

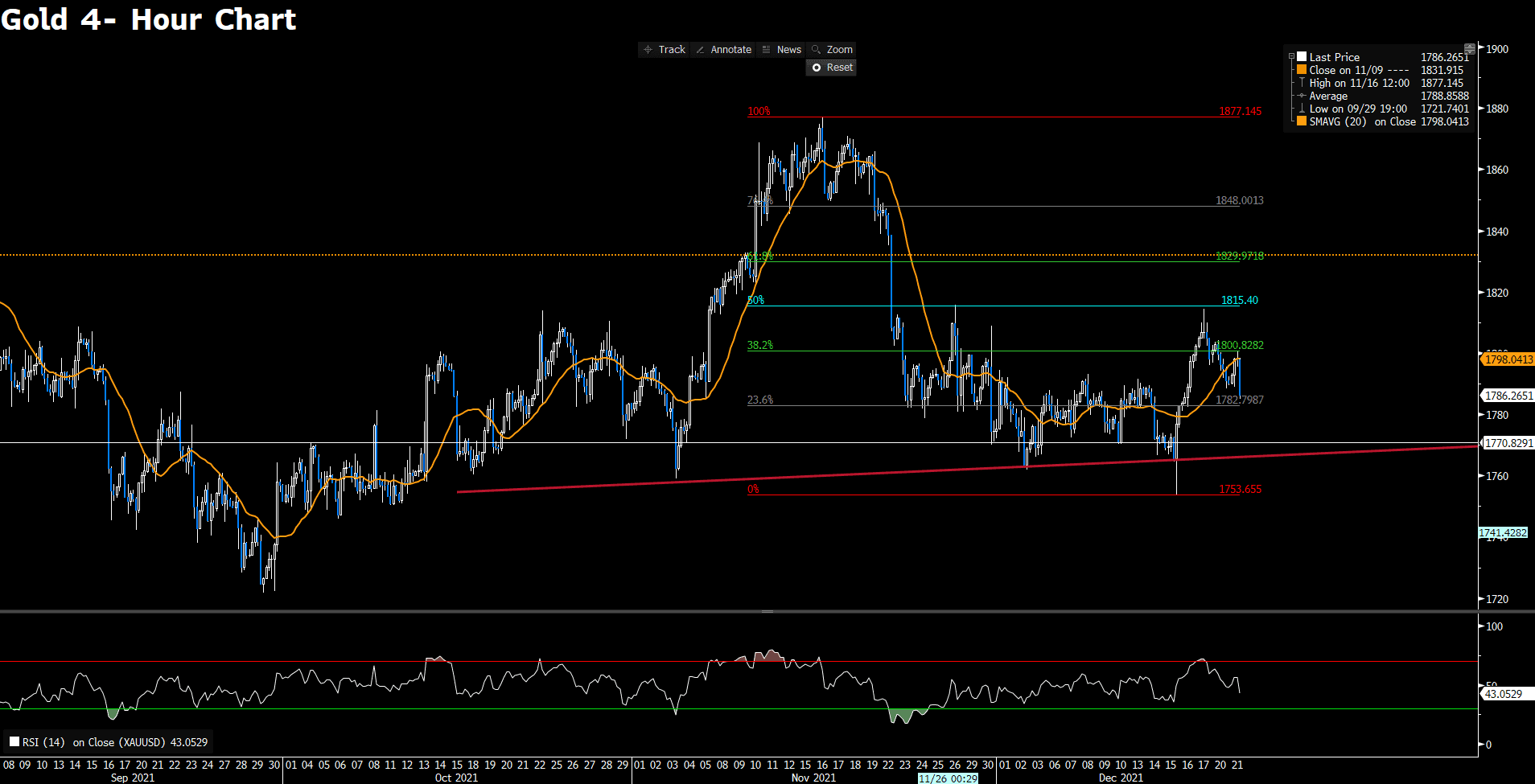

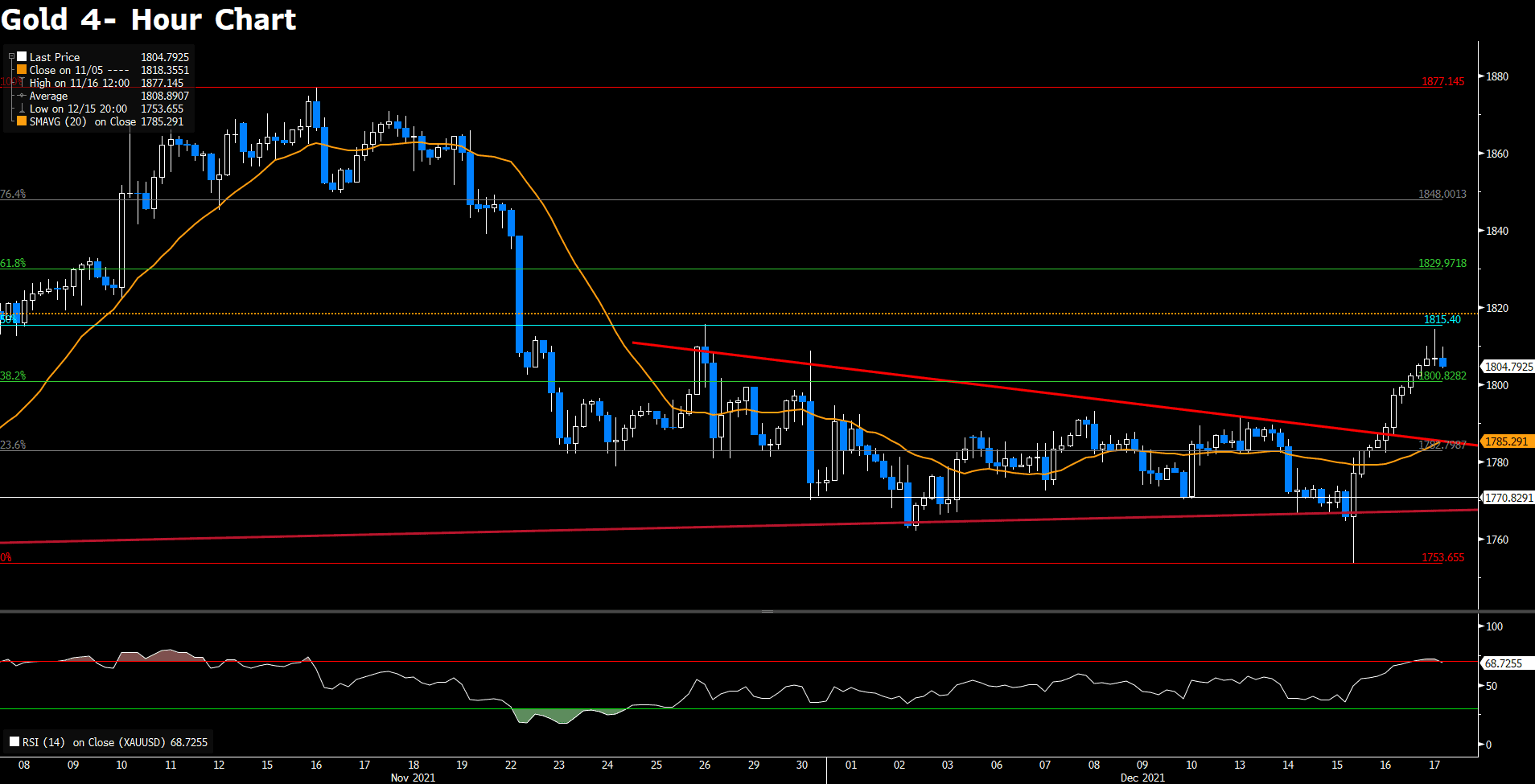

Gold ended the last month of 2021 with a 3.08% gain as market participants fear over the increased spread of the Omicron variant. 2022 could potentially mark the end to the pandemic and bring plentiful price action for the previous metal.

Technical Analysis:

GBPUSD now trades firmly above the previous resistance level 1.3500 where it struggles to cling on with several attempts. However, the greenback seems to regain some demands at the last hours of the year as the Omicron fears bring investors back to embrace the safe haven, and the looming Brexit import controls add more pressure onto the sterling.

On the technical front, we could see the 1.3500 resistance/support has been the turning point for Cable for many times, and this time is no exception. The RSI indicator is approaching the overbought level, suggesting a correction might happen in some near futures; however, the price action is back to above the 20 and 50 DMA, encouraging the bulls to keep pushing the pair north. The consolidation of the pair is expected to end at the start of the new year as the major investors come back from their holiday.

Resistance: 1.3570, 1.3670

Support: 1.3400, 1.3180

EURUSD (Daily Chart)

EURUSD regains some of its losses from Thursday but remains liveless throughout the day amid a lack of major data or events and mixed catalysts as traders brace for 2022. Major Asia-Pacific markets are off while some in Europe will also cheer New Year’s Eve, contributing to the inactive day. That said, the recent consolidation in EURUSD could be linked to the US dollar’s mixed performance and an absence of major bond traders.

As to the technical indicators, both RSI and MACD of EURUSD seem in a healthy spot right now. The price action remains above the 20-DMA, suggesting a relatively optimistic outlook in the short term.

Resistance: 1.1400, 1.1620, 1.1700

Support: 1.1200, 1.1000, 1.0780

Gold is set to end the year on a good note as it rises over 0.80% amid the two-day trading session. After the release of U.S. initial job claims figures on Thursday, gold initially dropped but quickly gained ground as investors’ fear over Omicron resurfaced. Risk off sentiment also spilled over into equity markets as the Dow Jones snapped its 6th straight winning session on Thursday and keeps falling amid Friday’s Wall Street trading.

On the technical side, gold seems to have broken out of the downward trend it displayed recently, but it remains to be seen if the yellow metal would be able to return to previous highs. RSI for the pair has risen to 62.11 as of writing. Gold is trading above its 20, 50, and 200 DMA.

Resistance: 1830, 1860, 1900

Support: 1765, 1725, 1680

Economic Data:

|

Currency |

Data |

Time (GMT + 8) |

Forecast |

|

|

EUR |

German Manufacturing PMI (Dec) |

16:55 |

57.9 |

|

|

USD |

ISM Manufacturing PMI (Dec) |

23:00 |

60.2 |

|