The global oil market is a behemoth in the world of finance and economics, wielding significant influence over numerous sectors and individual lives.

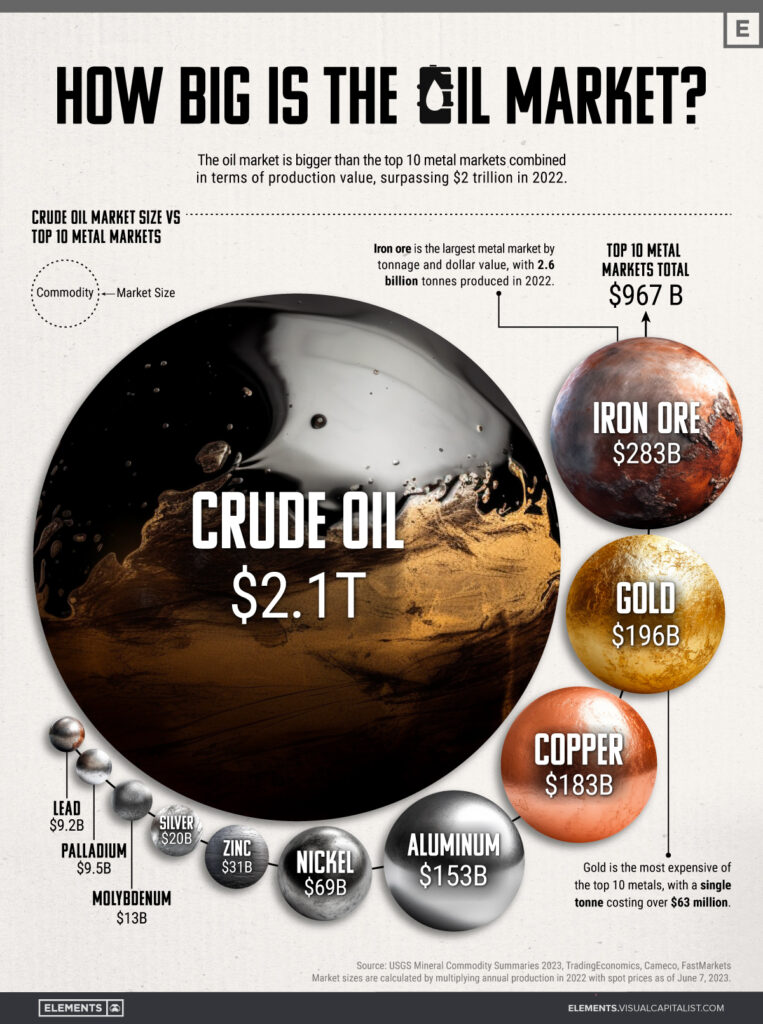

In 2022, the world maintained an average production of approximately 80.75 million barrels of oil every day, which includes condensates. This translates to an annual crude oil production of about 29.5 billion barrels, contributing to a market value that surpasses $2 trillion at current market rates.

Source: Visual Capitalist

To put this into perspective, consider the collective market size of the top 10 metal markets, which stands at $967 billion. Remarkably, this is less than half the size of the oil market. Furthermore, even if we were to aggregate all the remaining smaller markets in the raw metal industry, they would still fall significantly short of matching the magnitude of the oil market.

These statistics vividly underscore the extensive magnitude of global oil consumption each year, demonstrating its pervasive presence in our daily lives.

For those not intimately acquainted with the complexities of commodities trading or the foreign exchange (Forex) market, understanding the magnitude of the oil market can seem like a daunting task. However, we’re here to break it down for you and provide insights into how this mammoth market affects Forex trading, making it more accessible for the everyday trader.

The Role of Oil in the World Economy

Oil is more than just the fuel that powers our vehicles; it’s an essential component of the world economy. The intricacies of the oil market are crucial to comprehend as they impact various aspects of our lives, from transportation costs to the price of goods and services.

Energy Source: Powering Modern Life

Oil, often referred to as “black gold,” is the lifeblood of modern civilisation. It is a fundamental and indispensable energy source that powers transportation, industries, and households globally.

In the realm of transportation, oil fuels cars, trucks, ships, airplanes, and trains, enabling the movement of people and goods with unparalleled efficiency. Moreover, oil-based products like gasoline and diesel are critical for the functioning of agricultural machinery, enabling the production and distribution of food on a large scale.

Source: Business Africa Online

In industries, oil is a primary energy source for manufacturing, powering machinery and equipment essential for production. Additionally, households rely on oil for heating, cooking, and electricity generation, making it an essential component of daily life.

Economic Impact: Ripples Across Economies

Fluctuations in oil prices have a profound and direct impact on global economies. Oil is a major input in the production of goods and services across various industries.

When oil prices rise, the cost of production increases for businesses, leading to higher prices for end consumers. This phenomenon, known as cost-push inflation, can have a cascading effect on the broader economy, potentially leading to higher overall inflation rates.

On the flip side, when oil prices drop, it can stimulate economic growth as businesses experience cost reductions, enabling them to invest in expansion and hire more employees.

Oil’s economic impact is not limited to just the domestic economy. As a globally traded commodity, changes in oil prices can trigger geopolitical shifts and instability.

Nations heavily dependent on oil exports may experience significant swings in revenue, affecting their fiscal policies, foreign exchange reserves, and geopolitical influence. In times of extreme oil price volatility, countries may face economic challenges, potentially leading to regional or even global economic downturns.

Connection to Forex: Oil Price and Currency Values

Oil prices and Forex markets share a symbiotic relationship. Major currencies are often tied to the economic health of oil-producing nations. When oil prices rise, the economies of oil-producing countries experience increased revenue, resulting in a stronger demand for their currencies. Conversely, a decrease in oil prices can have the opposite effect, weakening the currencies of oil-exporting nations.

Forex traders closely monitor changes in oil prices as they provide valuable insights into potential shifts in currency values. The value of currencies such as the Canadian Dollar (CAD), Russian Ruble (RUB), and Norwegian Krone (NOK) is heavily influenced by oil prices due to the significant role oil exports play in their respective economies.

Understanding this dynamic relationship between oil prices and Forex markets is essential for traders seeking to make informed decisions and effectively manage their Forex portfolios. It’s a reminder of how interconnected the global economy truly is, where a shift in one market can resonate across various financial domains.

Key Players Shaping the Oil Market Landscape

In 2022, the price of oil surged, crossing the $100 per barrel mark, the highest in eight years. This was triggered by the instability caused by the Russian invasion of Ukraine, sending shockwaves through the energy markets. Oil companies reaped the benefits, doubling their profits and providing a substantial boost to major oil-producing nations.

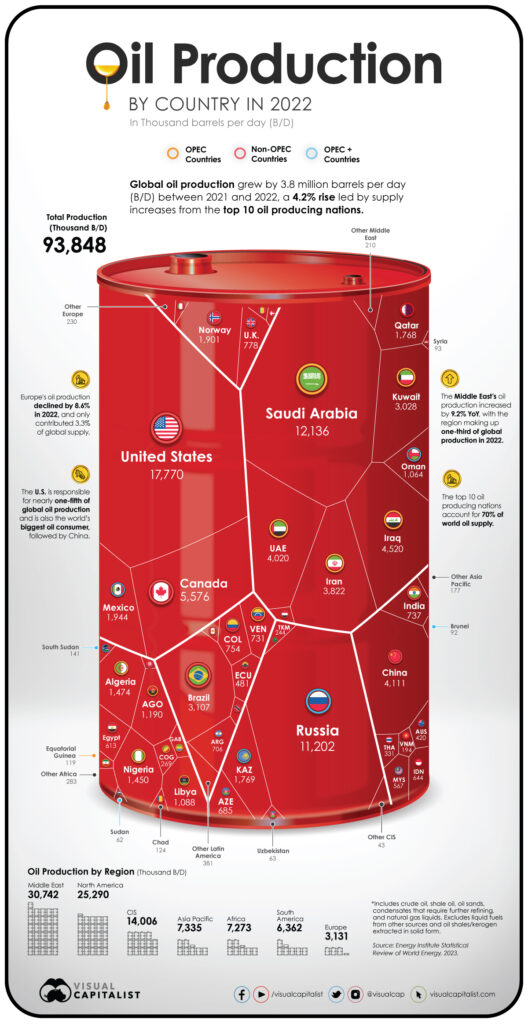

Source: Visual Capitalist

The United States, maintaining its position as the largest global oil producer since 2018, continued its streak in 2022 by producing nearly 18 million barrels per day. This accounted for almost a fifth of the world’s total oil supply. The majority of this production, approximately three-fourths, was concentrated in five key states: Texas, New Mexico, North Dakota, Alaska, and Colorado.

Saudi Arabia secured the second position by contributing 12 million barrels of oil per day in 2022, constituting about 13% of the worldwide oil supply. Following closely, Russia claimed the third spot with significant production of 11 million barrels per day during the same year.

When combined with Canada (fourth position) and Iraq (fifth position), these top five oil-producing nations supplied over half of the world’s entire oil production.

Simultaneously, the top 10 oil producers, encompassing rankings from 6th to 10th, including China, UAE, Iran, Brazil, and Kuwait, bore the responsibility for a significant 70% of the world’s oil production.

Notably, all top 10 oil giants increased their production levels between 2021 and 2022, resulting in a notable 4.2% year-on-year surge in global oil output. This growth highlights the substantial role these nations play in the global oil landscape.

Major Oil Producing Regions

The Middle East contributes to one-third of the world’s oil production, and North America accounts for another one-third of this production. Additionally, the Commonwealth of Independent States, a consortium of post-Soviet Union nations, stands as a significant regional oil producer, representing 15% of global oil production.

However, the data clearly reveals a declining share of oil production in Europe, presently constituting only 3% of the world’s oil supply. Over the past two decades, the European Union (EU) has witnessed a reduction of over 50% in its oil output due to various factors, including stricter adherence to environmental regulations and a shift towards natural gas.

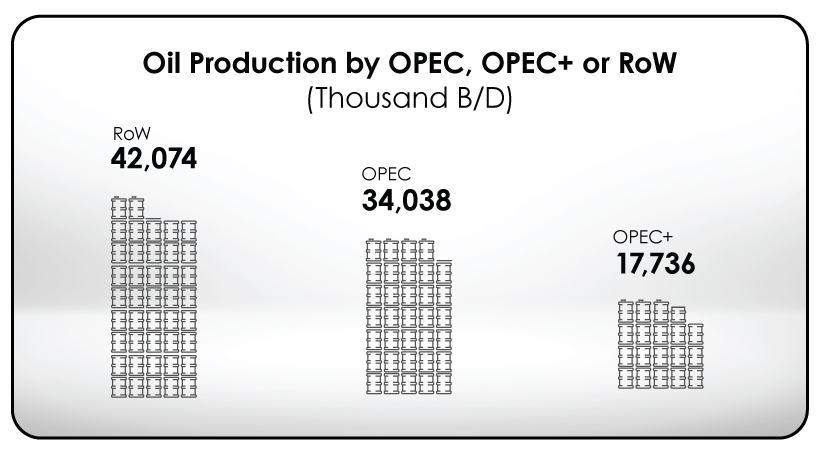

Source: Visual Capitalist

Shifting focus to OPEC members provides another perspective on regional oil production. OPEC nations collectively control approximately 35% of the global oil output and possess nearly 70% of the world’s oil reserves.

OPEC plays a pivotal role in influencing the global oil market. Consisting of major oil-producing nations such as Saudi Arabia, Iraq, Iran, and Venezuela, OPEC actively coordinates oil production levels to stabilise prices and ensure a consistent supply to the international market.

Moreover, considering the group of 10 oil-exporting countries with ties to OPEC, known as OPEC+, the proportion of oil production further increases, surpassing half of the world’s oil supply.

Global Oil Trading Hubs

In the intricate web of the global oil trade, certain key locations serve as the beating heart, where the pulse of this vital commodity is felt most intensely. These hubs are epicentres of oil trading, shaping market dynamics and influencing prices on a grand scale.

New York (NYMEX)

New York, specifically the New York Mercantile Exchange (NYMEX), stands as one of the most significant oil trading hubs globally. The NYMEX’s West Texas Intermediate (WTI) crude oil futures contract is a prominent benchmark for oil prices in the United States.

London (ICE)

The Intercontinental Exchange (ICE) in London is another major hub for oil trading. The Brent crude oil futures contract, a widely recognised global benchmark, is traded here, influencing prices on a broader scale.

Singapore (SGX)

Singapore has emerged as a major hub for oil trading in Asia. The Singapore Exchange (SGX) facilitates trading of multiple oil products, reflecting and impacting regional market trends.

Source SOMO

Driving Oil Prices: Key Influencing Factors

The world of oil is not just driven by supply and demand. There are pivotal factors, often beyond everyday headlines, that sway the prices we pay at the pump and impact the broader global economy. Understanding these driving forces is pivotal in comprehending how the oil market functions and how it influences the world economy.

- Geopolitical Events: Geopolitical tensions and conflicts in oil-producing regions can disrupt supply chains and production capacities, directly impacting oil prices. Events like political instability, wars, or sanctions can send shockwaves through the oil market, causing price volatility.

- Environmental Regulations: Environmental policies and regulations have a substantial influence on the oil market. Government initiatives promoting cleaner energy sources and stricter environmental standards can affect the demand for oil and related products, consequently influencing prices.

- Economic Indicators: Economic factors like GDP growth, inflation rates, and employment levels have a direct impact on oil demand. Growing economies often lead to increased energy needs, driving up oil consumption and prices. Conversely, economic downturns can lead to reduced demand and subsequently lower prices.

Investing in Oil

The world of oil presents intriguing prospects for investors, with various opportunities to capitalise on its dynamic market. However, alongside these prospects lie inherent risks that necessitate careful consideration and strategic risk management.

ETFs (Exchange-Traded Funds)

Exchange-Traded Funds are an accessible investment option for those seeking exposure to the oil market without directly trading commodities. ETFs often track oil prices and oil company stocks, providing a diversified investment approach.

Futures

Futures contracts allow investors to buy or sell oil at a predetermined price at a specified future date. It’s a direct way to engage with the oil market, but it requires a good understanding of market trends and fluctuations.

Stocks

Investing in oil company stocks provides ownership in a specific company involved in oil production, exploration, refining, or distribution. Stock values are influenced by company performance and broader market dynamics.

Options

Options give investors the right (but not the obligation) to buy or sell oil at a specified price within a set time. It offers flexibility and can be a part of a diversified investment portfolio.

How to Trade Oil with VT Markets?

When it comes to investing into the oil market, having a reliable and regulated broker is paramount. VT Markets offers oil trading with tight spreads, low commissions, and leverage of up to 500:1.

Start trading with VT Markets today by following these three simple steps:

1. Register: Select your preferred account type and submit your application.

2. Fund: Choose from a variety of methods to fund your account.

3. Trade: Select oil in the Energy section or explore more than 1000 instruments across all asset classes.

Additionally, you can test your oil trading strategies with our risk-free demo account. Wishing you the best of luck!

In conclusion, the global oil market is undeniably colossal, exerting immense influence over the world economy and financial markets, notably the Forex market. For non-professional traders, a solid grasp of the oil market fundamentals and its relationship with Forex trading is essential. Stay informed, manage risks prudently, and leverage this knowledge to navigate the dynamic world of Forex trading within the vast sphere of the oil market.