Say what? Is there anything better than cash at all?

Shouldn’t cash be the ultimate equivalent of financial stability?

While having money in the bank can offer a sense of security, clinging to cash will just halter your journey in achieving financial freedom. This is the biggest mistake could cost you the lifestyle you want to live.

By keeping cash and cash only, you are allowing yourself to be robbed. Here is how it happens.

Inflation erosion: Keeping cash is the sure way to lose

The key trigger is no other than inflation, which reduces the purchasing power of cash over time. If the inflation rate is higher than the interest earned on cash savings, the real value of cash holdings diminishes.

To put this into perspective, consider an inflation rate of 3% per year.

USD 1,000 in year 2024 will have the purchasing power of:

- (100% – 3%) x USD 1,000 = USD 970 in year 2025

Followed by

- (100% – 3%) x USD 970 = USD 940 in year 2026

Followed by

- (100% – 3%) x USD 940 = USD 912 in year 2027

So on and so forth.

What that means is inflation robs from everyone if all that is being done is saving cash, and nothing else. Every year, the stash of cash saved automatically evaporates into thin air just by the power of inflation alone. And just like death and taxes, no one escapes inflation.

Can you trust the banks? Really?

What about putting money in the bank to earn some interest rate, you ask? Wouldn’t that help to negate the effects of inflation too?

This depends on the difference between the inflation rate and the interest rate you earn by parking your spare cash in the bank. An extreme example would be Turkey, whereby the interest rate is somewhere around 50%.

“Wow, I’d be rich by parking Turkish lira in the Turkish banks!” One might think.

Not so fast. Wait till you see that the inflation rate of the Turkey is somewhere around 70% every year.

That means you would be netting at:

- (100% + 50% – 70%) x TRY 30,000 = TRY 24,000

Despite whooping percentage of interest rate received from the Turkish banks, the cash holder is just receiving a real loss of 20% in cash value. Not a very smart choice.

Having FOMO is good when it comes to beating inflation

Keeping too much cash on hand automatically means you lose out to inflation. By the same token, the benchmark to beat is to make your hard-earned cash work for you in a way faster than inflation erodes your wealth.

There are two ways to go about this.

Passive long-term investments

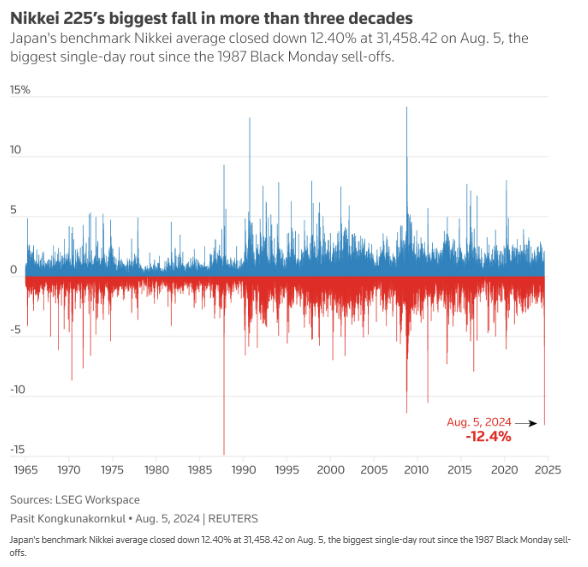

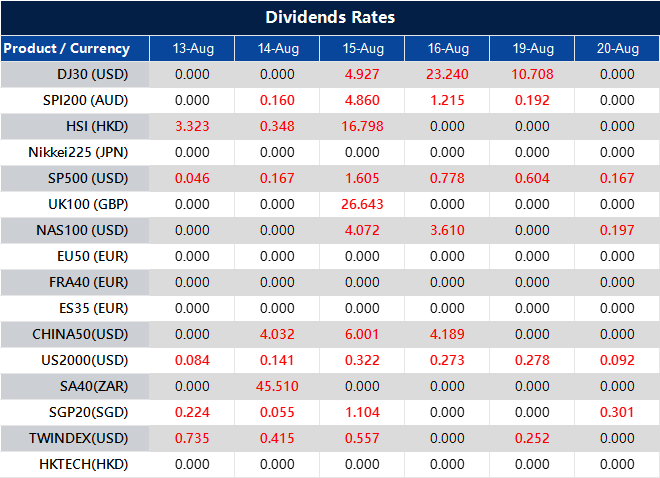

Asset classes such as stock, indices, bonds and ETFs have outperformed keeping cash in terms of return of investment (ROI). For example, the Nasdaq Composite (Symbol: NAS100) has an annualised return of 20.9% per annum in the last ten (10) years.

With the power of compounding, that gives you a return of 566.7% in the last decade by simply buying in and not doing anything. Sounds awesome?

Active flipping your capital in the financial markets

Yeah, 566.7% in a decade may sound great, but what if your capital is only $1,000?

Making 566.7% is a mere $5,667 worth of profits over 10 years. That is hardly much for ten years. While it does beat inflation, you will not be having the option to resign your job as and when you wish.

When you have a small capital, you need to make your money work harder. And this is made possible by CFD day trading. It is common to hear day traders making 100% gains in a day, sometimes in matter of minutes. Embark on your journey as a forex trader with VT Markets now. With 1000+ assets being offered by VT Markets, there is nothing to stop you from achieving your desired lifestyle.

Stop holding too much cash, let your money work for you

While having some cash on hand is essential for liquidity and emergency purposes, over-relying on cash can lead to missed opportunities for growth and wealth accumulation. Balancing cash reserves with strategic plans allows your money to work for you instead of you having to work hard for them, bringing you to another level of lifestyle that makes you happier.

Stop losing, start winning now with VT Markets!