Market capitalisation, frequently referred to as ‘market cap,’ serves as a vital metric for evaluating a company’s value in the stock market, akin to a comprehensive price tag for the entire entity.

source: ABC News

Understanding market capitalisation is pivotal as it offers traders insights into a company’s prominence within the market, thereby influencing their investment choices and risk management approaches.

Unveiling market capitalization

Market capitalisation stands as a fundamental metric in finance, utilised to evaluate a company’s value by encompassing the total worth of all outstanding shares of its stock.

Establishing market capitalisation occurs through an initial public offering (IPO), where an investment bank assesses the company’s value using diverse valuation techniques. This evaluation then determines the number of shares to be made available to the public and their respective pricing.

For example, if a company’s IPO value is set at $150 million, it may opt to issue 15 million shares at $10 each or 30 million shares at $5 each, ultimately resulting in an identical initial market cap of $150 million.

In simpler terms, market cap offers a glimpse into the prospective cost of purchasing all company’s shares at their prevailing market prices.

Understanding market capitalisation empowers investors and traders to evaluate a company’s stature and performance within the stock market.

Calculation methodology for market capitalisation

The computation of market capitalisation is straightforward, entailing the utilisation of a basic formula:

Market Cap = Current Stock Price × Total Outstanding Shares

Market capitalisation materialises through multiplying a company’s prevailing stock price by its aggregate outstanding shares. Here, the stock price signifies the value of an individual share in the company, while the total outstanding shares denote the available shares to the public.

Consider a hypothetical scenario involving XYZ Inc., with a current stock price of $50 per share and a total outstanding shares count of 10 million:

Market Cap = $50 (Current Stock Price) × 10,000,000 (Total Outstanding Shares)

Market Cap = $500,000,000

Thus, the market capitalisation of XYZ Inc. stands at $500 million.

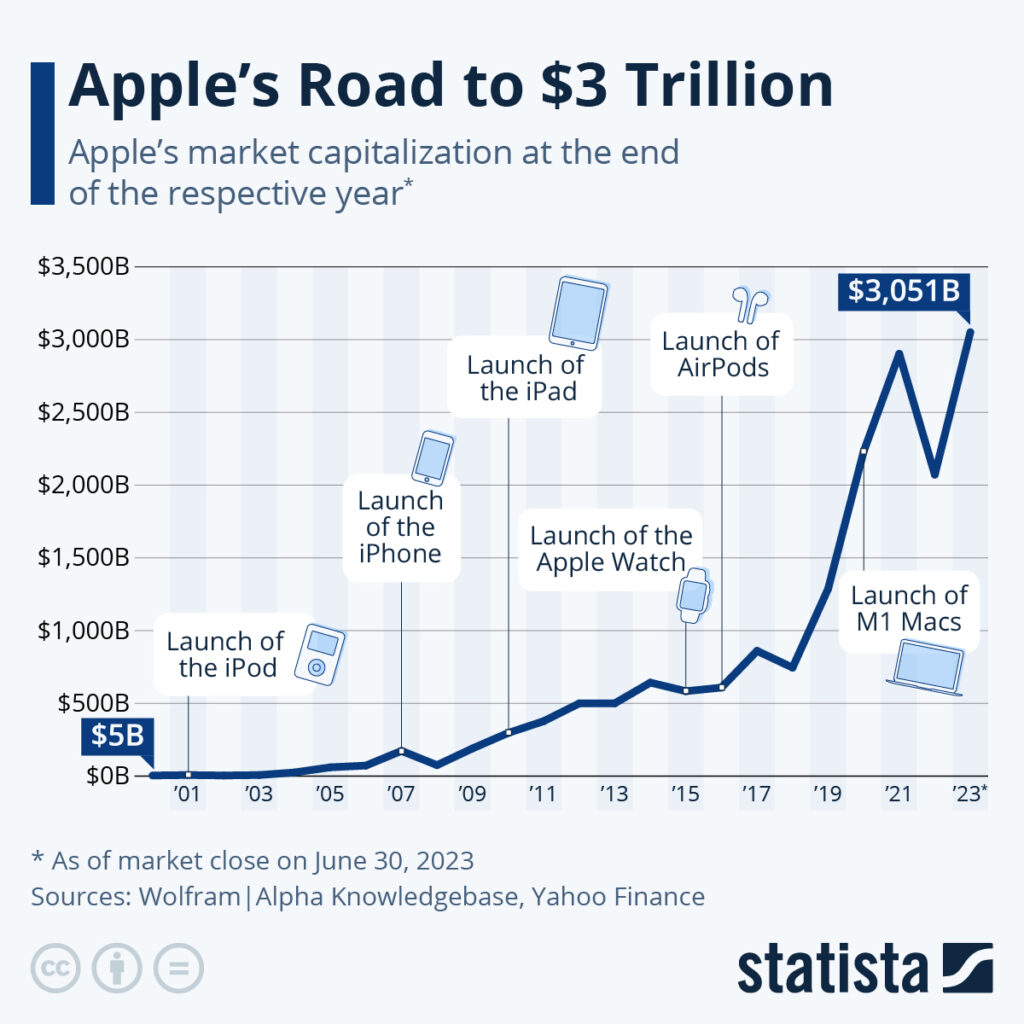

source: Statista

Delving into diluted market capitalisation

Both in traditional markets and cryptocurrencies, diluted market capitalisation assumes significance in assessing a company or project’s comprehensive value. It accounts for additional shares, such as stock options or tokens earmarked for team members and advisors, which possess the potential to dilute the value of existing shares or tokens.

For instance, revisiting Company A, with a stock price of $50, 10 million outstanding shares, and potential additional shares from stock options equivalent to 1 million shares:

Regular Market Cap = $50 (Stock Price) × 10,000,000 (Total Outstanding Shares) = $500,000,000

Diluted Market Cap = $50 (Stock Price) × (10,000,000 + 1,000,000) (Total Outstanding Shares + Potential Additional Shares) = $550,000,000

In this instance, Company A’s regular market capitalisation amounts to $500 million, whereas the diluted market capitalisation, factoring in potential additional shares, totals $550 million.

Understanding both formulations facilitates investors in gauging a company’s value more accurately, thus enabling informed investment decisions grounded on the company’s potential future share structure.

Categories of market capitalisation and investment approaches

Grasping market capitalisation necessitates categorising companies based on their magnitude and significance within the stock market. The principal categories encompass:

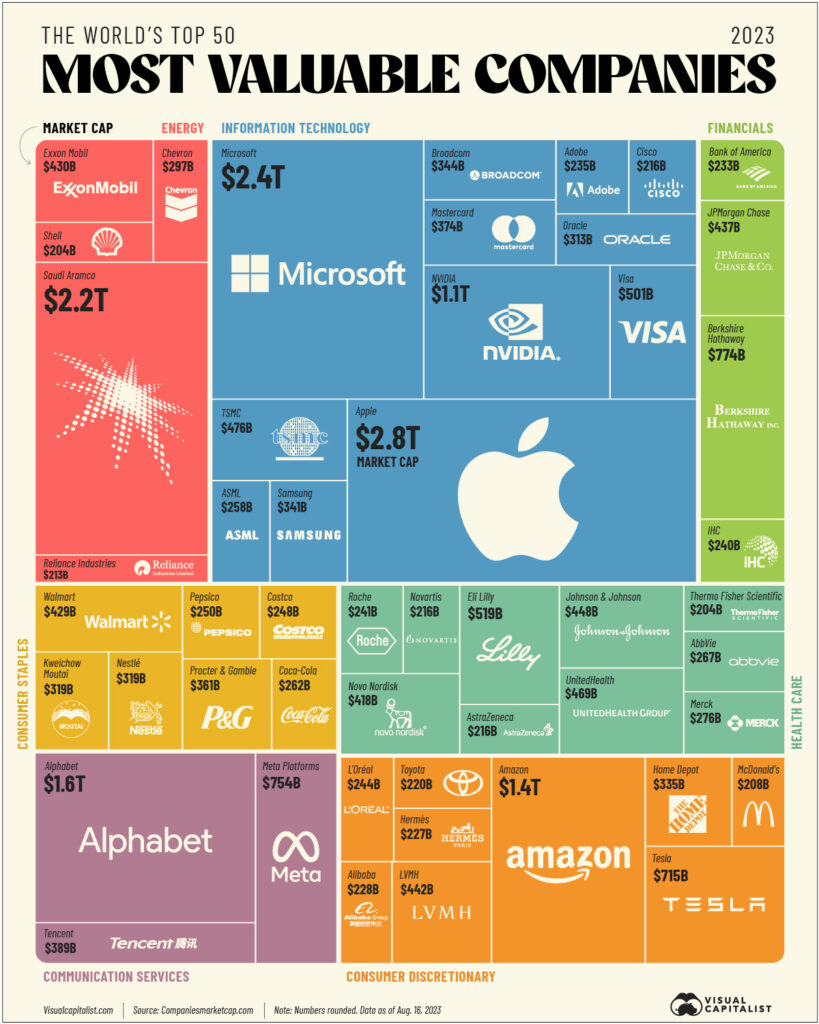

Large-cap: Characterised by sizable, well-established companies with a market capitalisation typically surpassing $10 billion. Notable examples encompass Apple, Microsoft, and Amazon.

Opting for large-cap companies proffers stability and incremental growth over time. Although short-term gains may be moderate, these companies frequently reward investors with consistent upticks in share value and dependable dividend disbursements.

Mid-cap: Encompassing companies with a market capitalisation ranging between $2 billion and $10 billion. Illustrative instances entail Etsy, Dropbox, and Duolingo.

Positioned between large and small caps, mid-cap companies represent established entities operating within sectors poised for accelerated growth. Despite presenting heightened risk due to their growth phase, mid-caps offer appealing prospects for investors seeking potential growth and expansion opportunities.

Small-cap: Encompassing companies with a market capitalisation below $2 billion, exemplified by Udemy, Getty Images, and Upwork.

Typically, small-cap companies, often younger or niche-focused, offer substantial growth prospects. Nevertheless, they are accompanied by escalated volatility and liquidity concerns, rendering them riskier investments. Nonetheless, their agility and potential for exponential growth render them enticing for investors possessing a higher risk tolerance and a long-term perspective.

source: Visual Capitalist

Market capitalisation and market indices

Market capitalisation forms the cornerstone of how market indices, such as the S&P 500, monitor market performance. Indices employ market cap-weighted methodologies, where larger companies wield greater influence, thereby implying that alterations in large-cap stocks significantly impact index movements.

Companies such as Apple, Microsoft, and Amazon, boasting substantial market caps, exert a pronounced influence on indices like the S&P 500. Consequently, if their market caps ascend, the index follows suit, reflecting a buoyant market sentiment.

Factors influencing market capitalisation

Market capitalisation, or market cap, is subject to an array of factors:

Company performance: Robust financial performance bolsters market cap, while undervalued shares may allure investors seeking growth prospects.

Investor sentiment: Positive developments elevate market cap, whereas adverse events can precipitate a downturn.

Industry trends: Flourishing industries tend to exhibit higher market caps, albeit market sentiment can instigate overvaluation or undervaluation of shares within these sectors.

Grasping these factors empowers investors to ascertain whether a company’s market cap accurately mirrors its intrinsic value and whether its shares are presently undervalued or overvalued.

In conclusion, market capitalisation emerges as a pivotal tool for investors and traders in navigating financial markets, furnishing insights into company size, stability, and growth potential, thereby guiding investment decisions and trading strategies. While market cap holds undeniable value, it is imperative to consider additional factors such as company performance and investor sentiment. By comprehending market cap’s significance and associated risks, traders can make well-informed decisions and efficaciously manage their portfolios for sustained success in finance.